By: Karim Ghobrial, Jabrenée Hussie, Sahithi Josyula, Michaela Wu, Michael Zhang

This study provides a comprehensive strategy for Shaboom Records to enhance its status as an independent music label in a highly competitive market, focusing on three key areas: revenue growth, digital service provider (DSP) strategies, and fan engagement. The supportive research reveals the need for companies to effectively navigate changes in the music industry, such as globalization and the rise of streaming. The goal of this research is to identify the most effective revenue streams for U.S. independent labels expanding into emerging global markets and the digital engagement strategies that yield the highest conversion rates and retention metrics for Gen Z and Gen Alpha listeners. Significant to this goal is the recognition that DSP optimization is largely based on securing relationships with playlist curators. Furthermore, social media has democratized the music industry, giving artists control over their narrative and the ability to connect with fans.

Industry Insights: Why EDM Matters Now

As the EDM (Electronic Dance Music) landscape continues to advance, independent labels face increasing challenges in standing out in a competitive market. According to a recent report, EDM saw a total of 59% increase in market growth since 2021 and reached $12.9 billion in 2024, surpassing pre-pandemic levels (Mulligan 2025). Despite this expansion, the dominance of major labels and shifting audience consumption patterns require indie labels like Shaboom to re-evaluate their branding, engagement strategies, and revenue models to ensure long-term sustainability and scale. We especially believe that exploring brand partnerships and researching ancillary revenue streams will be valuable for Shaboom, as it aligns with an area of interest the client is eager to engage. These partnerships across music include in-depth educational workshops, fitness playlists, meditation remixes and sound packs, in-game concerts, and more (Starter Pack: Music and Brand Partnerships 2023). While expanding Shaboom’s established UK and US markets, we will explore emerging markets where EDM and House music culture are thriving to offer opportunities for audience expansion.

The State of Shaboom Records

Founded in 1996 by Mark Bell, a veteran with more than three decades in the music industry, Shaboom Records is a UK-based independent label specializing in Electronic Dance Music (EDM) and rooted in House, one of its core subgenres. Known for consistent, high-quality releases and collaborations with House music icons, the label has built a strong global footprint across the U.S., South America—particularly São Paulo—and key European markets like the UK and Spain, along with a small following in Australia (Songstats, n.d.). During the pandemic, as nightclubs shuttered and Dance Pop’s rise slowed, producers shifted toward subgenres like Techno, Deep house & Tech House, which quickly surged in popularity. Artists such as John Summit, Rezz, and Fred Again brought these underground sounds into the mainstream, generating fresh momentum for House-driven labels like Shaboom (Kloboves 2023).

