The following study is part of an Arts in the Age of Covid research team project conducted over the summer. This study is compiled from the research conducted and summaries articulated by Victoria Li and is being published in two parts. Read part one here for an introduction to live audience-based TV shows.

As we near the end of 2020, it is important to consider the emerging opportunities for live television as the world transitions through the global pandemic. Live performers sharing space is one aspect of a live broadcast. A second element is a live audience. The following case study focuses on how China restarted its entertainment industries and how other markets might adapt as well.

Global Impact of Covid-19

One must recognize that the pandemic is global, but its impact on different countries and different locations varies due to public policy and approaches to addressing outbreaks. These external environments directly impact the approaches available to live television producers, workers, and audiences.

The line chart below shows daily confirmed new cases for the ten most affected countries. As of November 29, the United States (shown in green), Brazil (shown in orange), and India (shown in pink) are the main places where coronavirus cases are rising. No East Asian countries are included in this chart, indicating that they currently have the pandemic under control, though still not eliminated. Currently, several of the most heavily impacted countries seem to be seeing the beginning of a fall/winter spike, something experts have been concerned about since the pandemic began.

Figure 1: Global coronavirus cases. Source: Johns Hopkins University.

It is important to note that it is unfair to measure how efficient and effective each country is in dealing with the pandemic only from the confirmed cases perspective because public policy approaches are different between the west and the east. The west, for example the UK, follows the herd immunity approach. The individual sacrifices are shorter and smaller. This means that it will take more time to achieve a long-term, care-free living environment. The east, for example East Asia, follows a strict quarantine and elimination approach, which takes less time but requires the entire society to accommodate strict limitations and be immediately responsive and alert at all times.

When this research was conducted over the summer, East Asia was entering the next phase in handling the pandemic, and countries had started the “get back to work” process. Japan lifted its “stay at home” order in May, and lifted the “work ban” in the middle of June. Korea lifted its “stay at home” and “work ban” order both in May. But the reopening didn’t bring an immediate recovery to the economy. This is due to Japan’s and Korea’s economies high dependence on exports, and with the pandemic getting worse in other parts of the world, it is very hard to reboot exports.

General Landscape in China

China was the very first country hit by the virus, and now mostly has the virus under control. The diagram below shows the daily change in China’s confirmed new cases. Based on the diagram, China was hit by the pandemic significantly in January and February, and began to control the situation in March and April. The series of controls led to a peaceful time in May and June, when the newly confirmed cases are approximately 0 for consecutive two months. However, when entering July and August, another local peak of newly confirmed cases took place. This trend was similar to other countries’ trends.

Figure 2: Coronavirus cases in Mainland China. Source: Google.

Below is a diagram regarding China’s current pandemic status, with a total of 104 newly reported cases, an accumulated 93,329 confirmed cases, and a total of 4,750 deaths so far, as of November 29, 2020.

Figure 3: Cumulative coronavirus cases in China as of November 29, 2020. Source: World Health Organization.

It is necessary to have a general understanding of China’s pandemic situation since the economy reopening is closely related to the spread of pandemic. According to the Deloitte report , “Making production sets, live venues, theaters, and theme parks physically and psychologically safe for employees and consumers will be a significant challenge.” Thus, the reopening process cannot be done overnight.

In January, when China discovered the virus, it shut down all businesses and required every citizen to do quarantine at home. At that time, the whole entertainment industry—from cinemas, live events, to studios—were all closed down, and there was no indication of when everything would return to normal. It was apparent that there would be huge financial losses for production teams, no matter if it was TV production or live events production. According to a Chinese producer, “A daily loss of 500,000 RMB is not even the worst scenario.” Postponing film schedules imposed direct pressure on the production companies’ cash flow. Many Chinese production companies are trying to negotiate some deduction/waive policy with the government to allow for filming scenes.

At the end of January, the State Administration for Radio, Film and Television (SARFT) issued guidance regarding the publicity of the Covid-19 situation across all national channels. In the guidance, it stated that all programs should be organized by the SARFT with an emphasis on the news regarding the pandemic while cutting down on entertainment programs. Provinces including Hubei, Hunan, Zhejiang, Anhui, and Choingqing had all opened live news and special report programs about the pandemic. Hunan Satellite TV also produced a program about how to wear masks and other measures that could be taken to prevent the virus. The nation’s most popular gala—the Spring Festival Gala—also adjusted its schedule to comply with the guidance. It is a custom to have celebrities knock on citizens’ doors to celebrate the festival with them, but this year, in order to comply with the guidance, it canceled this part to advocate to decrease the public’s mobility.

