By: Ritika Gokhale, Pranay Raj Peddareddy, Nick Robinson, Peter Shireman, Abigail Whitehurst

In Part II, this part of the study moves from industry context to empirical analysis, translating strategic questions into evidence-based insights drawn from primary research. While Part I established the historical and market foundations of Games as a Service (GaaS) and transmedia adaptation and framed the challenges of player retention, monetization, and franchise longevity, Part II examines how these dynamics operate in practice. Using findings from a 1,159-response U.S. consumer survey, nine industry interviews with developers, influencers, and experiential professionals, as well as supporting secondary research, this section analyzes player behavior perceptions and expectations. Part II identifies the mechanisms that drive sustained engagement and trust in live service ecosystems, evaluates the effectiveness of current GaaS and transmedia strategies, and surfaces actionable insights that inform the strategic recommendations presented in the final chapter.

Frameworks

Massive successes like the multiplayer shooter Fortnite, which has 110 million monthly players, and the story-driven game Genshin Impact, expected to generate 10 billion dollars globally in 2025, demonstrate how lucrative the GaaS model can be (Sisario, 2024; Obedkov, 2024). However, video game publishers face significant challenges in establishing and maintaining successful GaaS titles (Small, 2024). These threats to survive in the GaaS market come from the challenge of navigating a saturated market where player attention is fragmented and competition for engagement is fierce. The GaaS model demands continuous content updates, active community management, and a robust ecosystem that fosters player retention and monetization over an extended period.

This difficulty is evidenced by the numerous high-profile GaaS failures, where promising titles like Sony’s Concord failed to capture a sustainable audience or generate sufficient revenue to justify ongoing development (Barder, 2024). These failures can result in significant financial losses for publishers and developers, damage brand reputation, and hurt consumer trust (Futter, 2024). This problem is particularly relevant to companies like Sega, which possess valuable libraries of intellectual property and a rich history in the gaming industry.

Additionally, the success of GaaS titles often creates a ripple effect throughout the wider entertainment ecosystem, impacting transmedia strategies (Hennig, 2015). The questions answered in this study include:

1. What common qualities do successful GaaS titles have?

2. Are there ways to gauge how transmedia supports a franchise breaking through to new audiences?

Methodology

Our research employed a combined approach exploring the factors contributing to the success of Games as a Service (GaaS) models and strategies for transmedia experiences. A survey was sent through SurveyKing, and quantitative data was gathered from participants who ranged from daily gamers to those who rarely or never play video games. The survey investigated key factors such as preferred game categories, attitudes towards different monetization methods, experiences with past GaaS titles, and interest in experiencing other forms of transmedia. Distinct survey paths were used to obtain different perspectives from video game players and non-players. Additional qualitative research was conducted through interviews with industry professionals such as marketing managers, game developers, and project leaders with a wide array of expertise in the entertainment industry. Case studies, social listening, and trend analysis supplemented our research. Industry reports from sources such as the National Research Group and Parrot Analytics also provided crucial market trends and data insights.

Grinding for Information: Our Collection Strategy

We launched a survey on Friday, January 30, 2025. The survey was distributed on LinkedIn, Instagram, and Discord groups. Within 24 hours, the survey received 150 responses. Our preliminary goal was 300 surveys. Ultimately, we received 325 responses. According to our survey results, 74% of respondents reside in the U.S. and 26% outside the U.S., with 56% identifying as male, 38% as female, and 6% as non-binary. 83% of our respondents fall within the age range of 18 to 34.

To help interpret the results of the survey within the greater gaming enterprise, we conducted interviews with industry professionals with experience in GaaS gaming, including developers and marketing managers. These include Victor Chen, Marketing Manager at Konami Digital Entertainment; Kai Layden, APAC Integrated Communications Manager at Electronic Arts; Takumi House, former Software Engineer at EA and Activision; and Yuki Mantani, a developer at Japanese mobile gaming company, DeNA, who has worked on GaaS titles such as Final Fantasy and Dragon Quest. We also interviewed Adam Hime, the Executive Vice President, Business Affairs, and Deputy General Counsel at Fifth Season, a film and television production company, to gain non-gaming perspectives on the industry's current video game transmedia trend.

Gamer or Non-Gamer? Who Are Our Respondents

SEGA defines a ‘Gamer’ as someone who spends more than two hours per week playing video games (C. Perez, personal communication, December 17, 2025). With this definition, among ourrespondents, 92% are gamers, and 8% are not gamers. Among gamers, 52% play on PC, 28% play onconsole, and 20% play on mobile. Among gamers, 78% are GaaS gamers, and 14% are non-GaaSgamers (and the remainder of the 8% play no games at all). Considering our focus on purchasing behavior, the fact that most of our gamers play or have played GaaS games is helpful to us. On the otherhand, from Fortnite to mobile games, free-to-play games are currently the most widely available type ofvideo game, making this majority unsurprising and easily accessible (VG Insights, 2024).

Keeping Players Logged In: Preferences for Gaming

In our survey, non-GaaS gamers have cited pay-to-win systems and repetitive gameplay as the primary reasons for their lack of interest in GaaS games. This aligns with an online study that found 77% of first-time gamers abandoned GaaS games due to pay-to-win mechanics (Mistplay, 2024)

Non-GaaS gamers have also cited single-player options (15%), compelling or well-written narratives (10%), and puzzle-solving challenges (10%) as potential features that could turn them toward GaaS games. This aligns with GaaS gamer preferences, with 15% prioritizing single-player mode, 10% valuing a strong story and narrative, and another 10% highlighting puzzles and challenges as essential features.