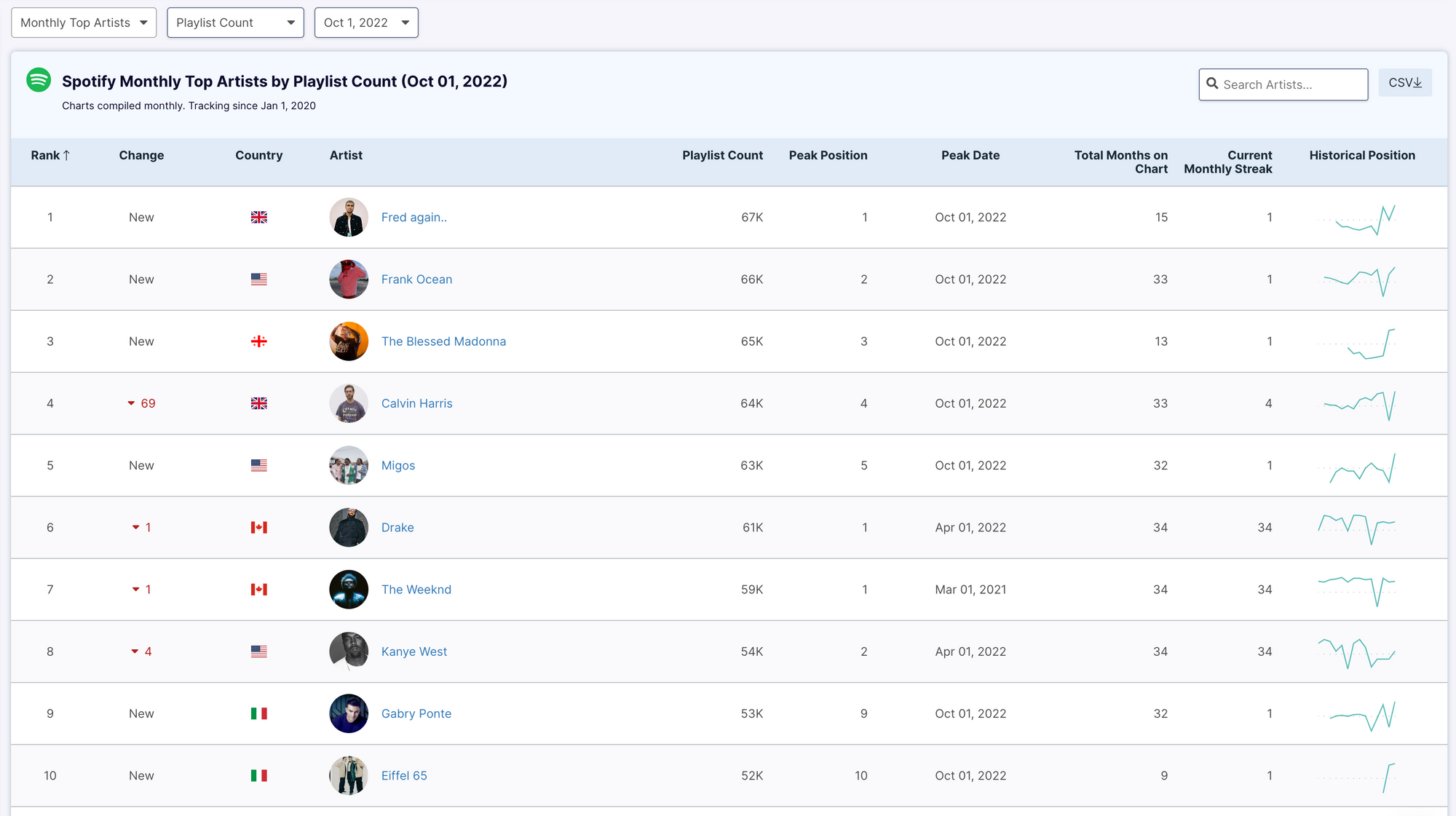

Figure 1. Spotify Top Artists by Playlist Count. Source: Chartmetric

Despite its reach, Shaboom Records faces a key challenge: low artist follower counts across social media and Spotify. This gap highlights the need to shift from passive engagement to sustained engagement and loyalty. To address this, Shaboom must implement holistic lifecycle marketing and product strategies that prioritize return on investment, using tactics like pre-saves, editorial playlist placement, and event-driven content across digital and physical. By directing these efforts around track or album release cycles and focusing on high-engagement platforms, the label can evolve by adopting digitally savvy operations while converting passing interactions into long-term fan relationships.

Before moving into the research, it is important to clarify terminology so that everyone reading this research has a shared understanding of the research findings and recommendations.

Definition of Terms

Listed below are terms that will be referenced throughout this study.

Artist Development: A process that helps musicians develop their skills and craft a professional career in the music industry (IndieFlow 2023).

Artists & Repertoire (A&R): A division of a record label or music publisher that discovers, develops, and finances new artists and songwriters (Berklee School of Music n.d.).

Customer Relationship Management (CRM): CRM encompasses the activities, strategies, and technologies businesses use to manage interactions with current and potential customers (Kulpa 2017).

Digital Service Providers (DSPs): A form of service that offers digital content and services to consumers (CloudBlue n.d.). For the purposes of this project, DSPs refer to music streaming providers such as Spotify, Apple Music, Beatport, etc.

Direct-to-fan (D2F): A promotional strategy aiming to put artists in front of their fans and dissolve the traditional barriers between them (Music Business Worldwide 2021).

