Written by Evan Aanerud

Financial reserves allow organizations grace in times of financial hardship. The pandemic into post-pandemic economic environment set many arts organizations into financial tailspins that they are still recovering from. Financial reserves need to be accessible, ie liquid, and there needs to be “enough”. What defines enough? According to the Nonprofit Finance Fund, most nonprofits have less than three months of reserves on hand:

WHAT IS AN OPERATING RESERVE?

Board members of nonprofit organizations will often set aside an Operating Reserve or "Rainy Day Fund" to fund operations in the case of uneven cash flows.

- Nonprofit Finance Fund, State of the Sector 2022 Survey Results

HOW HAS THE PANDEMIC AFFECTED CASH BALANCES AT NYC NONPROFIT THEATERS?

While many organizations faced uncertainty in recent years, performing arts organizations, no doubt, experienced intense economic uncertainty and weathered extremely difficult operational environments during the height of COVID-19. Though PPP (Paycheck Protection Program) loans, SVOG (Shuttered Venues Operating Grants) grants, and ERTC (Earned Revenue Tax Credit) funds helped keep the lights on. One question may managers have is how those short-term programs affected organizations’ operating budget, including surpluses, deficits, and cash-on-hand. To understand this in a more data-informed way, I analyzed a set of NYC nonprofit theatres to measure how the pandemic affected their cash balances.