On February 3, the first trading date for A share market, three major Chinese indexes went low. A group of entertainment companies’ stock prices dropped around 10%, and the average Shanghai Composite Index dropped 7.72%.

Restarting China’s Entertainment Industry

In March, China briefly attempted to restart about 4% of its cinemas in regions where the pandemic appeared to be under control. But business was dismal with audiences likely fearing second-wave infections. Authorities soon closed theaters again nationwide, according to Variety. While things were not very promising for the movies, TV shows were not as affected. Singing competition show “Geshou” (similar to “The Voice” in the U.S.)—an example of a live audience-based TV show—was in the middle of the competition process when the pandemic struck. It did not stop shooting; rather, it continued with all singers filming in their local place, and if there was more than one singer in the same city, those singers would shoot together. The live audience went online to watch the competition, voting for the singers and commenting on the performances.

While there were TV shows managing to adapt to the ongoing pandemic and policies, there were also TV shows that were customized their productions to this circumstance. Celebrity observation TV shows are one example, specifically “I Want to Live Like This” (shown in the image below). The celebrity observation TV shows are like “Keeping Up with the Kardashians” as the show is about documenting the daily life of the celebrity. These shows are very welcomed during the pandemic since most of them recorded how younger generations are trying to manage their lives when they are just beginning to live on their own. This theme echoed the reality that during the pandemic, many young Chinese have had to learn to cook, while before the pandemic, they didn’t necessarily need to know this since there were food deliveries everywhere.

What sets these Chinese shows apart from “Keeping up with the Kardashians” is that there is a viewing room where there is a host who controls of the flow of the program and where the celebrities watch the recorded show together with the host and audience. It is worth noting that the celebrities who attend the viewing are the same celebrities who were filmed in the documentary, so when there are funny or surprising events, the host can ask the celebrity about them directly.

Figure 4: Screenshot from Chinese show “I Want to Live Like This.” Source: Author.

Entering May, China expedited the reopening process and gradually lifted the restrictions regarding the live events and entertainment market. The Ministry of Market Management, Culture and Tourism Department released guidance regarding reopening for live events and entertainment places. This guidance marked the official reopening for the overall entertainment industry. In June, The Ministry of Market Management, Culture and Tourism Department revised the guidance with more detailed measures in reopening, such as an increase in the flow of people from 30% to 50%.

On July 16, SARFT released a notice to gradually reopen cinemas during the Covid-19 pandemic. According to the notice, places with a low risk of exposure to the virus that had already implemented well-rounded prevention methods could open cinemas on July 20. The cinemas finally returned after a full 180 days of quarantine.

Although the entire entertainment industry is recovering, the damage of the pandemic is tremendous. The timing of the pandemic was especially bad for China’s film productions, as it was during the Lunar New Year holiday, typically one of the year’s biggest moviegoing periods. Nearly all the movies had suspended their releasing time, waiting for further instruction on reopening. However, there was one movie that was still released on time, but in a completely different channel.

Changes in Distribution Channels

In a mere three days, a whopping 600 million people tuned in to Bytedance’s various video platforms, such as Xigua Video and TikTok, to watch the only new blockbuster they had access to for months: director Xu Zheng’s family comedy Lost in Russia. It is the very first time that people across the country were watching a theatrical premiere via their mobile devices.

Placing a theatrical premiere on a streaming platform was unprecedented and triggered theatres’ boycott against the movie Lost in Russia. However, according to interviews with several production company CEOs, investors, and industry analysts, this “accident” event may cause a long-term change not only for traditional production companies, but also for short-form video platforms.