Electronic Dance Music (EDM): A broad range of percussive electronic music genres made for clubs and festivals (Matos n.d.).

House Music: A genre of EDM that originated in Chicago in the 1980s, characterized by a repetitive four-on-the-floor beat and a typical tempo of around 120 bpm (MasterClass 2021).

Indie Label: A small business that operates independently. A clear distinction in contrast with major labels would be the lack of specific resources, such as distribution (Callaghan 2024).

Major Label: Dominant companies that control a large portion of the record market and are often part of a music group or have their own distribution and publishing (Icon Collective 2018).

Long Tail Business Strategy: A strategy that focuses on selling many niche products, each with relatively low demand, rather than a few popular items with high demand. This approach leverages the vast reach of the internet and digital platforms to cater to diverse consumer preferences (Larsen 2023).

Review of Literature

To support the strategic objective of expanding Shaboom’s fanbase, assessing the fundamental mechanism that drives EDM culture is crucial. A previous study at Syracuse University provides unique insights into the psychological and social factors contributing to the EDM community. The author interviewed EDM listeners aged 18-28 from the Tri-State area, and the finding highlights the strong sense of community fostered by the Peace, Love, Unity, Respect (PLUR) mantra through shared festival experiences and emotional connection (Monopoli 2021). Additionally, the International Journal of Event and Festival Management disclosed pivotal elements in the live music scene, which can contribute to further understanding of the EDM culture and community. The finding suggests that festivals and events represent opportunities for people to come together as a collective, and the multifaceted nature of sharing and belonging in events supports their potential to improve participants’ well-being (Quinn, 2024).

In addition to the intimacy and self-identification during live music events, EDM fans are also “social media exhibitionists [that] share even the most personal elements of their lives” (Eventbrite 2014, p. 4). They love tweeting and socializing online, contributing to “roughly 6 times more active than the average Twitter” (Eventbrite, p. 4). With such high digital engagement, it is no surprise that music discovery is expansive in this space. Over 60% of EDM fans stream music daily, and in 2024, EDM tracks accounted for 25% of the top 100 streamed songs globally (Macdonald 2024, para. 1). Interestingly, EDM fans are also gravitating towards vinyl, possibly to express their passion for music. In 2024, EDM vinyl sales saw an incredible 15% increase (Macdonald).

Current State

Although the music industry remains highly concentrated, with Sony Music Entertainment, Universal Music Group, and Warner Music Group dominating market share, recent data shows the growing influence of independent labels and artists, signaling a real shift in industry dynamics. In 2023, independents made up 46.7% of the recorded music market—40.8% through independent labels and 5.9% through artist-direct distributors like Ditto Music and TuneCore (Peoples 2024). This shift reflects a decline in monocultural dominance, driven by evolving audience tastes and digital transformation (Bello & Garcia 2021).

EDM, making up 39% of Coachella’s 2024 lineup, remains a dominant force, with live events driving most of the revenue (New Industry Friday 2024). Unlike the broader industry, where streaming, sales, and concert revenue are measured together, major festivals like Electric Daisy Carnival alone generate over $350 million annually (Katsilometes 2016; Godard, 2018). This heavy reliance on live shows reflects EDM’s “superfan” base and is pushing global expansion. Afro House, fusing African rhythms with house beats, is rising fast; Australia and Asia’s festival scene is pushing House onto bigger stages, and Brazilian subgenres like Phonk are shaping EDM global trends (Team Splice 2025). For labels like Shaboom Records, whose audiences stretch across key markets, international growth is crucial to the future of EDM and House.

Today’s music industry sees over 120,000 new tracks uploaded every day. By April 2025, Deezer (DSP) reported that more than 18% of daily uploads, around 20,000 tracks, were AI-generated, adding to market saturation and driving the devaluation of music (Vinyl Me, Please 2025). While DSPs have democratized distribution through SaaS-based models, they’ve also intensified competition and created monetization challenges for independent artists and labels. As the industry splits further, success now lies in platform optimization and consumer engagement strategies, forcing indie labels to focus on data-driven DSP operations and building direct, hyperlocal fan relationships across both physical and digital spaces (RouteNote Blog 2025; Mulligan, 2025).

