By: Karim Ghobrial, Jabrenée Hussie, Sahithi Josyula, Michaela Wu, Michael Zhang

This study advances Part II by translating Shaboom Records’ strategy into an execution plan across three tracks—DSP optimization, audience engagement, and revenue growth—using new evidence from a 225-response audience survey, targeted expert interviews (management, DSP ops, and brand partnerships), and case-led benchmarks. In Part I, we explained the market context and Shaboom’s strengths and gaps and defined three priorities: platform (DSP) performance, Gen Z/Gen Alpha engagement, and diversified revenues. The goal for this research is to identify the highest-leverage tactics that grow monthly listeners and streams, convert and retain fans, and expand monetization. Accordingly, Part 2 outlines actionable playbooks (Apple Music and YouTube Live growth, pre-save/pixel-based conversion, and CRM and D2F workflows), channel tactics (TikTok/Instagram content and Discord/Reddit community), and activation models (pop-ups, merch, and brand partnerships) to drive scalable, data-driven results while preserving Shaboom’s house-rooted identity.

Research Questions

To narrow the scope, this study will mainly focus on three research questions related to DSP strategies, audience engagement, and revenue growth. The following questions will help us identify the most sustainable strategies for indie labels.

What revenue streams are best suited for UK/US indie labels to use for the expanded growth?

What DSP strategies yield the best results for increased monthly active listeners and stream counts in the EDM genre?

What are the most effective methods indie labels can adopt to achieve high engagement and conversion rates among Gen Z and Gen Alpha listeners?

Introduction of Methodology

A key component of this research is an audience profile-based survey to understand music listenership. By identifying patterns in EDM listenership, demographic segmentation, purchase behavior, content discovery (DSPs and social media), and fan loyalty, the research targeted DSP strategies and case studies within the EDM genre and analyzed fan product consumption patterns.

Additionally, qualitative insights were gathered through interviews with industry professionals across management, marketing, finance, DSP operations, brand partnerships, and global streaming and sales. Key contributors include Hector Meza (EDM label brand strategist at Roda Artists), Travis Kirschbaum (Beatport, the leading EDM/dance DSP), Ranya Khoury (Spinnin’ Records), Benjy Grinberg (Rostrum Records), and more. These expert perspectives provided a deeper understanding of the operational strategies essential for independent label success in the evolving digital music landscape. To substantiate these findings, we incorporated scholarly articles, research on optimal digital streaming strategies, experiential marketing case studies, and EDM/house fan engagement patterns.

Limitations of the study

One limitation of this project is the scope and quality of existing research within the EDM sector. Academic journals and articles regarding EDM primarily focus on conceptual music theories and cultural studies rather than pragmatic business applications. The scope of insights was restricted due to gaps in the available client data. Addressing this gap requires rigorous evaluation of available data, particularly given challenges in accessing high-quality sources on EDM and dance music. The distribution of our survey is primarily centered around our personal networks. Most respondents come from our North American and Asia, which does not fully represent the broader global audience.

Understanding Today’s EDM Digital Audience

We conducted an online survey with 30 questions using the interactive platform Outgrow to explore music audience perspectives on digital streaming platforms, artist promotion, live events, music discovery, listening preferences, and overall consumer behavior. The survey was active for 60 days, from February 3 to April 3, 2025, and distributed through LinkedIn, Instagram, and Reddit. A total of 225 completed responses were collected.

Emerging Audience Profile and Strategic Gap

Our survey respondents were predominantly female (65%), followed by male (35%) and non-binary/others (5%). The majority of participants were aged 18–24 (55%) and 25–30 (30%), with a high level of education. Specifically, 39% were pursuing or had completed a Master’s degree. Regarding demographics, most respondents identified as Asian (64%), followed by White (17%) and Black/African American (13%). Geographically, respondents were primarily based in the United States (59%), Canada (14%), China (9%), and India (13%).

In contrast, Shaboom’s current digital audience skews male, primarily in their 30s, and shows lower engagement on social media platforms (Bankeble, 2025). Notably, while 73% of EDM fans in our sample expressed a strong preference for house music, only 15% had heard of Shaboom, underscoring a clear gap in the label’s digital identity. However, given this group’s tech-savviness and global background, it represents a worthwhile target for Shaboom to expand its digital footprint and reach a younger, more diverse audience.

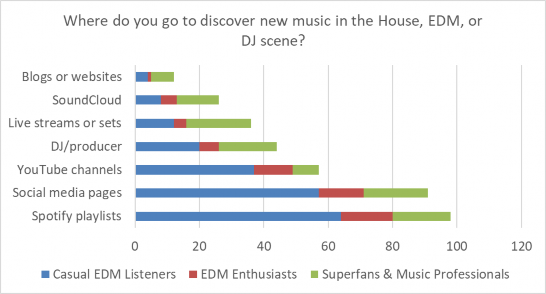

Figure 1: New Music Discovery Methods by EDM Fan Type. Source: Data from the author’s survey on EDM (2025). N=225.

Tailoring Discovery Channels by Fan Type

Music discovery is largely driven by Spotify playlists and social media pages, which are mentioned by 44% and 41% of all respondents. In addition, discovery preferences vary by people’s level of engagement with EDM. Both casual listeners and enthusiasts primarily rely on social media, YouTube, and Spotify to find new tracks. Alternatively, professionals and superfans value DJ recommendations, and live settings are often broadcast online that garner millions of streams, such as Boiler Room or Cercle. This suggests the importance of reaching mainstream listeners through accessible platforms while also highlighting the value of curating more community-driven experiences for dedicated fans who appreciate intimacy and connections with other fans.

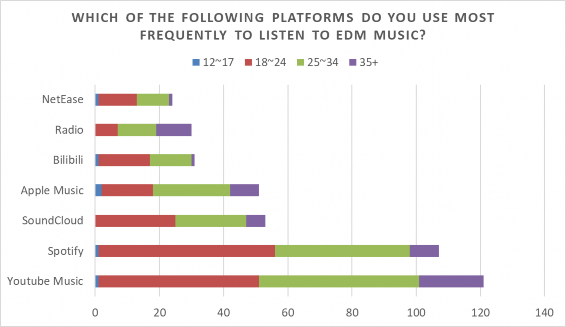

Figure 2: EDM Platform Distribution by Age Group. Source: Data from the author’s survey on EDM (2025). N=225.

Age-Segmented EDM & Social Media Platform Preferences

As seen in Figure 2, Spotify and YouTube Music are the most frequently used platforms, especially among the 18–34 demographic; Apple Music and SoundCloud serve as secondary platforms dominating the 25–34 group. Interestingly, although radio is not being picked as a top choice for other age groups, radio emerges as a top choice for the 35+ group. Additionally, the notable portion of Bilibili and NetEase shows potential as channels for international reach, especially among the Chinese audience.

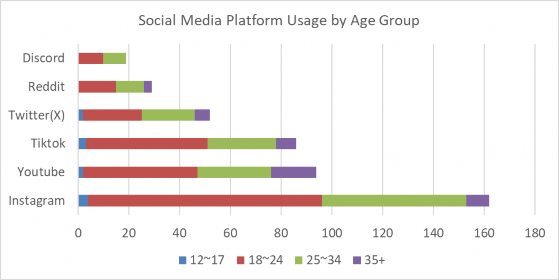

Figure 3: Social Media Platform Usage by Age Group. Source: Data from the author’s survey on EDM (2025). N=225.

One of our survey questions was related to social media platform use. Figure 3 illustrates the distribution of social media platform usage across different age groups within the EDM consumer segment. Key indicators show that Instagram and YouTube are the most widely used platforms across all age groups, particularly among the 18-24 and 25-34 demographics. This highlights a strong preference for visual and video-based content among EDM listeners.

