Arts and cultural nonprofits often operate in multiple markets for earned and contributed revenue. With increasing attention on data-driven decision making, effective market orientation often depends on effective data use. This fundamental collection, transmission, use, and interpretation of data within an organization collectively contributes to what can be considered an organization’s data culture.

Announcing 2024-2025 Research Themes and Outcomes

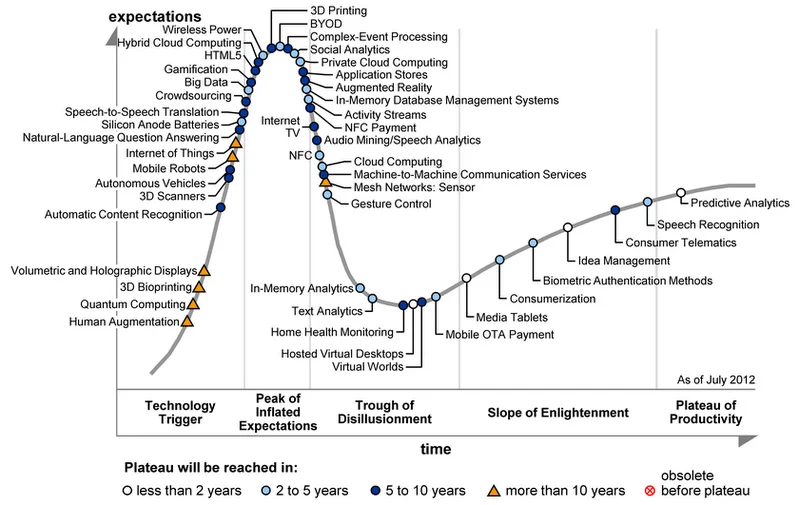

Whether artificial intelligence, blockchain, extended reality, or other developments, technology is hitting the creative sector from all angles. Regardless of where you sit within your organization, you are likely facing questions on how this emerging technology will impact your work. This year, we will continue to share content that sparks conversation and makes you rethink what is possible.

Cash Talks: The Impact of Financial Reserves on Theatre Companies

According to the Nonprofit Finance Fund, most nonprofits have less than three months of cash reserves on hand. Most nonprofits have experienced a drastic impact on their programs and financing throughout the COVID-19 pandemic. But research shows that nonprofits with reserves were less likely to reduce operating hours, lose staff, or experience difficulty paying employees or vendors for their services.

Use Sentiment Analytics to Predict Motion Picture Box-Office

The motion picture industry has long searched the magical formula of predicting future box office performances. A glimpse of future box office performances can help a studio save millions in post-production marketing and distribution expenses. The same logic applies to all nonprofit presenting and performing arts organizations - if NPOs can predict their future events’ financial outcomes NPOs can save their precious resources and reallocate them to other uses. Social media may just provide this magical prediction formula.

The Pew Research Center's Report on Arts and Technology

The Pew Research Center recently did a survey and report about how various arts organizations use technology including the internet, social media, and mobile technology. The report confirms that the arts are adapting to the overwhelming saturation of technology, particularly the internet and social media, and are venturing into deeper levels of engagement such as blogs, podcasts, and educational content.

Are Bricks and Mortar the Best Use for Money in the Arts? The Overbuild of Cultural Facilities in the United States

Recently, the University of Chicago’s Cultural Policy Center released the report, “Set in Stone: Building America’s New Generation of Arts Facilities, 1994-2008.”

Summary: The research examines the boom of major cultural building projects (museum, performing arts centers, and theaters) between 1998 and 2004, specifically looking at the decade between 1990 and 2000. The findings indicate during that period, “the level of investment in bricks and mortar as a percentage of total revenue and assets was disproportionate.” The full report addresses the landscape of cultural building, the investment determinants of cultural building, the feasibility of cultural building projects, and the effects on communities. The report takes into account population change, the national trend in ratio of arts organizations to cultural facilities, the relationship between the number of existing facilities in an MSA and the population, GDP, economic climate, municipal spending on physical infrastructure, spending by type of project, education rates, median household income levels, distribution of costs of projects (by region), geographic considerations, and other factors affecting the supply, demand and sustainability of cultural building projects.

[embed]http://youtu.be/KwhG7SK9csc[/embed]

Case Studies: Four case studies, presented as teaching resources, portray complex, management situations students and professionals might encounter in the real world. The cases (comprised using internal documents , construction data, and first-hand accounts from administrators, board members and/or volunteers involved in each situation) emphasize the need for managers to make strategic decisions, weighing the benefits and risks of each potential course of action. These studies provide a platform for discussion about the strategic design of projects, potentially shaping future design and management practice.