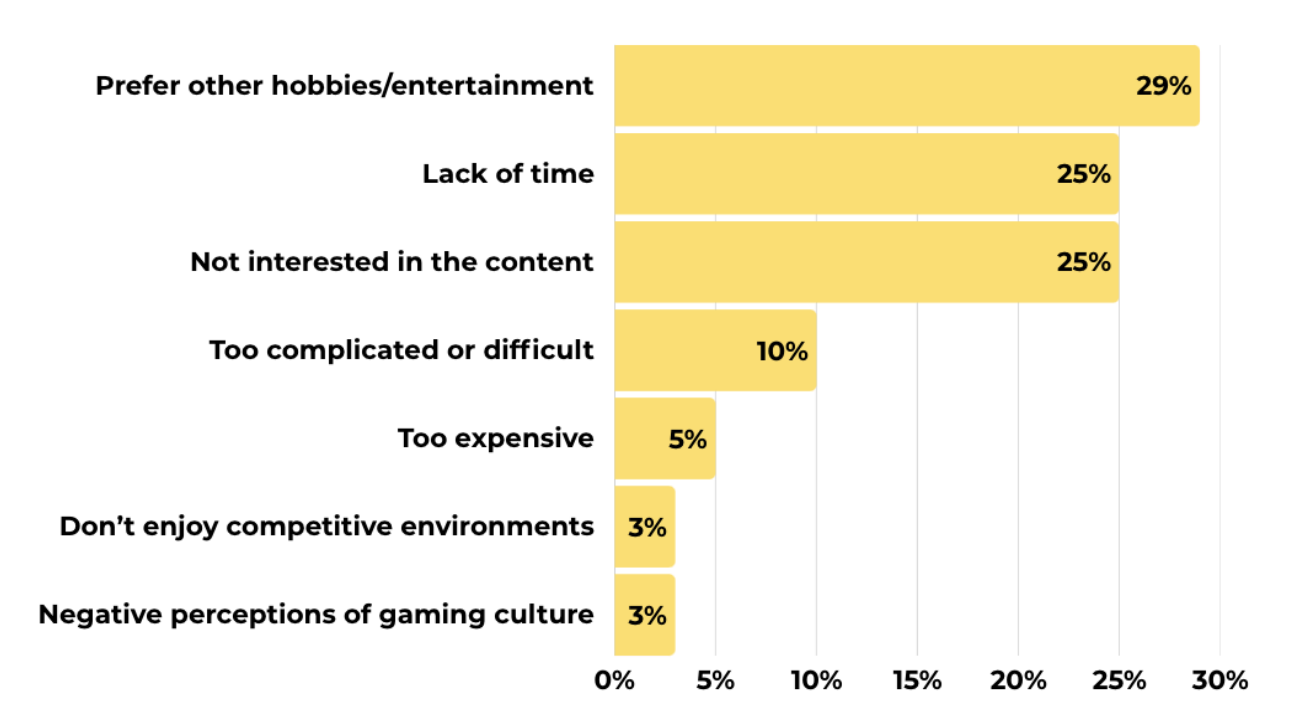

Among non-gamers, 25% cited a lack of interest in content, another 25% cited limited time for not playing video games, while 5% stated that it was too expensive to pay & play (See Figure 1). They are least bothered by negative perceptions of gaming culture, difficulty, and competition. Those who previously played but stopped mentioned fading interest and the increasing length of gameplay sessions as their primary reasons. When asked what would motivate them to play again, they preferred games that they could enjoy with friends or family, as well as games with shorter play sessions and no pay-to-win mechanics.

Figure 1: Factors Affecting Non-Gamers to Gamers Conversion. Source: Data from the author’s survey, “Factors Affecting Non-Gamers to Gamers Conversion” (2025)

Coins Well Spent: Gamer Spending Patterns

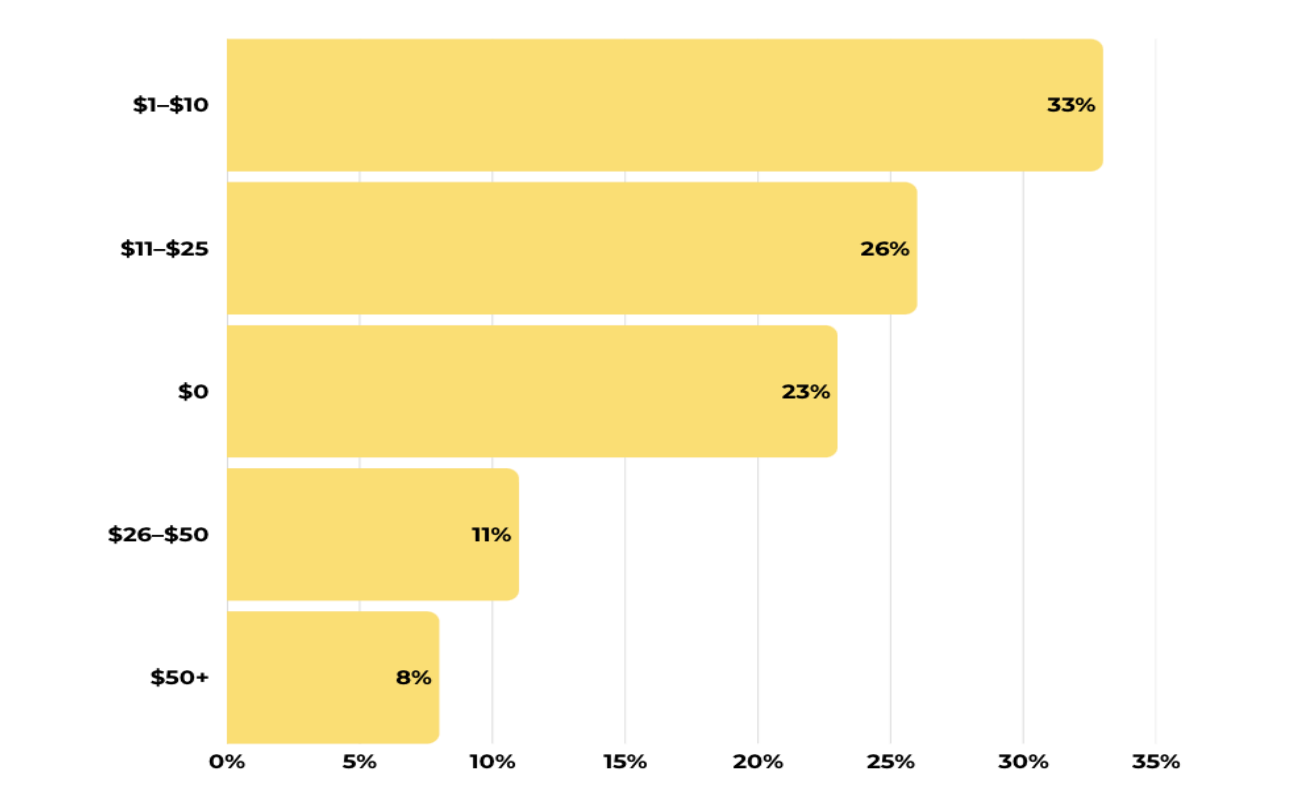

According to our survey data, 33% of GaaS gamers spend $1–$10 on a single in-game purchase, and 26% spend $11–$25. Less than 8% spent more than $50 (See Figure 2). Victor Chen stated that U.S. players spend more on microtransactions than players in other regions, so it is essential to keep this inmind when considering a global strategy (V. Chen, personal communication, November 5, 2024). Thesefindings also align with an analysis indicating that the median in-game purchase for the top 10 gamingapps is $5.99 (Chan, 2021).

Figure 2: GaaS Gamers Single In-Game Purchase Percentages. Source: Data from the author’s survey, “Amount of Money GaaS Gamers Are Likely to Spend for a Single In-Game Purchase” (2025).