This unprecedent move is a win-win for Bytedance and Huanxi Media, the production company of Lost in Russia. Bytedance has competed with its rival Kuaishou for years in taking over the majority market share of the short-form video venue, and it seemed that Kuaishou won an edge over Bytedance by acquiring a cooperation with CCTV’s spring festival gala — the entertainment spectacular that is the world’s most-watched TV show (reaching 1.23 billion viewers this year). Huanxi Media, on the other hand, is facing only three choices under the pandemic. Huanxi CEO Steven Xiang Shaokun explained:

We had three choices. One was to delay release, like the other movies. This had pros and cons, but the drawback was that we couldn’t know when it would be able to open. Another option was to put the film directly on our own platform. For sure that would lift our platform to another level, but it’s a $48 million (RMB 350 million) movie, and we’d have to charge people to watch it.

The third choice was that Bytedance would pay Huanxi $90 million — surpassing the original $85 million minimum guarantee from theatrical distributor Hengdian — for Lost in Russia and a small number of other titles, accelerating earlier plans to establish a wider content- and traffic-sharing agreement. Both Huanxi and Bytedance would stream the film immediately and free of charge on Huanxi.com and Bytedance’s suite of video apps, including Douyin (China’s version of TikTok), Toutiao, and Watermelon Video, bypassing theatrical release altogether.

The benefit for Huanxi Media was clear in the third choice, but what was there for Bytedance? The free movie is a powerful advertisement for streaming platforms held by Bytedance, and enabled Bytedance to acquired millions of new users at once. Whether these newly acquired users will stick to Bytedance’s platforms is hard to predict, but at least Bytedance bought itself a chance to compete with Kuaishou.

However, this win-win situation angered cinemas and other film studios. Around 23 firms went to write a joint letter complaining about Huanxi’s “Lost in Russia.” Although this move is not illegal, it “goes against the payment and revenue model that the movie industry has cultivated over many years, trampling and intentionally destroying the movie industry and premiere models,” according to the joint letter. Zhejiang province’s film industry also issued a statement that threatened to boycott future Huanxi films.

According to movie industry professionals and investors, the above situations are unlikely to continue to happen. They predict that once the situation goes back to normal, there will not be as many movies choosing to distribute over streaming platforms. Rather, films will still prioritize distributing through cinemas. This is based on the fact that going to see a movie in China has great social functions attached to it, and this function cannot be fulfilled by watching movie on streaming platforms. Additionally, it is highly unlikely that there will ever be a streaming platform willing to offer a price of 600 billion RMB to acquire a movie.

But Lost in Russia did provide a possible path that no one have ever tried, or even thought before. This unprecedented trail may reveal a future trend, which is that it is not necessary to either debut in cinemas or on streaming platforms in terms of movie distribution: it can be a coexistence. This idea is also backed up by Ling Bin, a law school professor in Peking University. According to Professor Ling, “The ultimate cause behind all these is that Bytedance jeopardized traditional theaters’ existing interest and competitive landscape.” Internet companies, including short-form video streaming platforms, have long struggled to blend in to the upper-stream of the movie industry, and they have had nearly no access to distribution since cinemas hold an irreplaceable position. But the win-win of Bytedance and Huanxi Media opened access to the movie distribution ecosystem. Although Huanxi Media is the one being most strongly accused, it is the invasion of Internet companies/streaming platforms that truly made traditional production companies and cinemas uncomfortable.

The United States had encountered this collision way before China did, when Netflix tried to join the Academy Awards. Although the competition between traditional movie distribution channels and the streaming platforms is still an ongoing situation, Netflix is gradually being accepted with its high-quality content. Based on this example, one might conclude that the merger of both traditional distribution channels and the streaming platforms is inevitable. Instead of going at business with an “eye for an eye” perspective, the traditional distribution channels and the streaming platforms can collaborate and achieve a win-win by utilizing the counterpart’s advantage. For streaming platforms, its advantage is the high volume of audience and convenience. For traditional distribution channels, it’s the exceptional viewing experience and space for audience to be social, as in the case of traditional movie theaters. Thus, cautiously providing the digital channels with movie distribution licenses, while exploring a “bi-distribution” model may be a future trend.

However, this trend will diminish traditional movie production companies’ income. Therefore, several production companies had started to invest more to TV series production as it is more stable investment choice.

From Movie Productions to TV Productions

Before movie theaters reopened in July, 180 days had passed without a single cinema opened in China. This fact made industry insiders understand that watching movie is far from a necessity in pop culture. The lockdowns reinforced another fact: the rise of made-for-streaming films and series.