The four case studies highlight issues of strategic decision making, project design, expansion and management at:

1) the Art Institute of Chicago in Chicago, IL

2) the AT&T Performing Arts Center in Dallas, TX

3) the Long Center for the Performing Arts in Austin, TX

4) the Taubman Museum of Art in Roanoke, VA

Key Findings: The report and the findings show that (taken from the report)

- Cultural institutions and arts facilities were overbuilt during the boom years

- Performing Arts Centers were the dominant form of new facilities

- The building boom affected the entire country, but was concentrated in the South, which saw enormous increases in the total number of facilities

- Building in the arts grew faster between 1998 and 2001 than or on par with building in other sectors, particularly health and education

- Rising population and higher average levels of education and income help explain why some cities built more than others

- There is no clear pattern of spillover effects (negative or positive) of specific cultural building projects on non-building local cultural organizations and the greater community

- There was far less investment in traditional theater facilities than there was in museum and performing arts centers

- The New York-Northern New Jersey-Long Island MSA spent more on cultural infrastructure ($1.6 billion) building than any other MSA during this period

- Research shows that for every additional cultural facility a city had, it invested between $0.11 and $0.23 more per capita per year in cultural building projects

- What influenced how much a city invested in cultural infrastructure was not the size of a city’s population, but how fast the population was increasing or decreasing

[embed]http://youtu.be/76vN7mb9n6E[/embed]

Looking Ahead: Joana Woronkowicz, co-author of the report, summarizes the lessons learned from the study and how the arts industry should proceed in making building project decisions.

• What is the motivation for the project?

• Does it align with organization’s artistic mission?

• Is there a need for the project (not a want), but a need?

• Do I have the leadership in place to take the project from the beginning to the end?

• Does the building project respond to the needs of the community?

• How can I be flexible in controlling expenses and nimble in generating income?

Americans are paying more for culture, opportunity looms on the technology front

New information out from the Consumer Price Index (CPI) indicate that Americans are spending more for both technology and entertainment (a catagory that includes cultural expenditures). How can cultural organizations capitalize on this? What does this mean? Articles in both The Atlantic and NPR's Planet Money look at these trends from a more general standpoint but don't drill down on the idea for the arts. The facts presented from the Atlantic indicate that 2007 Recreation expenditures are up by 1.7% over those from the US in 1947. The NPR article states that as a percentage of household income, expenditures on Entertainment rose from 5% of the total in 1947 to 6% in 2007. This information along with the more current information from the CPI which had the Recreation Index gaining by .6% (driven in part by a 1.2% and 2.0% rise in admission to cultural events in Dec 2011 and Jan 2012) this last January give the arts sector some reason to look favorably towards the horizon. These numbers mean recovery, and recovery means opportunity for change.

The relative gains in the arts sector are paltry compared to the gains made on technology purchases in the same amount of time. The number of personal computers in homes (worldwide), for instance, grew from 152 Million from 1993 to 2002. The number of internet users in that same time frame went from 10.5 million to 716 million. The growth of other tech is no less startling by most accounts. The synthesis of the growth of technology has yet to be fully realized by the arts sector at large but this brief respite (where revenue is rebounding from recession) should be a moment where we rally to adapt.

New information out from the Consumer Price Index (CPI) indicate that Americans are spending more for both technology and entertainment (a catagory that includes cultural expenditures). How can cultural organizations capitalize on this? What does this mean? Articles in both The Atlantic and NPR's Planet Money look at these trends from a more general standpoint but don't drill down on the idea for the arts. The facts presented from the Atlantic indicate that 2007 Recreation expenditures are up by 1.7% over those from the US in 1947. The NPR article states that as a percentage of household income, expenditures on Entertainment rose from 5% of the total in 1947 to 6% in 2007. This information along with the more current information from the CPI which had the Recreation Index gaining by .6% (driven in part by a 1.2% and 2.0% rise in admission to cultural events in Dec 2011 and Jan 2012) this last January give the arts sector some reason to look favorably towards the horizon. These numbers mean recovery, and recovery means opportunity for change.

The relative gains in the arts sector are paltry compared to the gains made on technology purchases in the same amount of time. The number of personal computers in homes (worldwide), for instance, grew from 152 Million from 1993 to 2002. The number of internet users in that same time frame went from 10.5 million to 716 million. The growth of other tech is no less startling by most accounts. The synthesis of the growth of technology has yet to be fully realized by the arts sector at large but this brief respite (where revenue is rebounding from recession) should be a moment where we rally to adapt.

What do these broad economic indicators mean? Consumer confidence has been slowly recovering since the doldrums that it was in around 2008 and 2009. As budgets start to recover and earned income from ticket and admission sales start to edge up, arts leaders will be faced with decisions about what to do with the money. The temptation to return departments and programs to the pre-recession status quo will be strong; the opportunity, however, for transformation through technology to meet the larger changes in how people are consuming arts and culture should be the priority.

As many technologies are currently moving out of first generation and subsequently becoming less expensive the opportunity to develop interfacing content for them is also becoming less expensive. Application development for mobile devices is, for instance, now within the fiscal reach of the arts sector. Similarly simulcast capabilities in HD are coming into broader usage in peforming arts organizations across the country. The time to identify and implement new technology is now.