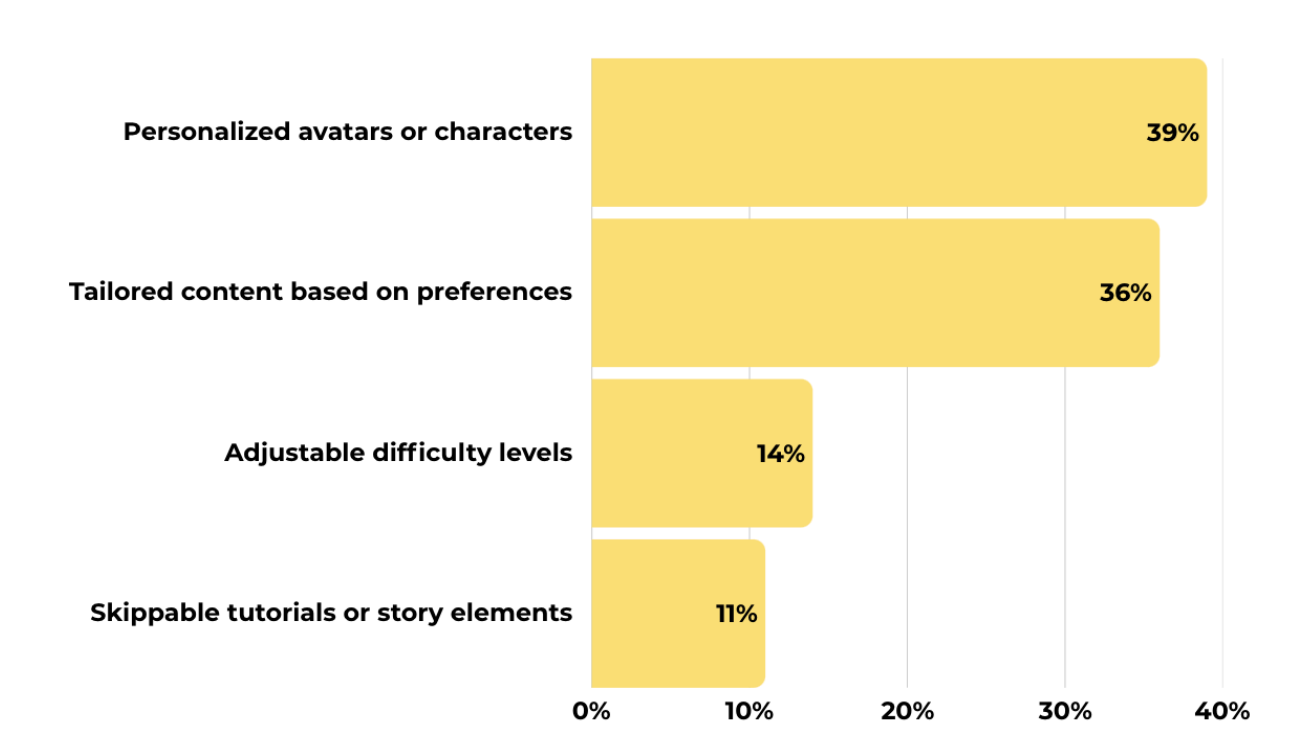

For the gamers who do spend money, customizing characters was the number one reason to spend. We found that among the top four most essential customization elements in a GaaS game (see Figure 3), “personalized avatars or characters” scored the highest (39%), becoming the most desirable element.

Figure 3: Most Desired Customization Elements in a GaaS Game. Source: Data from the author’s survey, “Most Desired Customization Elements in a GaaS Game” (2025).

In-game purchases can be classified into ornamental-based and functional-based (Cai et al., 2022). Personalized avatars or characters are achieved by purchasing ornament-based goods. A study has found that the longer gamers play with their customized avatars, the more their identification and empathy towards the character grow (Turkay & Kinzer, 2014). Players' attachment to their avatars has been observed to motivate their in-game purchases (Gibson et al., 2023).

Players purchase ornamental goods for three primary reasons: (1) envy of others' avatars or skins, (2) the need to be unique, and (3) the need to look attractive (Cai et al., 2022). Even without the ability to customize, gamers were found to identify more with their characters when those characters shared the same gender and ethnicity (Lim & Reeves, 2009).

Our survey also showed that compared to motivations like “curiosity to try something new” (22%) or “relief from bypassing a problematic challenge” (30%), players were far more likely to spend due to “excitement about new or exclusive content” (43%) and the “desire to enhance gameplay and experience” (35%). This corresponds with market analysis, which has found that joy and coolness are vital emotions motivating mobile gamers to make in-game purchases (DISQO, 2025). Players also spend to remove ads and achieve uninterrupted play, enhancing their experience (Digital Media Treatment, n.d.). The survey did not address negative emotions; however, market analysis found that envy is also a significant motivating factor behind in-game purchase (Cai et al., 2022).

However, we found that 23% of our respondents typically do not spend on in-game purchases. Yuki Mantani explained that most GaaS players never spend money, and the goal of every GaaS game is to get players to make their first purchase. Their data found that once a player spends an amount, they are more likely to pay again. At DeNA, monetization strategies are structured around different spender categories: light spenders (approximately $10/month), mid-tier spenders ($10-$100/month), and whales ($100+/month) (Y. Mantani, personal communication, February 3, 2025).

To enable users to transition into each stage, Mantani suggests offering “starter packs” with a steep discount so gamers believe they are receiving greater value. A market analysis found that $1.01–$5 is the sweet spot for in-app purchase pricing to convert a player into a spender (Unity Technologies, 2023). A perceived discount could convert non-spenders into spenders, even if it is not a steep discount. Developers create a reference point that amplifies perceived value by presenting a crossed-out “original” price (e.g., $24.99 reduced to $9.99).

Fortnite and Homescapes, a free-to-play puzzle game, also employ the ‘charm pricing’ method, with items priced just below whole dollar amounts, i.e. $1.99 instead of $2. Homescapes provide more numerical value in in-game currency for the gamer. $0.99 = 1,000 in-game currency, compared to other GaaS games where 1 USD is equivalent to a value in the 10s or 100s in in-game currency (Fang, 2019). Fortnite prices items in rounded numbers, 1500 instead of 1580, because more 0s seems to create the perception of more value (Fang, 2019).

