The following study is part of an Arts in the Age of Covid research team project. This study is compiled from the research conducted and summaries articulated by Clara Pérez Alfaro and is being published as a three-part series. The first introduces the similarities and potential opportunities that arts organizations, particularly performing arts institutions, can find by studying how the sports industry is adapting post-Covid-19. The second and third focus on two specific cases: La Liga and the NBA.

So why sports? Although the general perception of the sports industry focuses on teams and their players, the sports industry encompasses a vast number of stakeholders that affect the state of the industry. The industry is made up of a complex web of live sporting events, food stands, media rights, and brand sponsorships (Qara, 2019). Most importantly, as with the arts, fans and audiences play a key role when it comes to analyzing the state of the industry. Unlike the situation for arts audiences, the global sports market is growing and expected to continue to grow due to esports, an increase in the number of internet accessible devices and the advent of 5G (NEA, 2017).

It is important to take into account that the sports industry can be divided into two main segments: participatory sports (which are mostly recreational) and spectator sports. Spectator sports include the presence of an audience, whether on site or remotely through broadcasters or other distribution platforms. This study focuses almost exclusively on the spectator sports market, which is expected to be the fastest-growing segment of the industry with a compound annual growth rate (CAGR) of 5.9% (Wood, 2019).

DISTRIBUTION

Media rights and distribution models play an essential role in the composition of the sports market and could potentially do the same for the arts. With the creation of streaming services such as Netflix and Hulu, content consumption has shifted to an asynchronous manner. The days where you had to be home at a specific time to watch your favorite shows are over. Pay TV penetration peaked in 2009 and the number of subscriptions to satellite or cable TV services have been declining since. (James, 2016).

Social media platforms, such as Twitch and YouTube, realized that creating the same product as traditional broadcasters was not effective, and are looking for alternatives that look and feel like what younger audiences are accustomed to consuming on their platforms (Marcus, 2020). Arts organizations are beginning to investigate these venues, particularly to adapt to the Covid-19 pandemic. Twitch, now property of Amazon, has been a pioneer in the streaming arena. The platform known for its video game content started live streaming Champions League matches and basketball games on Twitch streamers’ channels with the streamers’ commentary and reactions. There is an interactive element to it that distinguishes Twitch from traditional broadcasters and appeals to younger audiences (Yasikioglu, 2019).

TECHNOLOGY AND DATA AS THE ARTS ENTER THE DIGITAL AGE FULL-THROTTLE

Patterns in fan behavior and technology are as important in the arts as they are in sports. Deloitte’s annual Sports Industry Outlook report predicts the future trends in the sports industry. The 2020 edition outlines five major tendencies, with two directly relating to both arts and sports: the growth of e-distribution and the introduction of 5G (Deloitte, 2020). When looking at all five of Deloitte’s trends, the predictions coalesce around two common threads: technology and data analysis.

Technological innovation has been changing the way sports are broadcasted since 1920, with the first widespread radio broadcast. Actual presence in the stadium was no longer necessary. In the 21st century, as technology has matured, the spectator vs. fandom model radically changed, reinforcing and expanding the sense of community in fans, present or not (Nachman, 2011).

Technology has not only affected the way fans consume sports, but it has also impacted sports themselves. Collecting data and analyzing it is essential in helping teams analyze their players, their rivals, and their overall structure. Data and technology have been at the core of the development of the sports industry. Data, however, has helped develop the whole ecosystem of the sports industry, not just the game itself. Most actors in the sports industry have used a combination of technology and data to improve audience experience. Sports organizations have detected patterns in digital engagement to understand what fans are watching, and when and where they are watching. In stadiums, electronic tickets are used to understand fan movement and predict anything from ticket pricing to staffing on game day (Ricky, 2020). A data-friendly attitude—similar to that in sports—needs to be adapted to the arts and cultural space quickly, especially as our products move to a more consistently digital locale.

The introduction of 5G in the sports industry is predicted to be one of the most revolutionary technological advances in the field. 5G will allow systems to store, process, analyze and act upon data at a much faster rate. For broadcasters, this means an increase in transmission speed: cameras could be connected wirelessly and have the same reliability as a wired connection (Ajadi et al., 2020). Additionally, this could potentially reduce the need for satellite trucks, allowing networks to relay new content from different places, such as the team bus, or provide additional viewing angles (Ajadi et al., 2020).

For fans and audiences, the introduction of 5G technology also presents a vast horizon of opportunities for new experiences. Overall, fans will be able to get incredibly fast real-time data and streaming when and where they want it. In stadiums, experiences can be revolutionized by providing instant replays, faster connectivity, or even live TV graphics. Moreover, 5G opens the door for fans to experience live games anywhere and with friends from across the world via VR devices (Deloitte, 2020).