Streaming services drive industry growth, with global music copyrights reaching $39.6 billion in 2021, a 40% increase from the CD era (Royalty Exchange 2024). The recorded music industry expanded from $13.1 billion in 2014 to $26.2 billion in 2022, with streaming revenue reaching $17.5 billion in 2022. Spotify alone distributed $10 billion to rights holders in 2024, allocating 62% of its revenue to labels, publishers, and distributors (Royalty Exchange).

Streaming revenue follows a pro-rata distribution model, where platforms retain approximately 30% of earnings, allocating the remaining 70% to rights holders (Nycyk 2022; LabelGrid, 2023).

Additionally, with the Spotify payment model, artists are paid between $0.00331 and $0.00437 per stream, and profits are split under terms where artists only receive their percentage after the label takes its share. Labels advance money upfront based on projected royalties and often treat recording costs as recoupable while requiring full repayment from the artist’s future earnings before royalties are paid (How Much Does Spotify Pay per Stream in 2025, 2025). In most cases, artists in the long tail are left at a net loss (Cornell University 2020).

Positioning the Indie Label for 21st Century Growth

This following research findings present a comprehensive strategy for scaling Shaboom’s brand as an independent label in today’s highly competitive market, focusing on three key areas: DSP optimization, audience engagement, and revenue generation. First, we will identify strategies for long-term sustainability (while maintaining Shaboom’s established unique brand identity) that resonate with fans and improve audience engagement and conversion to digital service providers (DSPs). We will also address retention of Shaboom’s core fan base and expansion into new audience segments with a focus on early adopters (Gen Alpha) and the select, emergent international EDM markets. We will examine DSP discoverability, the use of intimate live events and brand partnerships in this industry.

Synthesizing these elements, this research will offer a model and recommend revenue-generating and scaling strategies for both Shaboom and record labels in the 21st century. Our primary research includes interviews with key industry experts in artist development, marketing, DSP operations, indie label management, artist management, brand partnerships, and recording artists. The goal of these interviews is to examine how different sectors of the industry are successfully adapting to the transforming music market. Utilizing survey data, we will identify which DSP placements should be prioritized and, combined with research and interviews, will provide informed recommendations. These integrated findings will inform our strategic recommendations on focused investment and tactical priorities for Shaboom Records.

As social media became central to our lives, “consumers grew more adept at spotting inauthenticity, preferring real stories and genuine interactions over manufactured perfection” (Porscheng 2024, para 4). From both artist and label perspectives, we examine how they can achieve commercial success while creating the art that truly fulfills them. “Platforms like Spotify, YouTube, and social media allow indie artists to reach global audiences without the backing of a major label” (Pinzón 2024a, para 2). It is important to effectively use all of these platforms to expand your audience. Whether it is social media, live events, brand partnerships, or DSPs, they all work in tandem to contribute to the overall success of an indie label.

Summary

EDM is a fast-growing sector with a significant growing market share. However, the market dominance of major labels and in the DSP space poses challenges to indie labels like Shaboom Records. Given its artist roster’s low social media engagement, Shaboom needs to develop bespoke strategies to engage with emerging, younger audiences and leverage the advantages of digital sales channels. In Part 2, we will provide specific tactics drawn from our surveys and interviews into current trends, DSP optimization, and proven innovations to support fan engagement.

-

Ali, A. "Gen Z Nightlife Culture: Why Nostalgia Rules the Dance Floor." NBC News, March 1, 2024. https://www.nbcnews.com/pop-culture/gen-z-nightlife-culture-nostalgia-rcna125912.

Apple Music for Artists. "See How Shazam Works for Artists." 2025. https://artists.apple.com/support/1109-shazam-in-apple-music-for-artists.

Bacardi Limited, and Nick. "Bacardí® and Major Lazer Launch Innovative 'Sound of Rum' Concept." Bacardi Limited, January 11, 2017. https://www.bacardilimited.com/media/news-archive/bacardi-major-lazer-launch-innovative-sound-rum-concept/.