Our findings also suggest that TikTok and X (Twitter) hold a strong attraction among younger audiences, with notable usage in the 18-24 age group. Both clearly play a role in music discovery, viral trends, and fan engagement. TikTok’s alignment with EDM’s appeal in short-form content and challenges, alongside X (Twitter)’s use for real-time discussions, artist updates, and event tracking, reinforces their importance. Conversely, older age groups (35+) display significantly lower overall social media usage, indicating more passive engagement. Niche platforms like Discord and Reddit, despite having a smaller audience share, serve highly engaged communities with exclusive “drops” or releases and interactive tactics, making them essential for underground discussions, subgenres, and deeper music discovery.

The Reality of DSPs: Opportunities, Challenges, and Artist Perspectives

During our interview with Jeff DeLia, the founder of 72 Music Management and an artist manager, he highlighted that the biggest shift in editorial and algorithmic playlists on DSPs has become a major force. He cited how it changed the way the industry markets, distributes, and evaluates artists (J. DeLia, personal communication, December 12, 2024). However, insights gathered from other interviews reveal a divergence of perspectives.

Benjy Grinberg, founder and CEO of Rostrum Records, is known for discovering and developing early-career artists, including Wiz Khalifa and Mac Miller. Through our discussion, he emphasized the importance of DSP planning for boosting an artist’s visibility. “Our dedicated team focuses entirely on DSP strategies—determining release timing, deciding between waterfall releases or single drops, and ensuring songs are uploaded early enough to hit algorithm (B. Grinberg, personal communication, January 27, 2025).” The optimal timing for releasing music can provide a better opportunity for artists to leverage the algorithms with the highest exposure possible. Meanwhile, Hector Meza, an artist manager at Roda Artists who specializes in electronic music, observed that a DSP strategy should be integrated with live performances. Having a DJ play the music offers free promotion, potentially drawing a larger audience and increasing the chances of landing on more DSP playlists (H. Meza, personal communication, December 13, 2024). Engagement and community have always been key factors in the success of music distribution, as highlighted by both Meza and Grinberg. Their viewpoints align in emphasizing the importance of leveraging personal connections with fans to enhance algorithmic visibility on DSPs. These perspectives also strongly support our survey findings in Figure 1, which indicate that reaching mainstream listeners requires both digital and organic efforts through DSPs and live events.

However, from some artists’ perspectives, DSPs are less profitable than other revenue streams. In Chapter 2, we referenced Spotify’s payment model, which provides artists only between $0.00331 and $0.00437 per stream (How Much Does Spotify Pay per Stream in 2025). Even with one million streams, the total payout to an artist amounts to approximately $4,000. While one million streams may not seem substantial for an established artist, it can be a challenging milestone for emerging and independent artists. This concern is echoed by Sacha Robotti, a DJ and the founder of Slothacid Records. He observed, “A lot of money in streaming disappears into unknown pots—artists don’t always receive their fair share, especially if they aren’t properly registered (S. Robotti, personal communication, February 11, 2025)”. According to Xposure Music, masters of catalog management, DJs always earn significant income from live gigs, festivals, private events, and clubs (Walfish, 2024). As a result, Shaboom may need to undertake alternative revenue models that align more closely with these factors. While DSPs remain important for exposure and brand recognition, direct interaction with fans through live performances, club shows, and merchandise sales remains the primary revenue stream.

Beyond the Music: Building a Community, Not an Audience

To effectively connect with an artist’s audiences, regardless of demographic, it is necessary to be aware of and willing to move between emerging and existing platforms. Artist teams should monitor data and trends to identify what emergent platforms their current and desired audiences frequent. Position Music’s Label Marketing Director Lauren Rodriguez states, “Superfans drive early engagement, which boosts streaming numbers and visibility when new music is released” (L. Rodriguez, personal communication, December 11, 2024). Social media and email list updates can help indie labels and artists build a community that helps promote longevity.

Ghostly International focused on building strong relationships with their fans through social media engagement. By actively responding to comments, sharing behind-the- scenes content, and involving their followers in decision-making processes (such as album artwork selection or track listing choices), they created a sense of community and loyalty among their fan base. This not only drove organic fan engagement but also led to increased support for the label’s releases. (Peseckas, 2024, para 108)

Another method to connect with fans and generate ancillary revenues is through pop-up shops and merchandise. Fans use merchandise to convey their sense of belonging and loyalty to a fandom. Artists can exploit this by creating merchandise that fans want to own to show how devoted they are to the fandom. Whether fans are collectors, gift givers, or want to feel like they belong to a community, merch should align with these different needs to trigger fans to buy merchandise. Using strategic marketing and exclusive offerings in tandem with creating exclusive fan environments, whether it’s through live performances, artist engagements, or online fandom communities (Merchandise Mania, 2024).

In the age of social media, many up-and-coming artists see audience engagement and marketing as chasing viral moments and tailoring their music to platforms like TikTok. In contrast, Sacha Robotti, Slothacid label owner and DJ, personally communicates with his fans through social media posts and livestreams. He finds that social media engagement transfers well to attendance at his live shows, allowing him to meet those same fans beyond a phone screen. “There's this disconnect between what artists think the market wants. So, it's about focusing on the music and not chasing validation through numbers—because quality will always break through.” (S. Robotti, personal communication, February 11, 2025).

Indies can use this current decentralized model of the music industry to their advantage. Social media allows artist teams to learn more about what their fans want. Teams can use data analytics to compile audience profiles. These audience profiles can be used to understand their listener base and teach them how to effectively market to them. Using data to inform these decisions can allow artist teams to help predict which platforms they should be active on and how frequent, where different pop-ups should take place, and what merchandise does best in particular states or countries (Waves of Change, 2025).

Authenticity Over Clout: Crafting Meaningful Brand Partnerships

Brand partnerships normally come to those artists and macro influencers with big followings, but as seen with partnerships with up-and-coming artists or nano influencers, fan dedication and authentic brand alignment can lead to success. For example, when Wiz Khalifa was with Rostrum Records, he often wore Converse and talked about them in his music. The partnership between Wiz and Converse felt right to both Converse and Rostrum (B. Grinberg, personal communication, January 27, 2025). In August 2013, Converse and Khalifa released a limited-edition collection of 12 sneakers that sold out quickly, causing the company to release another collaboration in August 2014 (Converse Continues Partnership with Rapper Whiz Khalifa, 2014; Freaker, 2023).

In artist manager Hector Meza’s opinion, it may benefit indies to start small with local businesses before approaching major brands. “Building credibility through events and collaborations makes it easier to secure bigger partnerships.” (H. Meza, personal communication, December 13, 2024). This point was echoed by Ranya Khoury, Streaming Director at Spinnin’ Records, who has helped orchestrate collaborations with luxury fitness brand Peloton for fitness- aligned artists. She also highlighted Diplo’s partnership with wellness brands, one of which is Secular Sabbath, where he launched a wellness-focused cruise featuring yoga, ambient music, sound baths, and tea ceremonies. Tickets were priced at a minimum of $15,999 and sold out within hours (Insider Expeditions, 2025; R. Khoury, personal communication, March 24, 2025).