A University of Michigan Ross School of Business paper hypothesizes that people approach in-game purchasing behavior similarly to foreign currency (Fang, 2019). The paper then references another study, which found that people are likely to spend more in a foreign country when the value of their home currency is a fraction of the foreign currency, rather than a multiple. For instance, people were observed to spend more money in India when 1 USD was equivalent to 0.01 Indian rupees, instead of 100 rupees. Justin Fang, the paper's author, hypothesizes that gaming companies should apply the same principle to in-game currencies. Instead of 1 USD being equivalent to 100 virtual currency, 1 USD being equivalent to 0.01 virtual currency could result in people spending more (Fang, 2019).

The Psychology of Play: What Keeps Gamers Coming Back

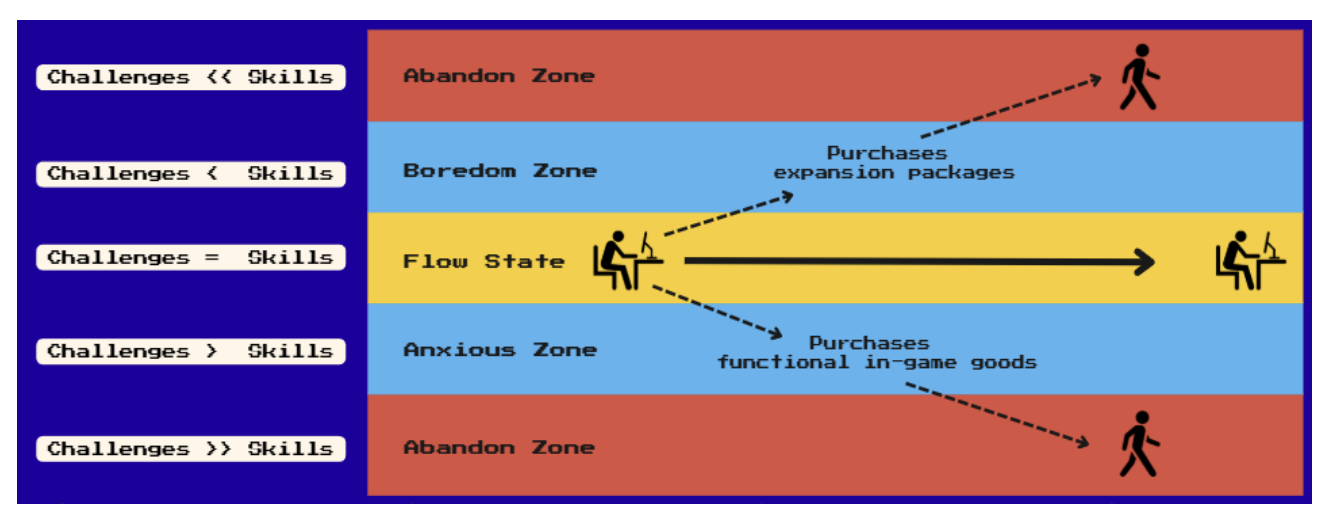

As seen in Figure 3, the following two essential customizable elements, highly valued by GaaS gamers, were tailored content based on personal preferences and adjustable difficulty levels, closely tied to gameplay. Interestingly, 11% of non-GaaS gamers cited repetitive (often referred to as “grindy”) gameplay as a significant reason for avoiding these titles. This prompted us to investigate how the most successful GaaS games structure their gameplay to retain players, sustain interest, and maintain high engagement. We found that these titles carefully manage the gameplay experience by fostering what researchers describe as a "flow state,” a psychological zone where players are fully immersed because the level of challenge matches their skill level. This concept, drawn from the work of Cai, Cebollada, and Cortiñas (2022), is critical to game design (See Figure 4).

Figure 4: Psychological Zones Affecting Gameplay Experience. Source: Author-created graph based on “The Psychological Journey of a Game Player Leading to an Effective 'Flow’ State for Continued Gameplay & Potential In-Game Purchase Entry Point” by Cai, X., Cebollada, J., & Cortiñas, M. (2022)

Players enter the “boredom zone” when a game becomes too easy. In this state, their skills significantly exceed the challenges presented, so the game no longer feels stimulating or rewarding. Successful GaaS games respond by offering expansion packs or more challenging content to reignite player interest. These expansions are often monetized, allowing players to purchase access to higher-level challenges that help restore balance and reestablish the sense of accomplishment they initially felt.

On the other end of the spectrum is the “anxiety zone.” This occurs when a game becomes too complex for a player’s current skill level, resulting in frustration rather than enjoyment. Successful GaaS titles use in-game purchases to rebalance the experience in these situations. Players are offered high-value goods such as upgraded equipment, power boosts, or premium characters to help them overcome these challenges. However, this is only effective if the item's value is meaningful and the reward feels proportionate to the cost. If not, players may exit the experience entirely,entering the abandonment zone. According to Yuki Mantani, “a difficulty spike is introduced after an initial period of smooth progress,” deliberately designed to nudge players toward spending (Y. Mantani, personal communication, February 3, 2025). If the challenge is too steep and the value proposition of the in-game item is unclear, players are unlikely to continue.

Once a player abandons a game, re-engagement becomes significantly more difficult. However, nostalgia is one of the most effective tools for winning them back. Players who grew up with a particular franchise or developed emotional ties to a specific character or world are more likely to respond to reminders of that past connection. Mantani explained that games based on established IPs, such as Final Fantasy, focus on re-engaging lapsed fans rather than attracting entirely new players. He noted that nostalgia is often used to “target players who have played past Final Fantasy games,” especially during periods of churn (Y. Mantani, personal communication, February 3, 2025).

Wear Blue and Gold Rings: Gamer Merch & Preference

We found that 55% of our GaaS gamers have responded that widely available merchandise does not affect their perception of the franchise. Most gamers do not purchase physical merchandise because they prefer to spend their money on in-game avatars and skins (An et al., 2024). A game designer on r/gaming, Reddit’s largest gaming forum, highlighted the advantage of digital items over physical merchandise, stating, “You sell an in-game skin for $10, you keep $7 profit, and the buyer will play your game more and want their friends to play so they can show it off. There is no inventory to manage and no per-unit cost to pay in advance” (Reddit, n.d.). As a result, many game companies refrain from producing physical merchandise, knowing that their consumer base values in-game aesthetics more.