As noted in Variety “What’s clear at the end of the day is that COVID-19 has boosted demand for online entertainment — it’s just a question of what channels will be delivering it, in what manner.” In fact, the decrease and uncertainty of the movie business encouraged more and more production companies to enter the TV shows business. According to an executive from Youku, which is one of the top three streaming platforms and is owned by Alibaba Group, Chinese audiences now prefer shorter, more straightforward content due to the uprising of short-form video platforms, and this phenomenon makes the movie industry especially hard to survive as since movies themselves are about telling stories with complex content and background. Once the habit of watching short-form videos is established, it will be more difficult for standard length movies to break through.

But TV shows will not be as affected since they do not require a big chunk of time devoted to the content, which better accommodates today’s young people’s social behavior. As stated above, many production companies had started to invest more in TV shows production as it has the following two major advantages.

TV Industry Advantages

One is that it can mitigate the industry threat imposed due to the lockdown of cinemas. TV shows are not as limited as the movie industry in terms of distribution channels. More and more TV shows in China are provided over streaming platforms, which protect TV shows during the Covid-19 pandemic. According to SARFT’s statistics, TV viewing time has increased by 40% during the pandemic, with an average of seven hours of viewing time per day per household. Streaming platforms received even better results. One of the most popular shows, the “Running Man Season 4” has a viewing of more than 0.2 billion. These data backed up production companies’ decisions to invest in TV shows, as they can diversity companies’ content production structure and can increase the ability to combat the market risk.

The second major advantage is that television production can facilitate companies’ financing ability. This is because, under most circumstances, movie tickets cannot be prepaid. Especially since the pandemic will coexist with us in the foreseeable future, there are too many uncertainties attached to movie industry. TV shows, on the other hand, are completely different. They can sign prepayment contracts with satellite TV and streaming platforms. In theory, prepayment contracts can be used as mortgage.

The distribution of TV shows in China is mostly controlled by three major technology companies’—Baidu, Alibaba, and Tencent—streaming platforms: iQiyi, Youku, and Tencent Video. Thus, the discussion around TV shows is the same as the discussion about streaming. These technology giants have complete control over the entertainment field, from infrastructure built-up, content production, to content distribution.

Take Alibaba’s Youku, another key streaming player in the entertainment field, as an example. Youku, with resources from Alibaba Group, promotes its TV shows inside the Alibaba system easily and acquires audience more efficiently. During the pandemic, Youku launched “Hao Hao Chi Fan” (Have a Good Meal) and “Hao Hao Yun Dong” (Have a Good Exercise). These two TV shows all applied a streaming logic where they focused more on the companionship between the host and the audience and their interaction.

During the Spring Festival (which is around February, just when China was swept by the virus), the DAU (Daily Active Users) for Youku increased by 18.4%, and a week later it increased by 31.5%. This is an outstanding performance even among the top tier streaming platforms. This unusual increase, so unusual that it almost goes against common sense, is not only a result of content innovation and fast and appropriate spontaneity to the disruptive event, but also the result from a long-accumulated solid technology foundation and the observation of user insights.

The disruptive event is both a challenge and opportunity for these streaming platforms, and for now it is apparent that the opportunity side has outweighed the challenge side. For Youku, iQiyi and Tencent Video, the huge demand for online entertainment life has broken the barrier to subscription increase. To shift an industry change into an opportunity during an unprecedented time is a 360-degree examination from strategy structure to the ability of implementation.

According to QuestMobile’s report on China’s Mobile Internet Data, the nationwide daily aggregated time spent online increased after the pandemic spread and cities locked down. The graph below can justify the above argument with the vertical axis representing the number of hours users spent in 0.1 billion hours and the horizontal axis representing the timeline.

Figure 5: Chart of hours spent online in China. Source: QuestMobile.

Problems in the TV Industry

However, TV shows are also facing finance problems. Most TV shows are distributed over streaming platforms and these platforms’ revenues rely on two major sources: subscription revenue and advertisement revenue. The pandemic definitely increased the subscription revenue as streaming platforms became the only choice of entertainment distribution channel. Amid the continued transition to subscription-based models, advertising remains important to M&E segments, and the rapid spending decline represents another challenge, according to Deloitte’s report. For commercially-funded TV broadcasters, they are facing an ironic situation, where though TV viewing has gone up with people in lockdown at home, advertising money has dried up as marketers worry about how their sales will fare in a locked-down world.