Recommendations

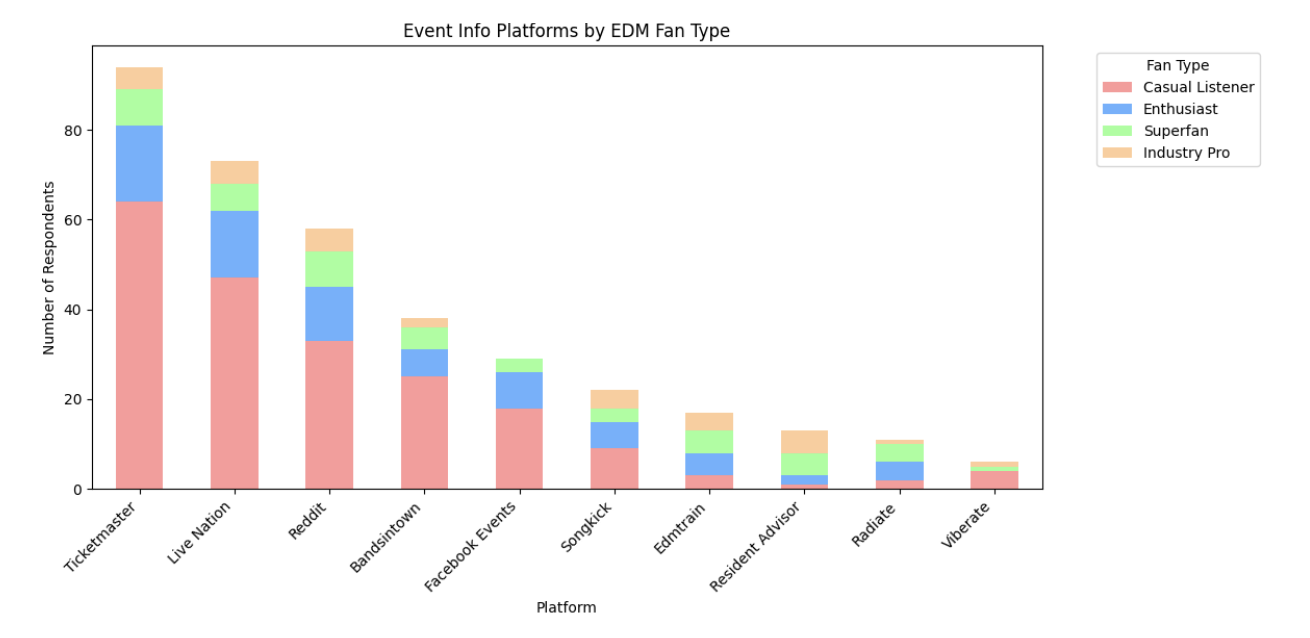

Our survey highlights how varying listener segments engage with music differently and reveals where targeted strategies could make the most impact. The survey showed that casual listeners gravitate toward Spotify, YouTube, and social media, while superfans and professionals seek out niche platforms like SoundCloud, Beatport, blogs, and DJ recommendations. This finding suggests a need for layered, audience-specific approaches.

Additionally, the dominance of Instagram and YouTube among 18-34-year-olds, along with TikTok’s traction in the 18-24 demographic, reflects a broader shift toward visual and short-form content as primary discovery tools. The high preference for Apple Music among teens also points to overlooked opportunities in DSP strategy. These behavioral patterns suggest that effective artist promotion must extend beyond reach to include conversion tactics, platform optimization, and more direct forms of fan engagement. Indie labels should observe tactics spanning music conversion, CRM integration, content creation, live events, and emerging technology to leverage cross-platform visibility in sustaining fan relationships and driving long- term growth.

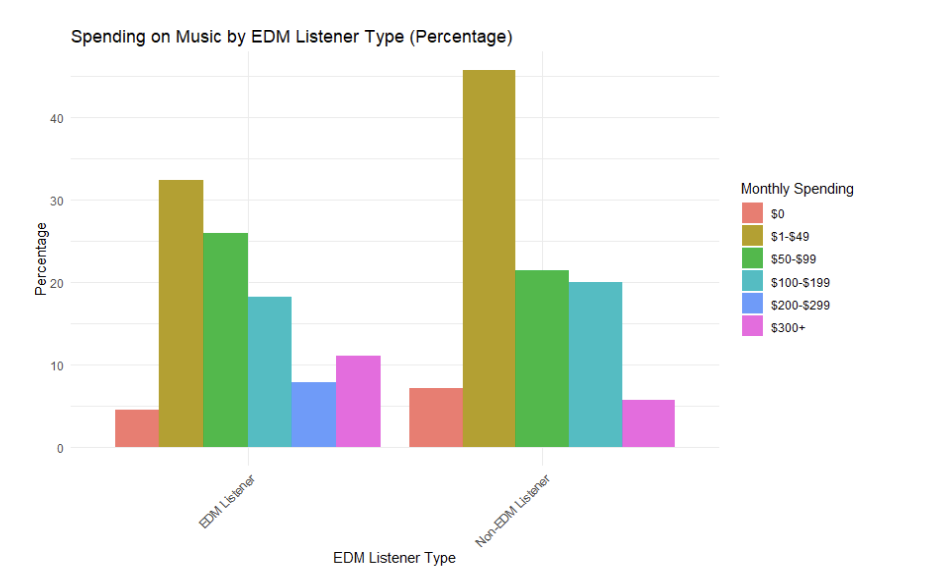

Consumer Spending

Insights from interviews about the growing interest in alternative visual and live event experiences, including localized events, were further validated by our consumer behavior data, which examined spending patterns among EDM and non-EDM fans. EDM listeners exhibit a more balanced distribution across spending tiers, with a notable portion allocating $50–$99 and $100–$199 toward music-related content such as exclusives, club events, and concerts. In contrast, non-EDM listeners are more likely to rely on free options, with a significantly higher percentage falling into the $0 spending category.

However, a substantial segment of non-EDM fans still invests $50–$99, likely representing dedicated fans of other genres. When it comes to premium spending ($200+), only a small percentage of EDM fans reach the $200–$299 and $300+ brackets—primarily hardcore festival-goers, vinyl collectors, or premium service subscribers. They still outspend their non- EDM counterparts in these higher tiers.

This data supports Rodriguez’s point about the power of superfans. It also underscores the opportunity to deepen engagement through localized, in-person strategies such as balcony events, pop-ups, and fan-driven experiences. In terms of monetizing these events, several artists have collaborated with exclusive event apps like Dice and Partiful to create intimate experiences, build exposure, and eventually get booked for larger venues and underground ticketed shows. As shown in Figure 5, platforms like Songkick and Bandsintown remain crucial to live activation strategies, with fans demonstrating high levels of interest and awareness in these discovery formats.

DSP Recommendations: Apple Music Growth and YouTube Live Expansion

Our survey data and secondary research support the idea that Apple Music is a business development opportunity. While instant “shazamming” and seamless playlist integration support physical-to-digital conversion, particularly among the 12–17 demographic (Apple, n.d.), there is more to leverage. This is why we strongly recommend that Shaboom opt into Apple Music’s DJ integration. Implementing this would position the company to enable commercial partnerships through DJ sessions and in-app digital real estate for promos (Paine, 2025).

Editorial placements on Today’s Hits, New Music Daily, and mood-based playlists are essential for EDM reach, while DJ-hosted radio shows and Artist Spotlight Stories deepen fan engagement. To enhance Shaboom’s positioning for editorial curation, growing a follower base and maintaining consistent engagement across social media are critical. This can be achieved by producing highly engaging short-form clips of DJ sets and reflecting current trends in House music. Demographic targeting via Apple Music for Artists, along with newer tools powered by Shazam’s geolocation data, can help hyper-target emerging regions showing organic growth (See How Shazam Works for Artists - Apple Music for Artists, 2025). Utilizing SmartLinks can further maximize audience engagement across platforms (Understanding and Leveraging Apple Music's Editorial Opportunities, n.d.; Music24, n.d.; Free Your Music, 2025).