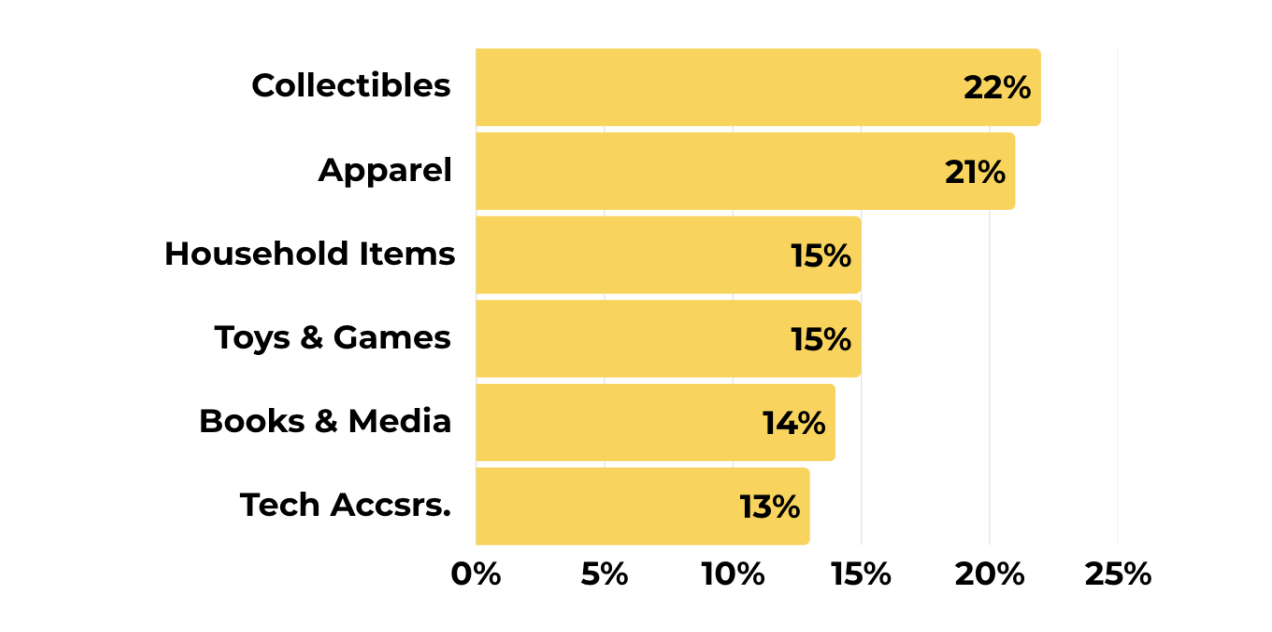

When purchasing merchandise, 22% of our GaaS gamers would spend on collectibles, while 21% would spend on t-shirts, hats, and hoodies (see Figure 5 below).

Figure 5: Preferred Franchise Merchandise Amongst GaaS Gamers. Source: Data from the author’s survey, “Preferred Merchandise Purchase of GaaS Gamers Of Their Favourite Video Game Franchise” (2025)

Gamers preferring to spend on collectibles aligns with gamer purchase preferences shared on r/gaming, where users mentioned items like the “Left 4 Dead med kit bags,” the “Fallout New Vegas playing card set,” and even regretted missing out on items like the “Radio controlled Clap Trap from Borderlands” (Reddit, n.d.). One user summed it up, saying, “Some merch seems like it would be simple to make and very low risk to produce,” yet fans still struggle to find official versions of the collectibles they want (Reddit, n.d.). As another user on r/gaming stated, “I would give Arkane silly amounts of money for some big giclée or screen prints of their setting and character concept art,” showing the strong demand for game-related merchandise and the missed opportunities studios face by not offering easy access to such products (Reddit, n.d.).

For t-shirts and apparel, segmenting into apparel based on nostalgic and contemporary IP is vital. Research indicates that as many adult gamers seek to reconnect with the games of their youth, and that nostalgia has driven an increased demand for merchandise featuring characters, logos, and artwork from classic titles of the 1980s and 1990s (Global Market Insights Inc., 2024). For contemporary IP, gamers tend to disregard logos and titles. One Reddit user has described generalized products with just logos as off-putting (Reddit, n.d.). For contemporary IP, Gamers appreciate character-specific apparel with in-game references or personalized apparel (Global Market Insights Inc., 2024).

Kai Layden also mentioned that character-based titles are the best candidates. He also noted that not all games lend themselves to merchandise. Titles with distinct characters and deep lore have the highest potential for physical products (K. Layden, personal communication, February 9, 2025). Merchandising is often paired with social media campaigns and in-game events to drive fan engagement (Deadline News, 2025).