In order to compensate the declining of advertisement revenue, Tencent Video offers audiences the option to pay for unlocking the final few episodes of certain TV shows in advance, such as “Qing Yu Nian” and “San Shi Er Yi.” In an attempt not to dishearten its existing subscribers, Tencent Video offers discounts for the members and a higher price for the general public in terms of the unlocking payment. This method is very direct and rewarding to the streaming platform and is followed by iQiyi as well. However, some industry insiders also pointed out that this method may dishearten subscribers anyway, because the underlying reason for these subscribers to pay for the subscription fee is to get access to exclusive content. By charging extra money to buy the option of advance viewing means that the streaming platform delayed the release of the final episodes deliberately, and, to some extent, this new business model is against what is agreed ahead when subscribers pay for the subscription. Additionally, subscribers cannot know in advance which TV shows will be charged to unlock the final episodes; rather, it is always determined by the streaming platforms along the way of releasing the TV shows.

Nonetheless, the greatest potential risk imposed on TV shows is from the uprising of short-form video platforms.

The Rise of Short-Form Videos

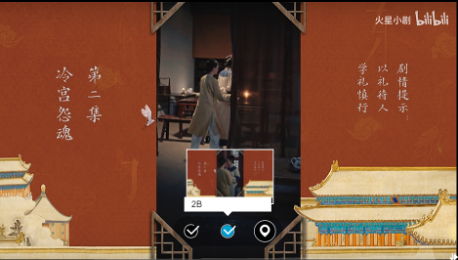

Standard length TV shows, including both the ones distributed on the streaming platforms and the ones on satellite TV, are now facing threats from numerous new forms of TV shows, especially the ones distributed on short-form video platforms. One example is the interaction TV series launched by Tencent short-form video platform Weishi, “Mo Yu Chuan Qi.” The story takes place in a fictional ancient China dynasty and is about how a maid uses her wit to survive and get revenge against the queen in the imperial palace. The story is very close to young people’s current situation as this TV series is more like a Bible of how to work one’s way up the social ladder or career path.

Like Quibi, “Mo Yu Chuan Qi” also uses the vertical playing mode instead of the mainstream horizontal playing mode. This choice is to facilitate audience’s participation in the interaction process. The TV series has a very clear target audience which is the young working class. Applying the vertical playing mode with each episode averaging a length of five to eight minutes while scattering three interaction points is very convenient for them to watch the TV series while commuting or on a tea break.

The interaction points are all choices that can be made on behalf of the main character, and different choices may lead to a different storyline. “Mo Yu Chuan Qi” had achieved 100 million views in two weeks of its launch. It can be called a success given that “Mo Yu Chuan Qi” is the very first TV series that applied the vertical playing mode and interaction points alongside the storyline. The interaction points increased the audience participation and adhesiveness to the TV series by making them be their own writer of the story.

The first image below is a screenshot of one of the scenes in episode one. At the bottom of the screen, there are two choices that the audience can play with, and the different choices will trigger completely different storylines (or, if you’re unlucky, an ending). The blue pinpoint icon in the second image shows the audience where they are currently among the storylines, and the final screenshot shows that they can go back to any previous interaction point they like to make different choices without the need to watch the entire episode all over again.

Figure 6: Screenshots from series “Mo Yu Chuan Qi.” Source: Author.

Tencent has combined its gaming and productions business units’ resources and produced the innovative TV series model, in an attempt to further develop Tencent Weishi inside the short-form video venue. This attempt is necessary for Tencent as the short-form video venue has already been occupied by Douyin (the local version of TikTok) and Kuaishou. Douyin’s DAU increased from 0.25 billion to 0.4 billion in 2019. It is almost a miracle to increase nearly 60% of DAU when Douyin has already had such a large user base. Douyin’s major rival Kuaishou has also increased its DAU from 0.16 billion in 2018 to 0.3 billion in February 2020. Kuaishou’s year-over-year DAU increase has reached an outrageous 87.5%.