Beatport. "Company." About Beatport. https://about.beatport.com/.

Bello, P., and D. Garcia. "Cultural Divergence in Popular Music: The Increasing Diversity of Music Consumption on Spotify across Countries." Humanities and Social Sciences Communications 8, no. 1 (2021): 1–8. https://doi.org/10.1057/s41599-021-00855-1.

Berklee School of Music. "A&R Representative." https://www.berklee.edu/careers/roles/ar-representative.

Book Music Bureau. "Elevating the Hotel Guest Experience through Music." https://bookmusicbureau.com/elevating_hotel_guest_experience/.

Bridge Audio. "Challenges Faced by Modern Record Labels: Navigating the Digital Age." Bridge Audio Blog. https://labelgrid.com/blog/content-distribution/challenges-faced-by-modern-record-labels-navigating-the-digital-age/.

Callaghan, P. "Essential Guide to Building a Successful Independent Record Label." January 4, 2024. https://releaseloop.com/blog/indie-record-label-guide-structure-success-tips.

Cardigan, S. "AM.RADIO 007: How We Packed 1,300 People into a Coffee Shop in a City We'd Never Been To." The putyouon Playbook (blog), March 11, 2025. https://stevecardigan.substack.com/p/amradio-007-how-we-packed-1300-people?utm_campaign=post&utm_medium=web.

Castellanos, J. "Experience Economy: How Millennials & Gen Z Shape Markets." Wealth Formula, 2024. https://www.wealthformula.com/blog/millennials-gen-z-shape-market/.

Cercle. YouTube channel. https://www.youtube.com/channel/UCPKT_csvP72boVX0XrMtagQ.

CloudBlue. "Digital Service Provider (DSP)." CloudBlue Glossary. https://www.cloudblue.com/glossary/digital-service-provider-dsp/.

Cornell University. "The 'Long Tail' of the Music Industry." Networks Course Blog for INFO 2040/CS 2850/Econ 2040/SOC 2090, December 12, 2020. https://blogs.cornell.edu/info2040/2020/12/12/the-long-tail-of-the-music-industry/.

Dada Life. "We've Got a New Track Coming Out Soon and It Needs a Name!" Reddit post, January 25, 2021. https://www.reddit.com/r/EDM/comments/l2yyvb/weve_got_a_new_track_coming_out_soon_and_it/.

Daily Gleams. "The Rise of Social Media DJs: Why Is Everybody a DJ These Days?" Medium. https://medium.com/@dailygleams/the-rise-of-social-media-djs-why-is-everybody-a-dj-these-days-77b125a7be80.

DeLia, J. "On Starting an L.A. Based Artist Management Company." Starter Story, October 13, 2020. https://www.starterstory.com/jeff-delia.

Dittomusic. "How Much Does Spotify Pay Per Stream in 2025." 2025. https://dittomusic.com/en/blog/how-much-does-spotify-pay-per-stream.

D'Souza, J. "YouTube Streaming Statistics by Revenue and Facts (2025)." Electro IQ, February 26, 2025. https://electroiq.com/stats/youtube-streaming-statistics/.

Eventbrite. EDM Audience Analysis. 2014. https://eventbrite-s3.s3.amazonaws.com/marketing/britepapers/Eventbrite_EDM_Social_Media_Listening_Project.pdf.

Flourish Prosper. "Comparing Royalties from Digital Downloads and Streaming across Different Platforms." Flourish Prosper Music Resources. https://flourishprosper.net/music-resources/comparing-royalties-from-digital-downloads-and-streaming-across-different-platforms/.

———. "The Evolution of Music Royalties in the Streaming Era." Flourish Prosper Music Resources. https://flourishprosper.net/music-resources/the-evolution-of-music-royalties-in-the-streaming-era/.

Forbes Agency Council. "Why Is Customer Relationship Management So Important?" Forbes, October 24, 2017. https://www.forbes.com/sites/forbesagencycouncil/2017/10/24/why-is-customer-relationship-management-so-important/.