Winning the Adaptation Game: Transmedia Preferences and Best Practices

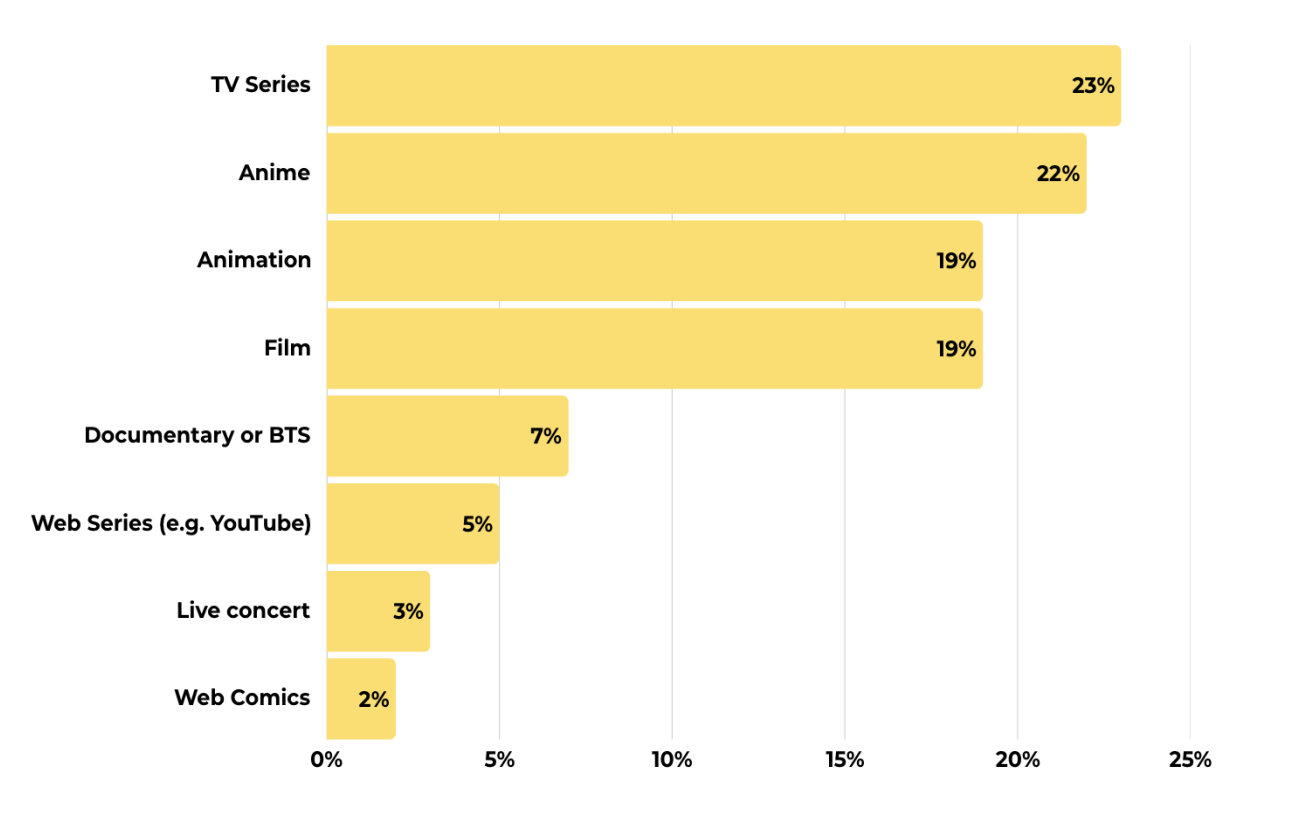

Regarding transmedia, most respondents would rather watch a TV series than a film (See Figure 6). Over the last two decades, video game adaptations have appeared across film and television, but TV series have emerged as the breakout format. Titles like Arcane: League of Legends and Cyberpunk: Edgerunners earned perfect 100 percent critics' scores on Rotten Tomatoes, while The Last of Us followed closely with 96 percent (National Research Group, 2024).

Figure 6: Preferred Medium for Video Game Adaptation Amongst GaaS Gamers. Source: Data from the author’s survey, “Preferred Medium for Video Game Adaptation Amongst to GaaS Gamers” (2025)

Despite performing well at the box office, successful film adaptations rarely cross over into specific market segments—80% of Five Nights at Freddy’s viewers were under 25 (National Research Group, 2024). On the other hand, video game adaptations such as The Last of Us and Fallout crossed into multiple quadrants and achieved mainstream success (National Research Group, 2024). The Last of Us was Google's most searched TV show of 2023, whereas the highest-grossing video game adaptation, The Super Mario Bros. Movie, did not even make it into the top 10 search charts for films that year (Google, 2023).

A market analysis found that one of the main reasons TV series have performed better, both critically and commercially, is that the format allows for long-form storytelling (Glazebrook, 2023). Most popular video games have lengthy, extended stories that range from 18 to 40 hours in length (Miller, 2024). Condensing such long stories into 120 minutes is a daunting challenge, whereas a TV series, with its extended runtime, has far more opportunity to stay true to the original.

According to Parrot Analytics (n.d.), to create a successful adaptation, the show or film must incorporate game elements to make it feel authentic and less like an homage. Still, it must stand out on its own to succeed both as an extension of the franchise for fans and as a standalone series for newcomers. For example, Castlevania and Arcane draw elements and familiarity from their source games, interweaving stories, characters, and settings, but ensure the focus is on building something new on top of this foundation, rather than merely recreating what already exists in a different medium.

According to a study by the National Research Group, 77% of gamers believe it is essential that the writer and director of an adaptation genuinely love the source material (National Research Group, 2024). A producer behind the successful Detective Pikachu movie mentions that one of the reasons the parent company trusted her with the IP was that she was genuinely passionate about it, making them believe she would do the IP justice (Batchelor & Dring, 2024). Borderlands producer Ari Arad says the Borderlands script was chaotic until Craig Mazin, writer of Chernobyl and The Last of Us, stepped in. “A lot of it was that Craig played the games,” says producer Ari Arad. “He basically cherry-picked everybody he liked and came up with a story to include them, which I think is a great way to do it. Lead with what you love” (Miller, 2024). Adam Hime explained, “A fan of the game in a key creative role builds trust,” a sentiment further illustrated in his advice to “involve producers/writers who understand and respect the IP.” Hime also pointed out, “Loyal fans demand fidelity, making risky creative choices harder,” further reinforcing the need for creative leads who understand what makes the original material special (A. Hime, personal communication, February 15, 2025). This sentiment is echoed by many fans, with one user on Reddit stating, “It's really hard for someone who doesn't get what's cool about something to adapt it because they are not going to know what needs to be preserved in the transition” (Reddit, n.d). Gamers are highly protective of what they love, and as a Bain report notes, “Gamers demand more from developers and publishers, expecting environments and narratives that resonate with their experiences and preferences” (Christofferson et al., 2024).

We also analyzed non-gamers’ interest in TV and film to assess transmedia potential and the likelihood of converting viewers into gamers. Non-gamers prefer watching dramas and mystery thrillers (21%) and discovering new content through social media trends and music (61%). A compelling plot and interesting characters are significant motivations for engaging with TV and movies. 51% of these respondents reported not having watched any video game adaptations in the past year, citing their lack of interest in video games and unfamiliarity with gaming franchises as the primary reasons.

We also found a small subset of non-gamers who were not interested in TV or movies (~1%). These respondents prefer socializing with friends and family and reading books (32%). They have displayed interest in viewing video-game-relevant content through short-form content (TikTok, YouTube Shorts) or podcasts and soundtracks (48%).

Conversely, a smaller subset (4%) consists of gamers less interested in TV and movies, preferring other content or activities such as listening to music or reading books (30%). Gamers who do not watch much TV or movies prioritize gaming daily or several times a week (90%) and favor action-adventure, first-person shooter (FPS), and role-playing game (RPG) genres (23%). They predominantly use PCs as their gaming platform (52%).

Press Play at the Right Time: Launches that Win

To translate possible film or TV viewers into gamers, game companies have strategically marketed their newest titles to coincide with the release of their adaptations. On April 10, 2024, the day the Amazon adaptation Fallout was released, the mobile game Fallout Shelter saw its daily revenue surge from $20,000 to $80,000 by April 13. Daily downloads also jumped from 20,000 to 60,000, rising 20% within 24 hours of the show's premiere (Batchelor, 2024).

Yuki Mantani emphasized that timing is critical for capitalizing on external media adaptations and sustaining player engagement (Y. Mantani, personal communication, February 3, 2025). In mobile gaming, especially where competition is high and attention spans are short, regular and well-planned updates — such as new characters, seasonal events, or unique in-game collaborations — are essential for keeping users engaged and reducing churn. Kai Layden also pointed to Apex Legends’ Asia Apex Festival at Makuhari Messe as a prime example of a high-impact transmedia event with good timing (K. Layden, personal communication, February 9, 2025). The festival employed a three-phase strategy: pre-event influencer marketing to build hype, live event content, including show matches and Virtual YouTuber watch parties, and post-event creator streams to sustain interest. This approach drove engagement and directly translated into player conversions with the launch of a new Apex Legends season.