In comparison, the standard-length streaming platforms like iQiyi had a DAU of 0.126 billion in 2017, 0.135 billion in 2018, and a year-over-year DAU increase of 7.14% ending 2018, as iQiyi hasn’t disclosed any DAU-related data for 2019. But, according to industry professionals, they predicted a year-over-year DAU increase of around 5%, given its past behavior and the rise of the short-form video platforms. Therefore, compared to the short-form video platforms, the user growth can be neglected. Thus, the standard-length streaming platforms like Youku, iQiyi and Tencent Video should be aware of the threats coming from Bytedance and Kuaishou, especially when Bytedance has already demonstrated its ambition in the standard-length video venue.

During the Spring Festival, Chinese spent much more time on short-form video platforms compared to standard-length video platforms. The graph below exhibits the components and proportion of time Chinese spent on each app. The first bar shows the data for the time period around the Spring Festival in 2020, the second bar shows data around normal days in 2020 (before the Spring Festival), and the third bar shows the data from the Spring Festival in 2019. The yellow bar represents social media platforms, the grey bar represents short-form video platforms, the dark blue bar represents mobile gaming apps, the red bar represents news apps, and the light blue bar represents standard-length streaming platforms. It is evident that due to the pandemic, the consumption of short-form videos and standard-length videos increased dramatically, especially the short-form videos. The overall short-form video apps took 10% of a person’s daily time more than the standard-length streaming platforms. Thus, the rise of Bytedance and Kuaishou is evident.

Figure 7: Chart of time spent on various apps. Source: QuestMobile.

Looking Towards Potentials for the New Normal

The probable challenges which the entities in the entertainment industry may face is lurking in every production process. To start with, the studios, when live TV shows’ productions do return, will need to have much smaller audiences in venues with greatly reduced capacities because of social distancing restrictions. In an attempt to make up for reduced attendance limits, studios may have to raise ticket prices— a potentially controversial move. Besides the potential lack of revenue flowing in, studios also face the prospect of increased costs as a result of the need for additional sanitation. The decrease in revenue and increase in cost may put studios in an uncomfortable situation.

For the performers for the live shows, with the limited audience or no audience at all (as China did), they may not feel comfortable performing as they used to do, as performing relies greatly on the connection of interacting in person with the audience. For the audience, their experience may be discounted as they may be subjected to wearing masks, undergoing temperature checks at the entrance, having social distancing seating schedules, and having a capacity restriction for restrooms.

On top of all these challenges, the most overarching obstacle is the inability to understand what the trajectory of the pandemic will be to come up with the right strategy. Executives in the industry all have different opinions about the future even though they share the same information.

In order to tackle these challenges, the first thing people need to do is to adjust their attitudes towards the future and stop assuming that the old ways will come back. After adjusting our attitudes, entities in the entertainment industry can consider accelerating the transition to agile methods, the ability to reconfigure strategy, structure, processes, people, and technology quickly toward value-creating and value-protecting opportunities. This is a well-accepted strategy for many businesses outside the entertainment industry, and this theory is backed up by strategy consulting firms like McKinsey and Deloitte, and is now of great value to the entertainment industry, given the circumstance it is facing.

For TV production, built on the research mentioned above, we can consider producing more live shows related to social concerns that are more flexible in terms of the shooting process. This can cater to what the audience is interested in and translate it into views. This can contribute to the good of overall communities, which makes shows more meaningful.

Innovative business models are beneficial for the overall entertainment industry as they can facilitate the enlargement of the market, which can later assist in industry development. The traditional business models and the innovative business models are not exclusive from each other: rather, they can go hand-in-hand by applying the advantages each and cooperating in more depth to achieve the development.

Zheng Zhihao, CEO of Maoyan Entertainment, says that entertainment is an indispensable need for consumers in China and demand will stabilize as the pandemic recedes. This also applies to the U.S. marketplace. We can expect a recovery in the consumption of entertainment products when the pandemic is controlled.

While the U.S. entertainment industry can refer to this trend, one should also be fully aware of the intrinsic differences in the marketplace between the U.S. and China. China has its own complete entertainment ecosystem, covering both the supply and demand sides. Thus, the industry will rebound earlier than other industries that heavily rely on the global market. However, the U.S. entertainment industry is one that can influence and be influenced by the global entertainment market. So, the recovery rate may be subject to the global economy as well as the global public health situation.