Free. "11 Music Marketing Strategies." Free Your Music (blog), 2025. https://freeyourmusic.com/blog/11-music-marketing-strategies.

FreeYourMusic. "Spotify vs. Apple Music: Royalty Calculator." September 15, 2023. https://freeyourmusic.com/blog/spotify-vs-apple-music-royalty-calculator.

Global Brands Magazine. "2025 Concert Trends: Expensive Tickets and the Growing Demand for Live Events." February 3, 2025. https://www.globalbrandsmagazine.com/2025-concert-trends/.

Gottfried, G. "More than 1M Viewers for Tomorrowland around the World Pay-per-View." Pollstar News, April 7, 2022. https://news.pollstar.com/2020/07/29/more-than-1m-viewers-for-tomorrowland-around-the-world-pay-per-view-2/.

Grebenar, A. "Lost in Music: Mapping the 21st Century House Music Event Experience." Journal of Policy Research in Tourism, Leisure and Events 12, no. 3 (2020): 363–81.

Gross, C. "Unity Announced New Partnership with Insomniac Events." Benzinga Newswires, March 11, 2022. https://www.proquest.com/wire-feeds/unity-announced-new-partnership-with-insomniac/docview/2637905010/se-2.

Gushcloud International. "Bankeble Talent Database." Unpublished internal database. https://bankeble.gushcloud.com/admin/talents.

Icon Collective. "Indie vs. Major Record Labels: Which Is Right for You?" November 7, 2018. https://www.iconcollective.edu/indie-vs-major-record-labels.

Indiefy. "Waves of Change: Exploring Decentralization and the Indie Music Industry." Indiefy Blog, January 14, 2025. https://indiefy.net/blog/waves-of-change-exploring-decentralization-and-the-indie-music-industry.

IndieFlow. "Understanding Artist Development and Why You Need It." May 1, 2023. https://www.indieflow.me/blog/artist-development-importance.

Insider Expeditions. "Diplo Presents Secular Sabbath at Sea." https://insiderexpeditions.com/diplo/.

Katsilometes, J. "Festivals Have Been a Game-Changer in Las Vegas, but How Much Is Enough?" Las Vegas Sun, June 6, 2016. https://lasvegassun.com/blogs/kats-report/2016/jun/06/festivals-have-been-a-game-changer-in-las-vegas-bu/.

Kim, L. "The Rise of YouTube DJs: Why Are We In Love With This Trend?" Medium, October 15, 2024. https://medium.com/@dailygleams/the-rise-of-social-media-djs-why-is-everybody-a-dj-these-days-77b125a7be80.

Kloboves, S. "While Pop EDM Genres Peak, Darker Subgenres Climb." How Music Charts, October 31, 2023. https://hmc.chartmetric.com/edm-genres/.

Kulpa, J. "Why Is Customer Relationship Management So Important?" Forbes, October 24, 2017. https://www.forbes.com/sites/forbesagencycouncil/2017/10/24/why-is-customer-relationship-management-so-important/.

LabelWorx Support. "Spotify for Artists - Countdown Pages." 2025. https://support.label-worx.com/hc/en-us/articles/19915776848786-Spotify-for-Artists-Countdown-Pages.

Larsen, M., E. Lammi, and T. Mullen. "What Is a Conversion Pixel? Quick Tips and Definition." 97th Floor, December 21, 2023. https://97thfloor.com/articles/glossary/conversion-pixel/.

Laylo. "How to Self-Promote Your Music." November 14, 2023. https://go.laylo.com/blog/how-to-self-promote-your-music.

Leadsinger, Inc. v. BMG Music Publishing. 512 F.3d 522 (9th Cir. 2008).

Lunio. "Tier 1, 2, 3 Countries List: Understanding Country Tiers in Digital Advertising." October 29, 2020. https://www.lunio.ai/blog/country-tiers-digital-advertising.

Macdonald, M. "Electronic Music Statistics 2024." Product London, February 23, 2024. https://www.productlondon.com/electronic-music-statistics-2024/.