Finally, timing strategies can work in both directions. When Arcane premiered on the same day as the League of Legends Championship final, an event watched by nearly 40 million people, it benefited from the overlap in fan interest. Within six days, Arcane had reached 34 million viewers and topped Netflix charts in 50 countries (Campaign Experience Awards, n.d.).

Survey Summary

Our combination of survey data and expert interviews has provided a well-rounded understanding of player behavior, audience expectations, and the evolving landscape of video game engagement. The insights presented in this chapter highlight strategic opportunities in both GaaS development and transmedia storytelling, and in the next chapter, we translate these findings into recommendations.

Recommendations

Based on the findings outlined above, we have derived six key recommendations to adopt to further leverage SEGA’s strengths in publishing and transmedia.

Stay in the Zone:

The previous content demonstrated that sustained engagement relies on maintaining a “flow state,” which involves balancing challenge and skill. Games that become too easy or too hard drive players away. While difficulty spikes can support monetization, they must feel fair and balanced. Nostalgia also helps re-engage lapsed players, particularly when combined with shorter, more casual sessions that cater to modern lifestyles.

Recommendation 1: Keep Players in the Flow

When players begin to churn, it is important to re-engage them by leveraging nostalgia. Pushnotifications, in-game messages, and targeted visuals featuring legacy SEGA characters, such as classicSonic, can remind players of their emotional connection to earlier titles. This strategy may increase thelikelihood of reactivation by tapping into players’ fond memories and established attachments. At thesame time, re-entry points should be carefully tuned to avoid overwhelming returning players. Difficultyspikes should feel challenging yet fair, encouraging players to stay rather than leave.

Build Your Character:

Customization is a major driver of engagement and satisfaction. Players value personalized avatars, and ornamental items outperform functional ones. The more time players spend with customized characters, especially those that reflect their identity, the stronger their emotional connection becomes, increasing retention and spending.

Recommendation 2: Make it Personal

We recommend allowing players to add detailed characteristics to their avatars, such as scars, blemishes, burns, or wounds, which can reflect the player’s real-life imperfections. This can be extended over time with makeover opportunities throughout the game's lifecycle, allowing gamers to update their characters based on their personal growth in real life. Customization should also extend beyond the main character to include sidekicks or best friends, allowing players to form a more profound emotional attachment to the game world and thereby increase revenue potential. Complete avatar reveals during gameplay or after milestone completions can serve as reward moments, and hosting themed in-game events that showcase player creations can foster engagement.

No Coin Wasted:

Effective monetization strategies employ clear, low-cost options, such as $0.99 charm pricing and high perceived value (e.g., USD 1 = 1,000 coins). Confusing conversions and leftover currency discourage purchases. Starter pack values can help convert non-spenders and encourage players to become consistent spenders.

Recommendation 3: Streamline Spending

SEGA should adopt price charming (e.g., $0.99, $1.99) and display reference discounts to boost perceived value. While implementing a high perceived value strategy, such as offering more in-game currency per dollar (e.g., 1,000 coins instead of 100), we also recommend that Sega research and test the monetization potential of a fractional currency system (e.g., $1 = 0.01 coins). Additionally, all functional purchases, such as stat boosts or equipment, should meaningfully enhance gameplay and support player progression.

More Than a Cutscene:

TV is the preferred medium for game adaptations. Series like Arcane and The Last of Us succeed by preserving deep storylines and character development, as opposed to films, which often lack the runtime to do games justice. Long-form storytelling better matches the scale of most video game narratives.

Recommendation 4: Consider TV Adaptations First

Sega should adapt its major IPs into television series. Storylines should either closely follow the original game or expand the universe with a consistent tone and genre. There should be collaboration with showrunners who understand the game to structure each season in a way that highlights different characters or arcs across the franchise.

Loot That Matters:

While most gamers prioritize in-game items, there is a strong demand for unique, character-driven, and nostalgia-based merchandise, whereas general logo merchandise is less appealing. Limited drops tied to events or deep lore can boost fan engagement and capitalize on missed revenue opportunities.

Recommendation 5: Sell Merch that Fans Want

Developing a merchandise strategy integrating physical and digital offerings will deepen fan engagement. Limited-edition physical merchandise should focus on iconic characters, story moments, and nostalgic IP, emphasizing collectibles, character-driven apparel, and art, avoiding generic logo-only designs. These drops should align with key events, such as game launches or adaptation premieres, to create urgency and relevance. Simultaneously, Sega could expand digital cosmetics in-game through character skins, themed avatar items, and seasonal packs tied to narrative moments or crossovers. Exclusive digital items should reward loyal players and attract new users during significant campaigns. Bundled offerings that combine physical and digital rewards can further enhance perceived value and brand loyalty.

Don’t Forget to Cool Down:

Timing game updates with adaptations drives strong results. Fallout Shelter’s revenue surge afterthe launch of Fallout highlights this. Coordinated campaigns before, during, and after significant mediaevents can boost engagement, downloads, and long-term retention.

Recommendation 6: Time it Right

To maximize transmedia impact, ensure that any GaaS game tied to a film or TV adaptation is available and prominently featured in digital stores during the adaptation’s release. Many casual viewers, especially those without access to high-performance gaming setups, will most likely interact with a mobile version first. By focusing launch marketing on the mobile platform through App Store placement, influencer content, and social media, Sega can drive faster adoption and higher engagement. Core gamers may naturally gravitate toward console or PC versions, but mobile is the most accessible gateway for broader audiences. Timing the mobile release with the adaptation’s premiere is key to converting passive interest into immediate gameplay.

Conclusion

Sega is well-positioned to leverage its established strengths in publishing and transmedia, enabling it to remain competitive and innovative in the evolving video game industry. Our recommendations focus on enhancing the player experience by balancing gameplay difficulty, expanding customization options, and streamlining monetization to make in-game purchases more intuitive and accessible. On the transmedia front, we recommend prioritizing television over film for deeper narrative development and broader audience reach. Additionally, synchronizing digital and physical merchandise drops with key game releases and media events can amplify engagement and brand affinity.

Sega already knows how to deliver a top-quality game. The research and recommendations presented here seek to enable the company to capitalize more effectively on its extensive library of game titles and achieve long-term success in an era characterized by live-service games and transmedia adaptations.