Additionally, several regions identified in the interviews as keystone EDM markets align closely with YouTube’s largest user bases. India leads with 491 million active users, followed by the U.S. with 253 million, Brazil with 144 million, and the U.K. with 54.8 million (D’Souza, 2025), making YouTube a critical platform for driving global engagement. The rise of YouTube DJs, not only on YouTube but also on other platforms, and the impact of virality with both short- and long-form content further establish YouTube as a key driver of engagement among EDM listeners, as confirmed by our survey results (Kim, 2024). YouTube remains a prominent platform for connecting with the 12–36 demographic, while TikTok stands out for reaching younger audiences (12–17) in terms of short-form potential. Based on this market research, we recommend a strategy of consistent multi-format checklist-compliant releases to enhance Shaboom’s reach, particularly focused on live DJ sets, Live Chat engagement and attractive visuals. Platforms like Cercle (3.36M subscribers) and Boiler Room (2.9M subscribers) demonstrate the conversion power of live streams (Cercle, n.d.; Social Blade, 2023). Cercle’s Mont Saint-Michel set with Peggy Gou (2019) reached 5.6 million views, turning live content into ticket sales. Research on millennial marketing indicates that live video drives three times more conversions than pre-recorded content (Annalect, 2023). This finding reinforces the power of live sessions and highlights why major virtual events like Tomorrowland's digital edition drew over 1 million viewers (Gottfried, 2020).

DSP Recommendations: Data-Driven Music Conversion Strategies

We have highlighted how music business owners like Grinberg and DeLia emphasized tailoring their strategies to maximize artist visibility and engagement (B. Grinberg, personal communication, January 27, 2025; J. DeLia, personal communication, December 12, 2024). Therefore, we recommend that Shaboom develop a music conversion strategy to boost artists' DSP performance. This strategy involves having listeners actively interact with artists’ music, reaching potential listeners, and collecting and analyzing listener behavior to customize marketing campaigns (Republic Network, 2022).

The findings from our industry survey indicate that social media pages and Spotify playlists are the two most utilized discovery methods among casual listeners and EDM enthusiasts. If an album gets pre-saved before the release, 70% of the users who have pre-saved it will stream within the first week, underscoring the importance of countdown pages and pre- save campaigns. (Spotify for Artists - Countdown Pages, 2025). This data point serves as key evidence supporting our belief that implementing a music conversion strategy will benefit Shaboom’s expanded development.

In particular, we recommend that Shaboom launch its conversion campaigns at least two weeks before the actual release date to maximize the exposure. During the conversion window, the marketing team should utilize data analysis with the conversion pixel through the DSP pre- save landing page, a piece of code placed on the website that tracks user interactions after they click on a digital campaign (Larsen et al., 2023). This information furnishes a way to build detailed audience profiles based on real-time social media user behaviors. Ideally, Shaboom can use this data to create lookalike audiences, new groups of potential customers who share similar characteristics (Larsen et al.). Essentially, Shaboom should continuously use pixel to tailor the target audience so that it can help the label maintain its core audience while expanding its reach to new fans through social media.

Audience Engagement Recommendations: Customer Relationship Management

To further support the music conversion strategy, Shaboom should consider exploiting a CRM system and start establishing a dynamic fan-artist ecosystem simultaneously. Our interviews with Khoury highlight a need to emphasize the savings rate in the EDM space (R. Khoury, personal communication, March 24, 2025). Rodriguez at Position Music also emphasized the importance of utilizing CRM to create an organic relationship between artists and fans (L. Rodriguez, personal communication, December 11, 2024). This further leads us to recommend several key strategies for optimizing music release campaigns, particularly focusing on pre-save and direct-to-fan (D2F) engagement.

Laylo is a messaging and CRM platform for creators and brands for D2F relationship building that has a sign-up page feature that can capture email and SMS opt-ins. During Valiant Heart’s single “Banshee” conversion campaign, the Laylo sign-up page increased the conversion rate by 39% compared to a traditional pre-save page (Laylo, n.d.). Laylo also offers an automated DM (Direct Message) feature through a keyword-driven campaign, in which an artist can set a specific word to support a coming music drop. When the system detects a keyword DM from a fan, an automated preset message from the artist will be sent directly to the fan.

With these strategic CRM tools, Shaboom can not only boost conversion rates but also grow a loyal fan base through exclusive content and notifications. These components were mentioned in several interviews as a keystone in connecting with fans. While attribution of streams is one of the biggest issues in this industry, we can project the return on stream numbers based on investment in these tools.

Engaging the EDM Audience: Instagram & TikTok Content Creation

Although some artists find constant content creation tedious, Meza has a few strategies that make navigating this new dominant form of marketing easier for other artists. He does not see a need for big production budgets for social media, citing that “iPhone content often performs better due to its authenticity (H. Meza, personal communication, December 13, 2024). Another aspect of content creation that gets overlooked is content repurposing. “Instead of creating new content constantly, use existing footage in multiple formats to maximize reach. To make this easier, film all content in a wide aspect to enable the content to be used on multiple social media platforms” (H. Meza, personal communication, December 13, 2024).

Rodriguez shared some platform-specific recommendations that we think would benefit Shaboom. The strategies she suggested were utilizing TikTok hooks at the beginning of videos and Instagram broadcast channels to draw as many super fans in as possible and make them feel special (L. Rodriguez, personal communication, December 11, 2024). For TikTok and Instagram Reels, artists should use viral moments to promote their songs and create eye-catching promotions.

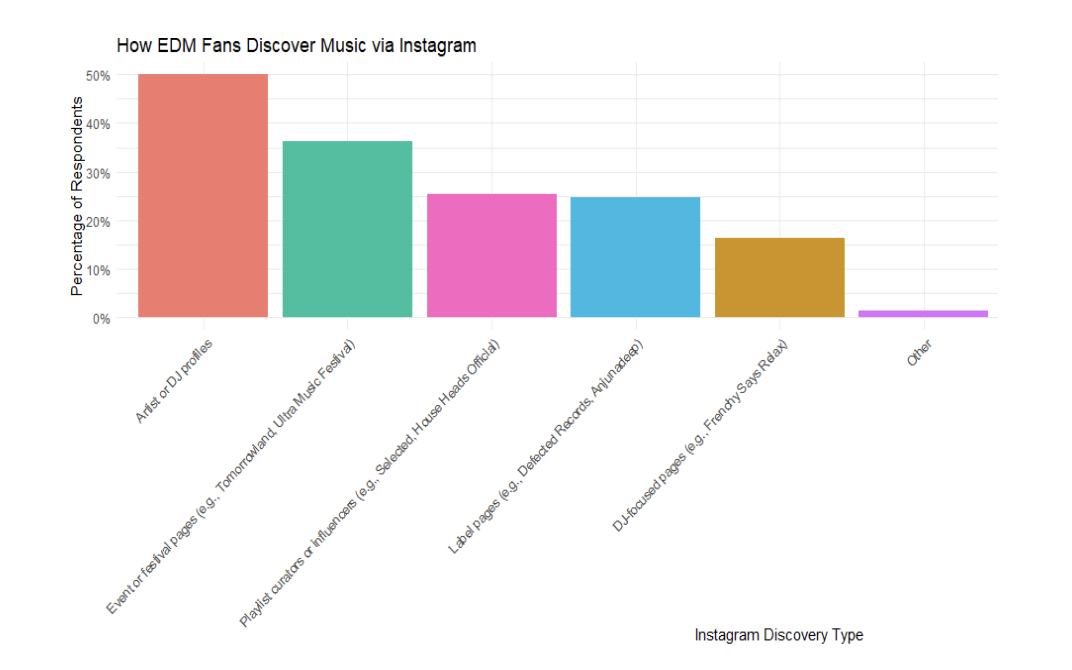

Instagram broadcast channels also represent a great way to create exclusive content, such as early access to new music and behind-the-scenes content that can be posted in these groups before release (10 Effective Social Media Strategies for Independent Musicians in 2024, n.d.). Half of our EDM survey respondents said they discovered new music via artist profiles and DJ profiles on Instagram; 39% of the EDM respondents through festival-related music pages; and 25% of the EDM respondents through curators or influencers, leading us to recommend the following strategies.