Madverse. "Music Metadata Essentials: Unlocking Discoverability & Royalties." Madverse Blog. https://www.madverse.co/blog/music-metadata-essentials-unlocking-discoverability-royalties.

MasterClass. "House Music Guide: A Brief History of House Music." June 7, 2021. https://www.masterclass.com/articles/house-music-guide.

Matos, M. "Electronic Dance Music | House, Techno & Trance." Britannica. https://www.britannica.com/art/electronic-dance-music.

Millennials. "Marketing to Millennials." Art of Impact, August 25, 2023. https://www.artofimpact.com/marketing-to-millennials/.

Monopoli, J. "Why Is The Culture Surrounding Electronic Music So Attractive?" Theses - ALL, 488. Syracuse University, 2021. https://surface.syr.edu/thesis/488.

Morris, James. "How Are Algorithms Affecting How We Find and Experience Music?" Communication Arts Blog, University of Wisconsin-Madison, June 2021. https://commarts.wisc.edu/2021/06/how-are-algorithms-affecting-how-we-find-and-experience-music/.

MSN. "Brewing Music: How Coffee Raves Are Bringing Party Experience to Coffee Shops." 2024. http://msn.com/en-in/entertainment/news/brewing-music-how-coffee-raves-are-bringing-party-experience-to-coffee-shops/ar-AA1wYl9N.

Mulligan, Mark. "A Model for a New Music Streaming Industry." MIDiA Research, March 18, 2025. https://www.midiaresearch.com/blog/a-model-for-a-new-music-streaming-industry.

———. "The IMS Business Report 2024." IMS IBIZA, April 25, 2025. https://www.internationalmusicsummit.com/business-report.

Music Business Worldwide. "There Are Now 120,000 New Tracks Hitting Music Streaming Services Each Day." June 9, 2021. https://www.musicbusinessworldwide.com/there-are-now-120000-new-tracks-hitting-music-streaming-services-each-day/.

Music24. Home page. https://music24.com/.

New Industry Friday. "Who Booked Coachella 2025? The Deep Dive." 2024. https://www.newindustryfriday.com/p/who-booked-coachella-2025-the-deep-dive.

Newkey-Burden, C., and T. W. U. Published. "Is This the End of the Big Night Out?" The Week, March 4, 2024. https://theweek.com/business/is-this-the-end-of-the-big-night-out.

NTIA. "NTIA Figures Reveal Extent of Crisis: UK Nightclubs Struggle as Dance Floors Nationwide Shut Down." February 14, 2024. https://ntia.co.uk/ntia-figures-reveal-extent-of-crisis-uk-nightclubs-struggle-as-dance-floors-nationwide-shut-down/.

Nycyk, Michael. "Online Music: How the Internet Changed the Recorded Music Industry." Academia.edu, December 12, 2020. https://www.academia.edu/92477271/Online_Music_How_the_Internet_Changed_the_Recorded_Music_Industry.

Paine, Andre. "DJ With Apple Music Launches to Enable Subscribers to Mix Their Own Sets." MusicWeek, March 25, 2025. https://www.musicweek.com/digital/read/dj-with-apple-music-launches-to-enable-subscribers-to-mix-their-own-sets/091655.

Peoples, Glenn. "Indies Own Nearly Half the Global Recorded Music Market. The Major Labels Aren't Taking It Lying Down." Billboard, November 8, 2024. https://www.billboard.com/pro/indie-labels-own-half-recorded-music-market-midia-report/.

Peseckas, P. "The Power Of Social Media In Boosting Indie Record Labels." APG Media Blog, June 16, 2024. https://www.apg.agency/blog/the-power-of-social-media-in-boosting-indie-record-labels.

Pinzón, S. "Indies on the Rise: How Independent Music is Changing The Industry Landscape." June 24, 2024. https://www.catapultmymusic.com/article/indies-on-the-rise-how-independent-music-is-changing-the-industry-landscape.

Pivotal Economics. Music Copyright 2021. 2021. https://pivotaleconomics.com/undercurrents/music-copyright-2021.

Porscheng, S. "Authenticity in Marketing: 5 Reasons Why It Matters More Than Ever." Social Native, July 25, 2024. https://www.socialnative.com/articles/5-reasons-why-authenticity-matters-more-than-ever/.