Resources

AdAge (2020, May 11). BLEAK OUTLOOK FOR TV IN SECOND QUARTER; Dearth of live sports and marketer spending cuts pressure ad revenue. Retrieved from https://go-gale-com.proxy.library.cmu.edu/ps/retrieve.do?tabID=T003&resultListType=RESULT_LIST&searchResultsType=SingleTab&searchType=AdvancedSearchForm¤tPosition=1&docId=GALE%7CA623826310&docType=Article&sort=RELEVANCE&contentSegment=ZONE-MOD1&prodId=AONE&contentSet=GALE%7CA623826310&searchId=R2&userGroupName=cmu_main&inPS=true&ps=1&cp=1.

Andreeva, N. (2020, April 30). Film Florida Releases Detailed Recommendations For Safe Sets In Era Of COVID-19: No Director’s Chairs, No Trailers, Clear Barriers For Actors & More. Retrieved from https://deadline.com/2020/04/film-florida-recommendations-safe-sets-covid-19-no-directors-chairs-no-trailers-clear-barriers-for-actors-mics-hairbrushes-1202923124/.

Arie, K. (n.d.). Title: Saturday Night Live : Shaping TV Comedy and American Culture. Retrieved from http://web.a.ebscohost.com.proxy.library.cmu.edu/ehost/ebookviewer/ebook/ZTkwMHh3d19fODE3MjQyX19BTg2?sid=d3d5760e-e9b7-44b5-86c8-91d331d1bf3b@sessionmgr4008&vid=0&format=EB&rid=.

Caijing, W. (2020, July 10). 生命向左,经济向右,后疫情全球经济格局. Retrieved from https://mp.weixin.qq.com/s/5sIOEc1ZlXCGOaLd4N8dYA.

Close-up, E. (2020, May 26). IDC: COVID-19 Will Have Limited Impact on Worldwide Telecommunications Services and Pay TV Spending in 2020. Retrieved from https://go-gale-com.proxy.library.cmu.edu/ps/i.do?&id=GALE|A624865843&v=2.1&u=cmu_main&it=r&p=ITOF&sw=w.

COUNTY OF LOS ANGELES DEPARTMENT OF PUBLIC HEALTH ORDER OF THE HEALTH OFFICER (2020, June 12). Reopening Protocol for Music, Television and Film Production: Appendix J. Retrieved from http://publichealth.lacounty.gov/media/coronavirus/docs/protocols/Reopening_MusicTelevisionFilmProduction.pdf.

Deloitte (2017). Agile Transformation Approach. Retrieved from https://www2.deloitte.com/content/dam/Deloitte/global/Documents/About-Deloitte/gx-about-deloitte-agile-deloitte-agile-transformation-approach.pdf.

Faughnder, R. (2020, February 29). Virus upends film, event worlds; The entertainment industry at large is feeling the effects of the outbreak and global travel bans. Retrieved from https://search-proquest-com.proxy.library.cmu.edu/docview/2367587374/D78C6A6D137041C6PQ/2?accountid=9902.

Faughnder, R. & James (2020, March 13). FILM WORLD FEELING VIRUS' EFFECTS; Release dates are delayed; CinemaCon is canceled as Hollywood grapples with the epidemic. Retrieved from https://search-proquest-com.proxy.library.cmu.edu/docview/2376481581/D78C6A6D137041C6PQ/1?accountid=9902.

Film, E. (2020, January 29). 广电总局:全国卫视减少娱乐性节目,加强疫情防控报道. Retrieved from https://mp.weixin.qq.com/s/SK7DRvqVcILypDD52o05Pg.

Film, E. (2020, January 30). 疫情下的影视产业:票房数据停更、剧组停拍、《囧妈》引发的讨论还在继续. Retrieved from https://mp.weixin.qq.com/s/0ixEl2Ttcv5kAakhKJAodw.

Film, G. (n.d.). STATE OF GEORGIA FILM & TELEVISION PRODUCTION BEST PRACTICES TO REDUCE CONTAGION OF COVID-19. Retrieved from https://www.georgia.org/sites/default/files/2020-05/covid-19_georgia_film.tv_best_practices.pdf.

Industry, T. E. (2020, February 28). 疫情催生文娱新消费:行业寒冬中谁先把火烧旺?. Retrieved from https://mp.weixin.qq.com/s/Zm4RKB5WKMCYTtxrHaN_dw.