Shaboom should transition to cultivating a dynamic, multifaceted digital presence without losing its brand equity. By customizing artist profiles, creating engaging festival-related content, and developing relationships with key influencers of DJ curation pages (e.g., Frenchy Says Relax, curated by Kareem AlFuwaires), the label can effectively tap into social media as a channel that DJ communities are highly engaged in. Artists should use broadcast channels to tease or preview releases and organically engage with their fans. The label page broadcast channel would promote all Shaboom Records activities and artists. Artist and label social media pages should give viewers an exclusive backstage look into Shaboom Records' inner workings and convey what it is like to be a hot, indie House Label.

Leveraging Niche Platforms to Drive Authentic EDM Engagement

Rather than targeting broad audiences, strengthening superfan connections is key in the house & EDM space. Our survey highlights Discord’s importance among Gen Z and millennial audiences, presenting an opportunity for Shaboom to establish a branded server. Organizing channels by interest, assigning tiered roles (fans, superfans, VIPs), and hosting AMA sessions with artists/DJs can create deeper interactive spaces. Offering exclusive perks like early event ticket access, merch drops, unreleased tracks, and invite-only listening parties will further drive D2F connection. A community-driven approach on Discord can enhance fan retention and monetization (Zen Media, 2024).

We also recommend Reddit as a strategic discovery tool for EDM labels. Analysis of the r/EDM subreddit, which is home to over 3 million active users, confirms it is a highly engaged platform for track identification and discovery. The volume of “ID PLEASE” posts demonstrates Reddit’s stickiness for music searches, offering a prime channel for amplifying new releases. A notable example includes Dada Life, a Swedish electronic duo, who promoted a new track on Reddit with an authentic, fan-focused video, garnering nearly 2,000 upvotes and high engagement from superfans (Dada Life, 2021). This underscores Reddit’s potential as a direct-to- fan discovery tool that converts to DSP song saves.

Grassroots to Global: Event Activations and Merchandising

Labels and artists can also capitalize on the attraction of exclusivity by using intimate and unique events. Fans crave in-person experiences in the post-COVID-19 era, and ticket prices continue to surge (2025 Concert Trends, 2025). Interview subject Robotti suggested that indies offer smaller, grassroots events to fans for $10 to $20. Additionally, smaller venues can allow fans to connect with artists and each other more directly in intimate spaces. These interactions also allow DJs and musicians to hone their craft (S. Robotti, personal communication, February 11, 2025). Rodriguez added to these recommendations, reiterating the value of smaller shows and highlighting the use of “pop-ups, or unique events like toy drives” (L. Rodriguez, personal communication, December 11, 2024). These smaller events can also help gauge fan demand before committing to larger-scale events.

Merchandise does not always have to be traditional band tees and hoodies. Artists can use distinctive products that reflect their personal brands to promote their music as well. Instagram broadcast channels can be utilized to gift superfans early or exclusive access to merchandise. DeLia’s experience with marketing albums provides a compelling example of artist merchandise curation. For Bobby Rush’s Sitting on Top of the Blues, he designed custom-made air fresheners featuring his image and a cherry vanilla scent (J. DeLia, personal communication, December 12, 2024).

Specialty products often manifest through well-researched and creatively executed brand partnerships. Our interviewees and research noted campaigns such as Peloton x Diplo, Wiz Khalifa, and Bacardi x Major Lazer’s Sound of Rum EDM initiative highlight how such collaborations not only drive engagement and attendance but also enhance long-term identity (Bacardi Limited & Nick, 2017). The Peloton x Diplo partnership shows how collaborations can drive long-term value through content integrations like curated playlists on Peloton. On a smaller scale, indie musicians like Phoebe Bridgers’ had a limited-edition "Kyoto" necklace with Catbird that quickly sold out, raised charitable funds, and boosted her personal and brand profiles (Pinzón, 2024b). We believe that Shaboom would benefit from activating potential partnership strategies to address key international and domestic markets. These could include collaborations with DJ equipment brands, fitness brands, or DJ events in the U.K., Latin America, or Spain and Asia that align with Shaboom’s roster, audience, and brand ethos.

Experiential Activations & The Rise of Alternative Venues: The Coffee Rave Revolution

In addition to consumer specialty and physical product creation to secure fan loyalty, our survey results highlight that the EDM audience thrives in live spaces. This finding emphasizes the growing demand for affordable, social, and localized activations, especially as nightclub closures accelerate. Between 2020 and December 2023, the UK (Key Dance Music Market) experienced 400 nightclubs shutting down, shrinking market availability by 31% (NTIA, 2024). This decline has left young music lovers with fewer accessible venues (NTIA, 2024), and with 39% of 18- to 24-year-olds abstaining from alcohol (Newkey-Burden & published, 2024), the rise of sober curiosity is creating demand for inclusive third spaces.

In findings from various surveys across Nielsen, 81% of the respondents say that the most engaging brand experiences they have seen involve music in a live setting (“Marketing to Millennials”, 2024). At the same time, 78% of millennials plan to increase their spending on experiences rather than physical things in the next year, pointing to a move away from material goods and a growing demand for real-life experiences (Castellenos, 2024)

The rise of AM.RADIO’s coffee DJ popup movement based in Los Angeles presents a different kind of opportunity. It is one that allows brands like Shaboom to engage with the 18-34 demographic through hyperlocal, community-driven events with low investment but a high return on online engagement (TikTok - Make Your Day, 2025; Cardigan, 2025). This global model originated in cities such as Amsterdam, London, and New York before expanding to Mumbai, Delhi, and other Indian cities. Coffee raves have redefined nightlife by creating alcohol-free, music-focused experiences, and DJs like Tanishq have embraced this model by transforming coffee counters into DJ booths while enabling more inclusive and intimate gatherings that drive digital conversion and curator attention ("Brewing Music," n.d.; MSN, n.d.). In alignment with this trend, we recommend that Shaboom partner with Dice to produce exclusive, Partiful, invite-only events to drive superfans and casual listeners into full-time fans of the roster and label.

Conclusion

A data-driven music conversion strategy is essential for Shaboom. By integrating Pixel tracking, Spotify Artist data, and YouTube and Meta Ads campaigns, Shaboom can proactively boost listener engagement and expand audience reach. Additionally, the DSP pre-save landing page strategy will serve as a hub on artists' social media platforms, maximizing visibility. To maintain artistic integrity, we encourage artists to have creative control over their landing page design.

CRM platforms like Laylo are also valuable for collecting actionable data to develop future strategies for loyal fandom building. Our DSP analysis highlights Apple Music as a key partner, offering higher artist payouts and editorial placement potential. To capitalize on this opportunity, indie labels should submit tracks early through Apple Music for Artists, maintain cohesive branding, and leverage editorial opportunities such as New Music Daily and Artist Spotlight Stories.