FANS & AUDIENCE

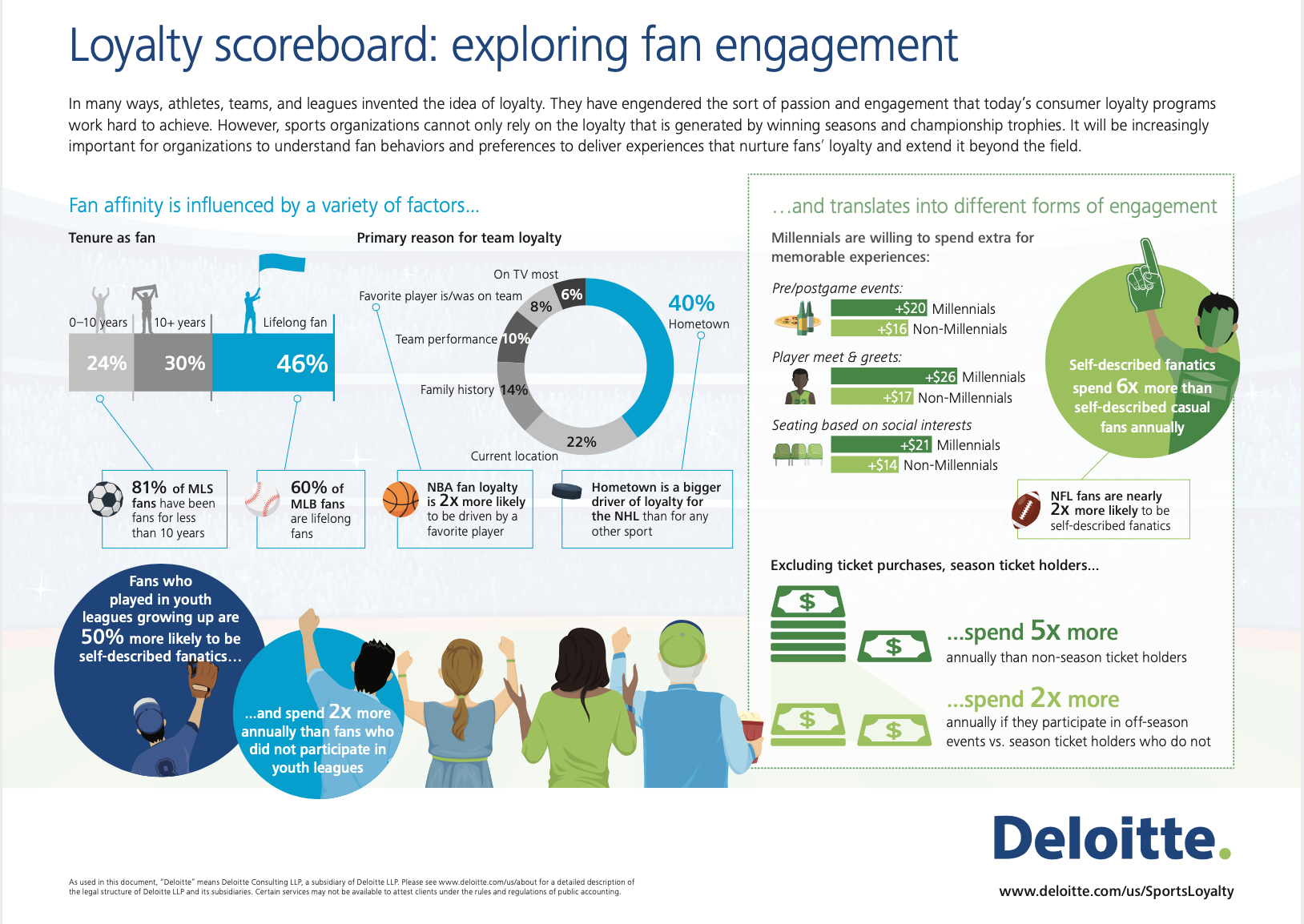

Just like the arts, sports fans and audiences are at the core of the industry. Fans are consumers, and the industry as a whole looks to them to find and create opportunities for engagement and new revenue streams.

Engagement, however, does not start and end in the stadium or the theatre. Managers in sports and the arts need to think about a holistic experience. Although live games are a focal point for fan interaction in sports, there are countless opportunities that go beyond game day (Giorgio et al., 2016[1] ). Fans are constantly looking for ways to interact with their teams, whether it is talking about games with friends, buying merchandise, or reading articles online. While sports teams will continue to take advantage of these interactions to boost affinity by creating deeper team experiences, the arts need to meet that standard.

Figure 1: A visual exploration of fan engagement. Source: Deloitte.