James, H. (2020, March 30). The long road home: Ticketing business struggles on amid coronavirus pandemic. Retrieved from https://search-proquest-com.proxy.library.cmu.edu/docview/2396317091?accountid=9902&rfr_id=info%3Axri%2Fsid%3Aprimo.

Kathleen, B. (2020, April 20). Entertainment may look different post-pandemic. Retrieved from https://search-proquest-com.proxy.library.cmu.edu/docview/2392112121?accountid=9902&rfr_id=info%3Axri%2Fsid%3Aprimo.

McKinsey (2020, May 1). From surviving to thriving: Reimagining the post-COVID-19 return. Retrieved from https://www.mckinsey.com/featured-insights/future-of-work/from-surviving-to-thriving-reimagining-the-post-covid-19-return.

News, C. B. (2020, April 20). Maoyan CEO: China Entertainment Demand is Only Delayed by COVID-19, and Will Rebound. Retrieved from https://go-gale-com.proxy.library.cmu.edu/ps/i.do?p=ITOF&u=cmu_main&id=GALE|A621392412&v=2.1&it=r&sid=ITOF&asid=23596859.

Newsweekly, E. (2020, May 15). Findings from William Paterson University Broaden Understanding of COVID-19 (The Role of YouTube and the Entertainment Industry in Saving Lives by Educating and Mobilizing the Public to Adopt Behaviors for Community Mitigation of COVID-19. Retrieved from https://go-gale-com.proxy.library.cmu.edu/ps/i.do?p=ITOF&u=cmu_main&id=GALE|A623375474&v=2.1&it=r&sid=ITOF&asid=54553a6f.

Northhighland (n.d.). SCOPING THE IMPACT OF COVID-19: THE LONG-TERM VIEW (PART THREE). Retrieved from https://www.northhighland.com/insights/blog/scoping-the-impact-of-covid-19-the-long-term-view-part-three.

Rebecca Davis, Patrick Frater (2020, May 6). How China’s Tech Giants Charged Ahead When Coronavirus Shut Down Cinemas. Retrieved from https://variety.com/2020/biz/features/china-entertainment-industry-internet-online-theaters-coronavirus-1234598816/.

Research, Q. (2020, February 12). QuestMobile2020中国移动互联网“战疫”专题报告. Retrieved from http://www.ebrun.com/20200212/373051.shtml.

Service, T. N. (2020, May 27). Ga. Gov. Kemp: Georgia Film, TV COVID-19 Best Practices Available to Industry as Production Planning Continues. Retrieved from https://search-proquest-com.proxy.library.cmu.edu/docview/2406903533?accountid=9902&rfr_id=info%3Axri%2Fsid%3Aprimo.

State, N. Y. (2020, June 23). INTERIM GUIDANCE FOR MEDIA PRODUCTION DURING THE COVID-19 PUBLIC HEALTH EMERGENCY. Retrieved from https://www.governor.ny.gov/sites/governor.ny.gov/files/atoms/files/MediaProduction_MasterGuidance.pdf.

Variety (2020, March 11). HIGH ANXIETY HUW. Retrieved from https://search-proquest-com.proxy.library.cmu.edu/docview/2384156911/4793444619DD4151PQ/1?accountid=9902.

Wire, C. (2020, June 2). Entertainment leaders release Covid-19 production guidelines. Retrieved from https://go-gale-com.proxy.library.cmu.edu/ps/i.do?&id=GALE|A625541944&v=2.1&u=cmu_main&it=r&p=ITOF&sw=w.

You, B. t. (2018, June 18). Porter’s Diamond Model: Why Some Nations Are Competitive And Others Are Not. Retrieved from https://www.business-to-you.com/porter-diamond-model/

数娱梦工厂 (2020, July 26). 疫情后中国电影新动向:减项目、控成本、转线上发行?|上影节. Retrieved from https://mp.weixin.qq.com/s/BbbezEc7VBlRQtDXfn_lNw

犀牛娱乐 (2020, February 3). A股开市影视股集体跌停,疫情之下影视公司更难了. Retrieved from https://mp.weixin.qq.com/s/f6AwOF9nXwVkEnUQDJ61jw

中国新闻网 (2020, July 29). 政策松绑,演出与娱乐市场加速复苏. Retrieved from https://m.sohu.com/a/410453592_653225.