Shazam stats on Apple Music for Artists also offer a powerful geo-targeting tool, allowing Shaboom to identify emerging markets and customize regional rollout strategies for maximum impact. To expand reach, we recommend consistent, high-quality live set releases with active chat moderation—particularly on platforms like YouTube. Dominant in key markets such as India, Brazil, and the UK, YouTube also aligns with our interview findings, reinforcing live streams as a powerful tool for converting new markets and the already existing Shaboom audience in the UK.

Utilizing Instagram and, particularly, broadcast channels allows fans to feel a sense of belonging to fandom communities, which resonates with both Shaboom’s current audience demographic and the Gen Z and Gen Alpha emergent audiences. Community-driven platforms like Discord and Reddit should also play a central role in Shaboom’s strategy. Discord fan listening parties and Reddit’s track ID culture present a unique avenue for organic discovery.

The live music industry is the backbone of EDM culture, and indies can offer smaller experiences for fans, such as intimate concerts, pop-up shows, or unique merch giveaways. Beyond digital, Shaboom can lead in the emerging physical-to-digital movement by anchoring its brand in experiential activations. This includes coffee raves, balcony sets, and exclusive events powered by platforms like DICE and Partiful. From cafés to boutique hotels, Shaboom’s sound can be a part of these spaces not only to enhance brand presence but also to drive real- world Shazam moments and return on exposure and social media growth. Adopting these strategies will support Shaboom Records in sustaining its current brand position as a successful legacy brand and enable the label to scale as a market leader in the future.

Survey Findings

Among all the different subgenres of EDM listeners in our different EDM listener types, we see that House music takes the most percentage within casual listeners. This indicates that this survey is mostly skewed towards casual house listeners.

Figure 4: EDM Sub Genre Preferences by Listener Type. Source: Data from the author’s survey on EDM (2025), What Kind of EDM Fan Are You?

EDM listeners show a more balanced distribution across spending tiers, with a significant portion allocating $50-$99 and $100-$199 for music-related content such as exclusives, clubs, and concerts. In contrast, non-EDM listeners tend to rely more on free options, with a notably higher percentage falling into the $0 spending category. However, a considerable segment still spends $50-$99, likely representing devoted fans of other genres. Regarding premium spending ($200+), only a small percentage of EDM listeners reach the $200-$299 and $300+ brackets, likely consisting of hardcore festival goers, vinyl collectors, or subscribers to premium services—outspending their non-EDM counterparts in these tiers.

Figure 5: Spending on Music By EDM Listener Type (Percentage). Source: Data from the author’s survey on EDM (2025). N=225.

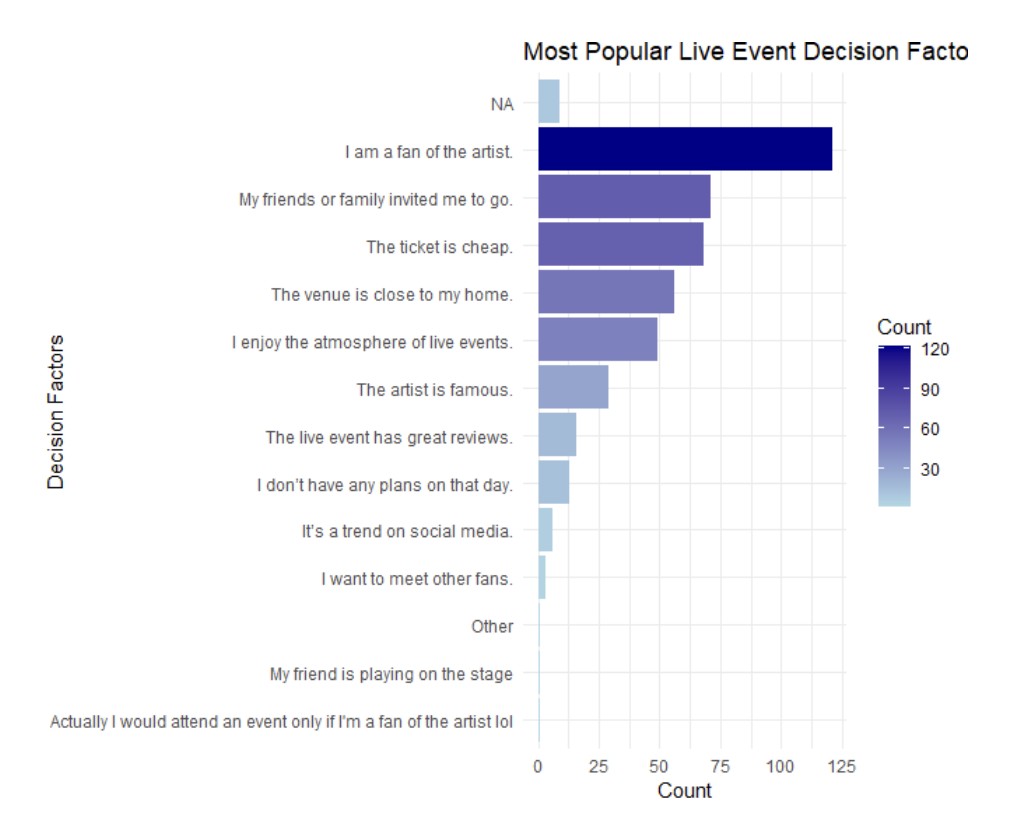

Most people value factors such as being a fan of the artist, receiving an invitation from friends or family, and affordable ticket prices. Fandom is the primary driving force behind live event attendance. Additionally, the opportunity to enjoy time with friends and family plays a significant role. In contrast, the artist's popularity and the particular event's reputation are less influential in their decision-making.

Figure 6: Decision factors to choose live events among EDM fans. Source: Data from the author’s survey on EDM (2025), What Kind of EDM Fan Are You?

Figure 7: EDM audience preferences via Instagram. Source: Data from the author’s survey on EDM (2025), What Kind of EDM Fan Are You? [Which Instagram pages do you follow to discover new music in the house, EDM, or DJ space?]

Figure 8: EDM audience Discovery of Live Events.

-

Ali, A. "Gen Z Nightlife Culture: Why Nostalgia Rules the Dance Floor." NBC News, March 1, 2024. https://www.nbcnews.com/pop-culture/gen-z-nightlife-culture-nostalgia-rcna125912.

Apple Music for Artists. "See How Shazam Works for Artists." 2025. https://artists.apple.com/support/1109-shazam-in-apple-music-for-artists.

Bacardi Limited, and Nick. "Bacardí® and Major Lazer Launch Innovative 'Sound of Rum' Concept." Bacardi Limited, January 11, 2017. https://www.bacardilimited.com/media/news-archive/bacardi-major-lazer-launch-innovative-sound-rum-concept/.

Beatport. "Company." About Beatport. https://about.beatport.com/.

Bello, P., and D. Garcia. "Cultural Divergence in Popular Music: The Increasing Diversity of Music Consumption on Spotify across Countries." Humanities and Social Sciences Communications 8, no. 1 (2021): 1–8. https://doi.org/10.1057/s41599-021-00855-1.

Berklee School of Music. "A&R Representative." https://www.berklee.edu/careers/roles/ar-representative.

Book Music Bureau. "Elevating the Hotel Guest Experience through Music." https://bookmusicbureau.com/elevating_hotel_guest_experience/.

Bridge Audio. "Challenges Faced by Modern Record Labels: Navigating the Digital Age." Bridge Audio Blog. https://labelgrid.com/blog/content-distribution/challenges-faced-by-modern-record-labels-navigating-the-digital-age/.