Position Music. "About." https://www.positionmusic.com/pages/about.

Quinn, Bernadette, and Maarit Kinnunen. "Guest Editorial: Sharing and Belonging in Festival and Event Space: Introduction to Special Issue." International Journal of Event and Festival Management 15, no. 1 (2024): 1–6. https://doi.org/10.1108/IJEFM-02-2024-107.

Republic Network. "6 Conversion Strategies for Music Industry." June 15, 2022. https://www.republicnetwork.es/en/blog/6-conversion-strategies-for-music/.

Roda Artists. "About." Accessed March 3, 2025. https://rodaartists.com/tags/about.

Rostrum Records. "Rostrum Records." Genius. https://genius.com/artists/Rostrum-records.

RouteNote Blog. "Spotify's 1,000-stream Threshold Cost Indie Artists Nearly $50 Million in 2024." April 24, 2025. https://routenote.com/blog/spotifys-1000-stream-threshold-cost-indie-artists-50-million-in-2024/.

Royalty Exchange. "Emerging Markets in Music Royalties." September 26, 2024. https://royaltyexchange.com/blog/emerging-markets-in-music-royalties.

Slothacid. "About Us." https://slothacid.com/pages/about-us.

Smith, J. W. "Breakdowns and the Aesthetic of Disorientation in Festival-House Music." Twentieth-Century Music 21, no. 3 (2024): 421–47. https://doi.org/10.1017/S1478572223000087.

Songstats. "Blakkat: Spotify Analytics." https://songstats.com/artist/tm49rxfg/blakkat/audience?source=spotify.

Spotify. "Metadata: What It Is and Why It Matters." Spotify for Artists. https://artists.spotify.com/blog/metadata-what-it-is-and-why-it-matters.

Team Splice. "Splice Unveils the Genre Trends That Will Shape the Sounds of 2025." Blog | Splice, January 22, 2025. https://splice.com/blog/splice-unveils-genre-trends/.

The Dark Horse Institute. "How Electronic Music Production Changed the Music Industry." Dark Horse Institute Blog. https://darkhorseinstitute.com/how-electronic-music-production-changed-the-music-industry/.

The Ghetto Flower. "10 Effective Social Media Strategies for Independent Musicians in 2024." https://theghettoflower.com/blog/10-effective-social-media-strategies-for-independent-musicians-in-2024.

The Strikingly Blog. "Merchandise Mania: The Psychology Behind Why We Buy Fan Gear." June 30, 2024. https://www.strikingly.com/blog/posts/merchandise-mania-psychology-behind-buy-fan-gear.

Thierry Godard. "The Economics of Electronic Dance Music Festivals." SmartAsset, May 21, 2018. https://smartasset.com/mortgage/the-economics-of-electronic-dance-music-festivals.

Unchained Music. "Unraveling Music Artist Advances: An In-Depth Guide to How They Work." 2023. https://www.unchainedmusic.io/blog-posts/unraveling-music-artist-advances-an-in-depth-guide-to-how-they-work.

Vinyl Me, Please. "The Surge of AI-Generated Music: Deezer Reports 20,000 Daily Uploads." April 18, 2025. https://www.vinylmeplease.com/blogs/music-industry-news/the-surge-of-ai-generated-music-deezer-reports-20-000-daily-uploads.

Vocal Media. "Understanding and Leveraging Apple Music's Editorial Opportunities." Vocal. https://vocal.media/beat/understanding-and-leveraging-apple-music-s-editorial-opportunities.

Walfish, G. "How Much Does a DJ Make?" Xposure Music, November 27, 2024. https://info.xposuremusic.com/article/how-much-does-a-dj-make-in-2024.

Water & Music. "Starter Pack: Music and Brand Partnerships." 2023. https://www.waterandmusic.com/starter-pack-music-and-brand-partnerships/.

Zen Media. "Discord Marketing: How Brands Can Use Discord to Build Communities." https://zenmedia.com/blog/discord-marketing/.