Current State of the Sports Industry

The Covid-19 pandemic has forced most sports leagues to cancel or postpone all games and in-house activities just as it affected live arts participation. These disruptions are affecting every factor of the industry.

As life with fear of the pandemic settles down, many leagues have restarted or are set to do so in the summer. As in the arts, safety guidelines are the main concern, but there is also a concern about how to make the live experience attractive to fans. Given that games will now be played without a live audience or with just a small audience, there is a value gap in the product being delivered.

Fans and audiences, however, will play an important role in the return of live sports. Although studies have shown that fans approve of the return of live sports even without live audiences, it will be important to understand how audiences engage with this new content (Zucker, 2020). Additionally, the sports world is not only about the matches, but it is also about the experience and the communities that fans build around their teams. Therefore, understanding how leagues and distributors will create new experiences for fans to engage and build virtual communities will help inform opportunities that could also benefit the arts sector.

Technology is the factor that crosses this scenario. Given that all experiences are currently virtual, leagues and distributors (both broadcasters and streaming service providers) will need to embrace technological innovations to reach their audiences. On the one hand, producers will need to find ways to enhance the viewing experience to bridge the value gap due to the lack of live spectators and fans. On the other, it is important to analyze if, with new technologies, distributors will develop new virtual spaces to create online fan experiences and enhance the viewer experience.

RESOURCES

Ajadi, T., Ambler, T., Udwadia, Z., & Wood, C. AnnuAl Review of Football Finance 2020. Deloitte Sports Business Group, 2020.

Deloitte Center for Technology, Media & Telecommunications. 2020 Sports Industry Outlook. Deloitte, 2020.

Giorgio, P., Murali, R., & Freeman, K. Refunding home field advantage. Deloitte Sports Business Group, 2016.

Goldman, Aaron. “How The War Over Sports Rights Will Change The Media Landscape.” Broadcasting + Cable, October 15, 2019, https://www.nexttv.com/blog/how-war-over-sports-rights-change-media-landscape

James, Meg. “The rise of sports TV costs and why your cable bill keeps going up.” Los Angeles Times, December 5, 2016, https://www.latimes.com/business/hollywood/la-fi-ct-sports-channels-20161128-story.html

Marcus, Daniel. “Facebook Is Reportedly Steering Away From Live Sports.” Forbes, January 31, 2020, https://www.forbes.com/sites/danielmarcus/2020/01/31/facebook-steering-away-from-live-sports/#7865c7645196

Nachman, Corey and Dashiell Bennett. “14 Innovations That Changed Sports Broadcasting Forever.” Business Insider, April 17, 2011, https://www.businessinsider.com/evolution-how-we-watch-sports-2011-4#1965--the-birth-of-on-screen-graphics-6

Nath, Trevir. “The NBA's Business Model.” Investopedia, January 29, 2020, https://www.investopedia.com/articles/investing/070715/nbas-business-model.asp

National Endowment for the Arts. 2017 Survey of Public Participation in the Arts. September 2018, https://www.arts.gov/artistic-fields/research-analysis/arts-data-profiles/arts-data-profile-18

QARA. “Sports Industry Insights.” October 17, 2019, https://medium.com/qara/sports-industry-report-3244bd253b8

Reiff, Nathan. “How The NBA Makes Money.” Investopedia, February 5, 2020, https://www.investopedia.com/articles/personal-finance/071415/how-nba-makes-money.asp

Ricky, Abhas. “How Data Analysis In Sports Is Changing The Game.” Forbes, January 31, 2019, https://www.forbes.com/sites/forbestechcouncil/2019/01/31/how-data-analysis-in-sports-is-changing-the-game/#182542f73f7b

Shamir, Shachar. “Why Fan Engagement is Very Important.” Medium, September 26, 2018, https://medium.com/@Shashamir/why-fan-engagement-is-very-important-6b0302b25c5f

Turk, Victoria. “Why sport is the next frontier for Twitch.” Wired, October 4, 2019, https://www.wired.co.uk/article/twitch-livestream-sport-music

Wodinsky, Shoshana. “Facebook secures deal to stream Champions League matches in Latin America.” The Verge, August 16, 2018, https://www.theverge.com/2018/8/16/17702308/facebook-stream-champions-league-matches-latin-america

Wood, Laura. “Sports - $614 Billion Global Market Opportunities & Strategies to 2022 - ResearchAndMarkets.com.” BusinessWire, May 14, 2019, https://www.businesswire.com/news/home/20190514005472/en/Sports---614-Billion-Global-Market-Opportunities

Zucker, Joseph. “ESPN Study: Majority of Fans Favor Sports Returning Without Crowds amid COVID-19.” Bleacher Report, May 4, 2020, https://bleacherreport.com/articles/2890095-espn-study-majority-of-fans-favor-sports-returning-without-crowds-amid-covid-19