Callaghan, P. "Essential Guide to Building a Successful Independent Record Label." January 4, 2024. https://releaseloop.com/blog/indie-record-label-guide-structure-success-tips.

Cardigan, S. "AM.RADIO 007: How We Packed 1,300 People into a Coffee Shop in a City We'd Never Been To." The putyouon Playbook (blog), March 11, 2025. https://stevecardigan.substack.com/p/amradio-007-how-we-packed-1300-people?utm_campaign=post&utm_medium=web.

Castellanos, J. "Experience Economy: How Millennials & Gen Z Shape Markets." Wealth Formula, 2024. https://www.wealthformula.com/blog/millennials-gen-z-shape-market/.

Cercle. YouTube channel. https://www.youtube.com/channel/UCPKT_csvP72boVX0XrMtagQ.

CloudBlue. "Digital Service Provider (DSP)." CloudBlue Glossary. https://www.cloudblue.com/glossary/digital-service-provider-dsp/.

Cornell University. "The 'Long Tail' of the Music Industry." Networks Course Blog for INFO 2040/CS 2850/Econ 2040/SOC 2090, December 12, 2020. https://blogs.cornell.edu/info2040/2020/12/12/the-long-tail-of-the-music-industry/.

Dada Life. "We've Got a New Track Coming Out Soon and It Needs a Name!" Reddit post, January 25, 2021. https://www.reddit.com/r/EDM/comments/l2yyvb/weve_got_a_new_track_coming_out_soon_and_it/.

Daily Gleams. "The Rise of Social Media DJs: Why Is Everybody a DJ These Days?" Medium. https://medium.com/@dailygleams/the-rise-of-social-media-djs-why-is-everybody-a-dj-these-days-77b125a7be80.

DeLia, J. "On Starting an L.A. Based Artist Management Company." Starter Story, October 13, 2020. https://www.starterstory.com/jeff-delia.

Dittomusic. "How Much Does Spotify Pay Per Stream in 2025." 2025. https://dittomusic.com/en/blog/how-much-does-spotify-pay-per-stream.

D'Souza, J. "YouTube Streaming Statistics by Revenue and Facts (2025)." Electro IQ, February 26, 2025. https://electroiq.com/stats/youtube-streaming-statistics/.

Eventbrite. EDM Audience Analysis. 2014. https://eventbrite-s3.s3.amazonaws.com/marketing/britepapers/Eventbrite_EDM_Social_Media_Listening_Project.pdf.

Flourish Prosper. "Comparing Royalties from Digital Downloads and Streaming across Different Platforms." Flourish Prosper Music Resources. https://flourishprosper.net/music-resources/comparing-royalties-from-digital-downloads-and-streaming-across-different-platforms/.

———. "The Evolution of Music Royalties in the Streaming Era." Flourish Prosper Music Resources. https://flourishprosper.net/music-resources/the-evolution-of-music-royalties-in-the-streaming-era/.

Forbes Agency Council. "Why Is Customer Relationship Management So Important?" Forbes, October 24, 2017. https://www.forbes.com/sites/forbesagencycouncil/2017/10/24/why-is-customer-relationship-management-so-important/.

Free. "11 Music Marketing Strategies." Free Your Music (blog), 2025. https://freeyourmusic.com/blog/11-music-marketing-strategies.

FreeYourMusic. "Spotify vs. Apple Music: Royalty Calculator." September 15, 2023. https://freeyourmusic.com/blog/spotify-vs-apple-music-royalty-calculator.

Global Brands Magazine. "2025 Concert Trends: Expensive Tickets and the Growing Demand for Live Events." February 3, 2025. https://www.globalbrandsmagazine.com/2025-concert-trends/.

Gottfried, G. "More than 1M Viewers for Tomorrowland around the World Pay-per-View." Pollstar News, April 7, 2022. https://news.pollstar.com/2020/07/29/more-than-1m-viewers-for-tomorrowland-around-the-world-pay-per-view-2/.

Grebenar, A. "Lost in Music: Mapping the 21st Century House Music Event Experience." Journal of Policy Research in Tourism, Leisure and Events 12, no. 3 (2020): 363–81.

Gross, C. "Unity Announced New Partnership with Insomniac Events." Benzinga Newswires, March 11, 2022. https://www.proquest.com/wire-feeds/unity-announced-new-partnership-with-insomniac/docview/2637905010/se-2.

Gushcloud International. "Bankeble Talent Database." Unpublished internal database. https://bankeble.gushcloud.com/admin/talents.

Icon Collective. "Indie vs. Major Record Labels: Which Is Right for You?" November 7, 2018. https://www.iconcollective.edu/indie-vs-major-record-labels.

Indiefy. "Waves of Change: Exploring Decentralization and the Indie Music Industry." Indiefy Blog, January 14, 2025. https://indiefy.net/blog/waves-of-change-exploring-decentralization-and-the-indie-music-industry.

IndieFlow. "Understanding Artist Development and Why You Need It." May 1, 2023. https://www.indieflow.me/blog/artist-development-importance.

Insider Expeditions. "Diplo Presents Secular Sabbath at Sea." https://insiderexpeditions.com/diplo/.

Katsilometes, J. "Festivals Have Been a Game-Changer in Las Vegas, but How Much Is Enough?" Las Vegas Sun, June 6, 2016. https://lasvegassun.com/blogs/kats-report/2016/jun/06/festivals-have-been-a-game-changer-in-las-vegas-bu/.

Kim, L. "The Rise of YouTube DJs: Why Are We In Love With This Trend?" Medium, October 15, 2024. https://medium.com/@dailygleams/the-rise-of-social-media-djs-why-is-everybody-a-dj-these-days-77b125a7be80.

Kloboves, S. "While Pop EDM Genres Peak, Darker Subgenres Climb." How Music Charts, October 31, 2023. https://hmc.chartmetric.com/edm-genres/.

Kulpa, J. "Why Is Customer Relationship Management So Important?" Forbes, October 24, 2017. https://www.forbes.com/sites/forbesagencycouncil/2017/10/24/why-is-customer-relationship-management-so-important/.

LabelWorx Support. "Spotify for Artists - Countdown Pages." 2025. https://support.label-worx.com/hc/en-us/articles/19915776848786-Spotify-for-Artists-Countdown-Pages.

Larsen, M., E. Lammi, and T. Mullen. "What Is a Conversion Pixel? Quick Tips and Definition." 97th Floor, December 21, 2023. https://97thfloor.com/articles/glossary/conversion-pixel/.

Laylo. "How to Self-Promote Your Music." November 14, 2023. https://go.laylo.com/blog/how-to-self-promote-your-music.

Leadsinger, Inc. v. BMG Music Publishing. 512 F.3d 522 (9th Cir. 2008).

Lunio. "Tier 1, 2, 3 Countries List: Understanding Country Tiers in Digital Advertising." October 29, 2020. https://www.lunio.ai/blog/country-tiers-digital-advertising.

Macdonald, M. "Electronic Music Statistics 2024." Product London, February 23, 2024. https://www.productlondon.com/electronic-music-statistics-2024/.

Madverse. "Music Metadata Essentials: Unlocking Discoverability & Royalties." Madverse Blog. https://www.madverse.co/blog/music-metadata-essentials-unlocking-discoverability-royalties.

MasterClass. "House Music Guide: A Brief History of House Music." June 7, 2021. https://www.masterclass.com/articles/house-music-guide.

Matos, M. "Electronic Dance Music | House, Techno & Trance." Britannica. https://www.britannica.com/art/electronic-dance-music.

Millennials. "Marketing to Millennials." Art of Impact, August 25, 2023. https://www.artofimpact.com/marketing-to-millennials/.