-

Alexander, Bryan. 2020. “How Sonic the Hedgehog Avoided Death by Twitter with a Dramatic, Game-Saving Redesign.” USA Today, February 13.

https://www.usatoday.com/story/entertainment/movies/2020/02/13/sonic-the-hedgehog-movie-redesign-how-backlash-made-character-better/4730593002/.An, Xiaoyan, Yifan Peng, Zhicheng Dai, Yu Wang, Zhijie Zhou, and Xiaoyan Zeng. 2024. “Buying Game Derivative Products Is Different from In-Game Purchases: A Mixed-Method Approach.” Behavioral Sciences 14 (8): Article 652.

https://www.mdpi.com/2076-328X/14/8/652.Bailey, Kat. 2024. “Concord’s Initial Development Deal Was $200 Million, But It Wound Up Costing Sony Much More—Report.” IGN, October 30.

https://www.ign.com/articles/concords-initial-development-deal-was-200-million-but-it-wound-up-costing-sony-much-more-report.Bankhurst, Adam. 2025. “Upcoming New Video Game Movies and TV Shows: 2025 Release Dates and Beyond.” IGN, January 9.

https://www.ign.com/articles/upcoming-video-game-movies-and-tv-shows.Barder, Ollie. 2024. “The Crisis of Massive Budgets in Gaming Is Still a Very Current Issue.” Forbes, November 22.

https://www.forbes.com/sites/olliebarder/2024/11/22/the-crisis-of-massive-budgets-in-gaming-is-still-a-very-current-issue/.Batchelor, James. 2024. “Fallout Shelter’s Daily Revenue Rockets to $80,000 After TV Show Debut.” GamesIndustry.biz, April 16.

https://www.gamesindustry.biz/fallout-shelters-daily-revenue-rockets-to-80000-after-tv-show-debut.Batchelor, James, and Chris Dring. 2024. “How Video Games Conquered Hollywood.” GamesIndustry.biz Microcast (podcast), October.

https://open.spotify.com/episode/5FggzBFcWV3u2OIvsmlRdY.Benfell, Grace. n.d. “60% of All Playtime in 2023 Was Spent on Live-Service Games More Than Six Years Old.” GameSpot. Accessed February 1, 2025.

https://www.gamespot.com/articles/60-of-all-playtime-in-2023-was-spent-on-live-service-games-more-than-six-years-old/1100-6522366/.Bharanidharan, Shobana. 2024. “Video Game Adaptations Primed to Overtake Comic Book IPs.” Kidscreen, April 10.

https://kidscreen.com/2024/04/10/report-video-game-adaptations-primed-to-overtake-comic-book-ips/.Birk, Max V., Regan L. Mandryk, and Cheryl Atkins. 2016. “The Effects of Avatar-Based Customization on Player Identification.” In Proceedings of the 2016 CHI Conference on Human Factors in Computing Systems, 694–704.

https://doi.org/10.1145/2858036.2858062.Britannica Editors. 2025. “Sega Corporation.” Encyclopedia Britannica. April 5.

https://www.britannica.com/money/Sega-Corporation.Byshonkov, Dmitry. 2024. “Game Market Overview: The Most Important Reports Published in November 2024.” devtodev, December 2.

https://www.devtodev.com/resources/articles/game-market-overview-the-most-important-reports-published-in-november-2024.Cai, Xueming, Jorge Cebollada, and Monica Cortiñas. 2022. “A Grounded Theory Approach to Understanding In-Game Goods Purchase.” PLOS ONE 17 (1): e0262998.

https://journals.plos.org/plosone/article?id=10.1371/journal.pone.0262998.Campaign Experience Awards. n.d. “Arcane – Netflix Global Experiential Launch.” Accessed February 27, 2025.

https://www.campaignexperienceawards.com/finalists/arcane-netflix-global-experiential-launchd0004.Chan, Sheryl. 2021. “The Median Price of In-App Purchases Has Grown 50% Since 2017 on iOS.” Sensor Tower, March.

https://sensortower.com/blog/app-store-iap-median-price.Christofferson, Anders, Anders Videbaek, Andrew Egan, Tom Rowland, and Mike Madden. 2024. “Gamer Survey: Young Players Reshape the Industry.” Bain & Company, August 28.

https://www.bain.com/insights/gamer-survey-young-players-reshape-the-industry-gaming-report-2024/.Clement, J. n.d. “Global Video Game Subscription Market Value 2020–2025.” Statista.

https://www.statista.com/statistics/1240333/consumer-spending-video-game-subscriptions/.Deadline News. 2025. “eSports Merch in 2024: Gamers Are Buying More Than Just Skins.” February 20.

https://www.deadlinenews.co.uk/2025/02/20/esports-merch-in-2024-gamers-are-buying-more-than-just-skins/.Dubois, L.-E., and J. Weststar. 2021. “Games-as-a-Service: Conflicted Identities on the New Front-Line of Video Game Development.” New Media & Society 24 (10): 2332–2353.

https://doi.org/10.1177/1461444821995815.Flew, Terry. 2025. “Media Convergence.” Encyclopedia Britannica, February 4.

https://www.britannica.com/topic/media-convergence.Fragen, Jordan. 2023. “HBO’s The Last of Us Sets New Bar for Game-to-TV Adaptations.” VentureBeat, March 14.

https://venturebeat.com/games/hbos-the-last-of-us-sets-new-bar-for-game-to-tv-adaptations/.Gibson, Ellie, Mark D. Griffiths, Filipa Calado, and Adrian Harris. 2023. “Videogame Player Experiences with Microtransactions.” Computers in Human Behavior 140: 107622.

https://www.sciencedirect.com/science/article/pii/S0747563223001176.Glazebrook, Luke. 2023. “TV Is the Future of Video Game Adaptations, Not Movies.” ScreenRant, February 5.

https://screenrant.com/video-game-adaptations-tv-better-than-movies/.Hennig, Martin. 2015. “Why Some Worlds Fail.” IMAGE: Journal of Interdisciplinary Image Science 11 (1): 17–33.

http://dx.doi.org/10.25969/mediarep/16505.Osborn, Gregory E. 2024. “Why Are Film & TV Adaptations of Games Good Now?” Video Games Industry Memo, November 15.

https://www.videogamesindustrymemo.com/p/why-are-film-and-tv-adaptations-of.Peters, Jay. 2023. “HBO’s The Last of Us TV Show Is Pushing the Game Up the Sales Charts.” The Verge, February 13.

https://www.theverge.com/2023/2/13/23597863/hbo-the-last-of-us-tv-show-game-part-i-sales-npd-group.Taylor-Hill, G. 2023. “Sony Investing $2.1B in Gaming R&D, Focusing on Live Service.” Insider Gaming, July 12.

https://insider-gaming.com/sony-live-service-games-investment/.Unity Technologies. 2023. Mobile Growth and Monetization 2023. Unity.

https://create.unity.com/mobile-growth-monetization-2023.Velocci, Carli. 2024. “Fallout Games See Big Player Influx After TV Show Debut.” Polygon, April 24.

https://www.polygon.com/24131018/fallout-games-steam-player-count-bethesda-tv-show.