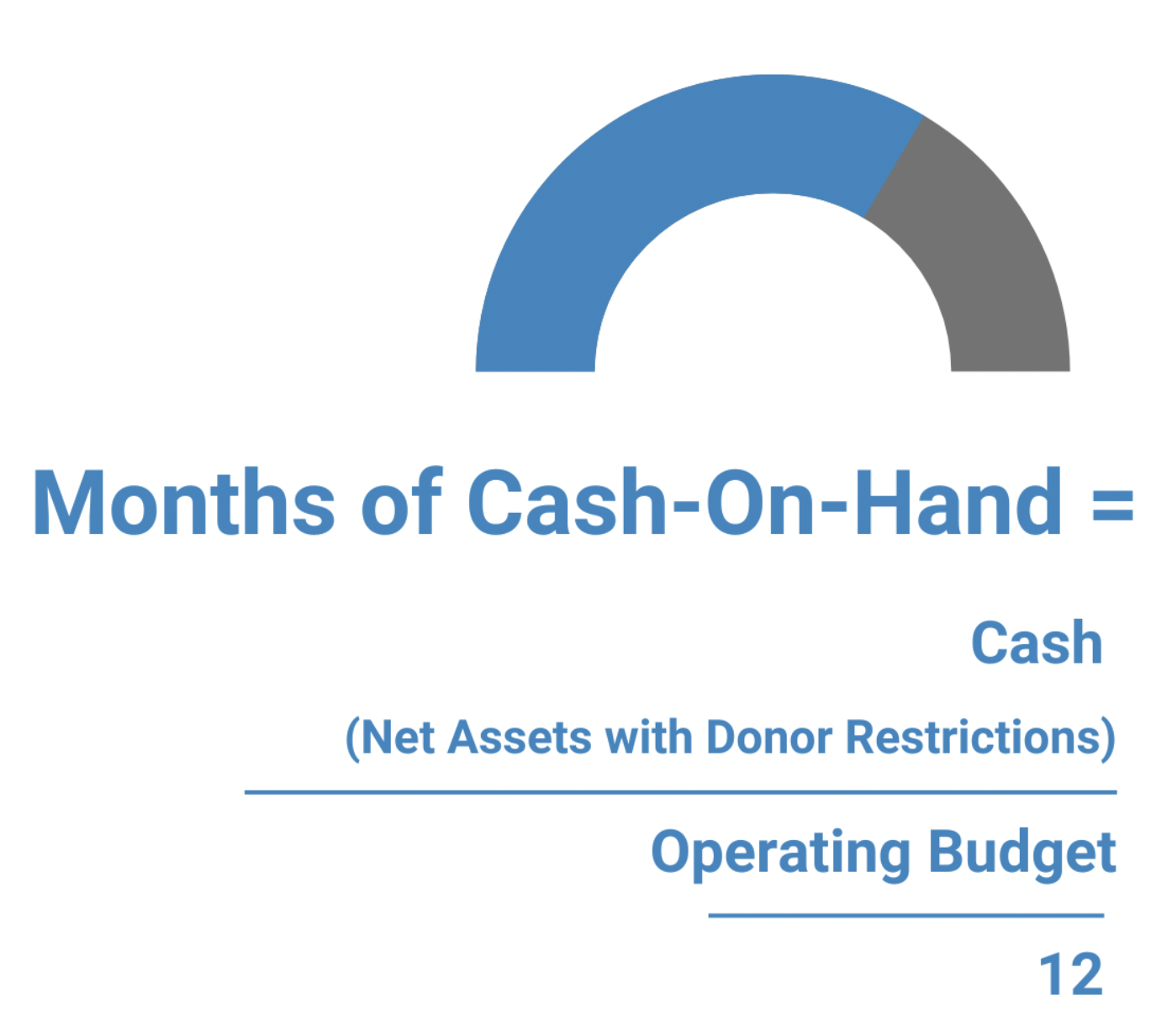

What is Cash on Hand?

A nonprofit organization's cash-on-hand is the sum of all unrestricted cash and cash equivalents. Unrestricted cash and cash equivalents are cash that are not restricted by purpose or time. Months of cash-on-hand is a useful metric to democratize how we measure unrestricted cash across organizations that are very different in size.

Source: Author

Smaller Companies

On average, smaller NYC Theater companies have grown unrestricted cash balances faster than larger theaters. Between 2016 and 2019, months of cash-on-hand stayed relatively low for smaller organizations with operating budgets under $10 million. For example, Second Stage Theater had 1.34 months of cash-on-hand at the end of FY17, but in FY18 they had 4.76 months of cash-on-hand.

Interestingly, beginning in 2020, months of cash-on-hand began to rise for both large and small theaters. In 2021, the average small NYC theater had almost 13 months of expenses in cash available. Surprisingly, larger theaters experienced didn't increase their unrestricted cash balances as fast as smaller organizations by 2021. These large increases in unrestricted cash in 2020 and 2021 are largely attributed to the effects of the COVID-19 pandemic and the cancellation of all live performing arts events. Even though ticket sales were essentially non-existent, NYC theaters were still spending a fraction of what they had normally spent on a typical season pre-pandemic.

But that doesn't tell the full story. Operating reserves set more robust organizations apart in the long-term. Organizations with unrestricted operating reserves have larger cash levels than organizations without reserves. When operating reserves are included in the sum of available cash, larger theaters have demonstrated stronger fiscal strength over the past six years than smaller theaters.

Larger organizations = Larger reserves

Lincoln Center Theatre and Manhattan Theatre Club are two examples of organizations that have some of the largest reserves in the theatre industry. Combining their board reserve and cash, Lincoln Center Theater could pay it's monthly expenses for 63 months. That's over five years.

But even for smaller organizations with smaller budget sizes, have a cash on hand if not a formal operating reserve. Looking at the charts provided, it is clear that the goal is there, but the engine is simply smaller. At the end of the day, a reserve is the organization's "savings account" and is adaptable to their financial needs and flows. This adage became abundantly clear during throughout the COVID-19 pandemic. Research shows that nonprofits with reserves were less likely to reduce operating hours, lose staff, or experience difficulty paying employees or vendors for their services. Establishing an operating reserve is wise for any theater to prepare for future fiscal uncertainty.

Establish an Operating Reserve in Your Nonprofit:

The Board of Directors will need to approve the implementation of an Operating Reserve fund in your organization. One path to achieving a fund is for the board to adopt a “reserve policy," as they are the governing body with fiduciary oversight. As leaders work alongside boards, it is useful to reference guidance on how much the nonprofit will set aside, defining the circumstances that removing reserve funds will be enforced under, the process the nonprofit will go through to determine whether to dip into reserves, and how the nonprofit will repay into the reserve account. A few useful and potential references for working with your board or finance committee are below.

In summary, having cash reserves may feel like a luxury, but it is a fundamental financial strategy for a healthy and sustainable organization. If yours is smaller than is recommended or than you want, the hardest but necessary first step is simple: plan to save.