Monopoli, J. "Why Is The Culture Surrounding Electronic Music So Attractive?" Theses - ALL, 488. Syracuse University, 2021. https://surface.syr.edu/thesis/488.

Morris, James. "How Are Algorithms Affecting How We Find and Experience Music?" Communication Arts Blog, University of Wisconsin-Madison, June 2021. https://commarts.wisc.edu/2021/06/how-are-algorithms-affecting-how-we-find-and-experience-music/.

MSN. "Brewing Music: How Coffee Raves Are Bringing Party Experience to Coffee Shops." 2024. http://msn.com/en-in/entertainment/news/brewing-music-how-coffee-raves-are-bringing-party-experience-to-coffee-shops/ar-AA1wYl9N.

Mulligan, Mark. "A Model for a New Music Streaming Industry." MIDiA Research, March 18, 2025. https://www.midiaresearch.com/blog/a-model-for-a-new-music-streaming-industry.

———. "The IMS Business Report 2024." IMS IBIZA, April 25, 2025. https://www.internationalmusicsummit.com/business-report.

Music Business Worldwide. "There Are Now 120,000 New Tracks Hitting Music Streaming Services Each Day." June 9, 2021. https://www.musicbusinessworldwide.com/there-are-now-120000-new-tracks-hitting-music-streaming-services-each-day/.

Music24. Home page. https://music24.com/.

New Industry Friday. "Who Booked Coachella 2025? The Deep Dive." 2024. https://www.newindustryfriday.com/p/who-booked-coachella-2025-the-deep-dive.

Newkey-Burden, C., and T. W. U. Published. "Is This the End of the Big Night Out?" The Week, March 4, 2024. https://theweek.com/business/is-this-the-end-of-the-big-night-out.

NTIA. "NTIA Figures Reveal Extent of Crisis: UK Nightclubs Struggle as Dance Floors Nationwide Shut Down." February 14, 2024. https://ntia.co.uk/ntia-figures-reveal-extent-of-crisis-uk-nightclubs-struggle-as-dance-floors-nationwide-shut-down/.

Nycyk, Michael. "Online Music: How the Internet Changed the Recorded Music Industry." Academia.edu, December 12, 2020. https://www.academia.edu/92477271/Online_Music_How_the_Internet_Changed_the_Recorded_Music_Industry.

Paine, Andre. "DJ With Apple Music Launches to Enable Subscribers to Mix Their Own Sets." MusicWeek, March 25, 2025. https://www.musicweek.com/digital/read/dj-with-apple-music-launches-to-enable-subscribers-to-mix-their-own-sets/091655.

Peoples, Glenn. "Indies Own Nearly Half the Global Recorded Music Market. The Major Labels Aren't Taking It Lying Down." Billboard, November 8, 2024. https://www.billboard.com/pro/indie-labels-own-half-recorded-music-market-midia-report/.

Peseckas, P. "The Power Of Social Media In Boosting Indie Record Labels." APG Media Blog, June 16, 2024. https://www.apg.agency/blog/the-power-of-social-media-in-boosting-indie-record-labels.

Pinzón, S. "Indies on the Rise: How Independent Music is Changing The Industry Landscape." June 24, 2024. https://www.catapultmymusic.com/article/indies-on-the-rise-how-independent-music-is-changing-the-industry-landscape.

Pivotal Economics. Music Copyright 2021. 2021. https://pivotaleconomics.com/undercurrents/music-copyright-2021.

Porscheng, S. "Authenticity in Marketing: 5 Reasons Why It Matters More Than Ever." Social Native, July 25, 2024. https://www.socialnative.com/articles/5-reasons-why-authenticity-matters-more-than-ever/.

Position Music. "About." https://www.positionmusic.com/pages/about.

Quinn, Bernadette, and Maarit Kinnunen. "Guest Editorial: Sharing and Belonging in Festival and Event Space: Introduction to Special Issue." International Journal of Event and Festival Management 15, no. 1 (2024): 1–6. https://doi.org/10.1108/IJEFM-02-2024-107.

Republic Network. "6 Conversion Strategies for Music Industry." June 15, 2022. https://www.republicnetwork.es/en/blog/6-conversion-strategies-for-music/.

Roda Artists. "About." Accessed March 3, 2025. https://rodaartists.com/tags/about.

Rostrum Records. "Rostrum Records." Genius. https://genius.com/artists/Rostrum-records.

RouteNote Blog. "Spotify's 1,000-stream Threshold Cost Indie Artists Nearly $50 Million in 2024." April 24, 2025. https://routenote.com/blog/spotifys-1000-stream-threshold-cost-indie-artists-50-million-in-2024/.

Royalty Exchange. "Emerging Markets in Music Royalties." September 26, 2024. https://royaltyexchange.com/blog/emerging-markets-in-music-royalties.

Slothacid. "About Us." https://slothacid.com/pages/about-us.

Smith, J. W. "Breakdowns and the Aesthetic of Disorientation in Festival-House Music." Twentieth-Century Music 21, no. 3 (2024): 421–47. https://doi.org/10.1017/S1478572223000087.

Songstats. "Blakkat: Spotify Analytics." https://songstats.com/artist/tm49rxfg/blakkat/audience?source=spotify.

Spotify. "Metadata: What It Is and Why It Matters." Spotify for Artists. https://artists.spotify.com/blog/metadata-what-it-is-and-why-it-matters.

Team Splice. "Splice Unveils the Genre Trends That Will Shape the Sounds of 2025." Blog | Splice, January 22, 2025. https://splice.com/blog/splice-unveils-genre-trends/.

The Dark Horse Institute. "How Electronic Music Production Changed the Music Industry." Dark Horse Institute Blog. https://darkhorseinstitute.com/how-electronic-music-production-changed-the-music-industry/.

The Ghetto Flower. "10 Effective Social Media Strategies for Independent Musicians in 2024." https://theghettoflower.com/blog/10-effective-social-media-strategies-for-independent-musicians-in-2024.

The Strikingly Blog. "Merchandise Mania: The Psychology Behind Why We Buy Fan Gear." June 30, 2024. https://www.strikingly.com/blog/posts/merchandise-mania-psychology-behind-buy-fan-gear.

Thierry Godard. "The Economics of Electronic Dance Music Festivals." SmartAsset, May 21, 2018. https://smartasset.com/mortgage/the-economics-of-electronic-dance-music-festivals.

Unchained Music. "Unraveling Music Artist Advances: An In-Depth Guide to How They Work." 2023. https://www.unchainedmusic.io/blog-posts/unraveling-music-artist-advances-an-in-depth-guide-to-how-they-work.

Vinyl Me, Please. "The Surge of AI-Generated Music: Deezer Reports 20,000 Daily Uploads." April 18, 2025. https://www.vinylmeplease.com/blogs/music-industry-news/the-surge-of-ai-generated-music-deezer-reports-20-000-daily-uploads.

Vocal Media. "Understanding and Leveraging Apple Music's Editorial Opportunities." Vocal. https://vocal.media/beat/understanding-and-leveraging-apple-music-s-editorial-opportunities.

Walfish, G. "How Much Does a DJ Make?" Xposure Music, November 27, 2024. https://info.xposuremusic.com/article/how-much-does-a-dj-make-in-2024.

Water & Music. "Starter Pack: Music and Brand Partnerships." 2023. https://www.waterandmusic.com/starter-pack-music-and-brand-partnerships/.

Zen Media. "Discord Marketing: How Brands Can Use Discord to Build Communities." https://zenmedia.com/blog/discord-marketing/.