Throughout my tenure as Chief Editor of Research at AMT Lab, I have focused on the benefits of the gaming industry for nonprofits, as well as the monopolistic tendencies and battles of Big Tech, specifically regarding arts and entertainment. Recently, these two worlds have collided, as a wave of consolidation in the gaming industry has raised a new set of antitrust concerns across the globe. In the center of it all? None other than Microsoft, a Big Tech giant that has evaded the antitrust spotlight over the past few years – until now.

Quick Market Overview

Acquisitions exist in all sectors, nor are they always dangerous or bad. However, in 2020, the gaming industry saw an uptick in acquisitions (33%), as well as a revenue increase of 38.24% globally. While this was partially influenced by the pandemic, market predictions over the next 6 years show only growth in the industry. Similarly, the trend of acquisitions in 2020 increased: 2021 resulted in more acquisitions in gaming, and thus far, 2022 has had the largest and fiercest consolidation that the industry has seen to date. The caliber of these mergers and acquisitions raise monopolistic concerns across the sector.

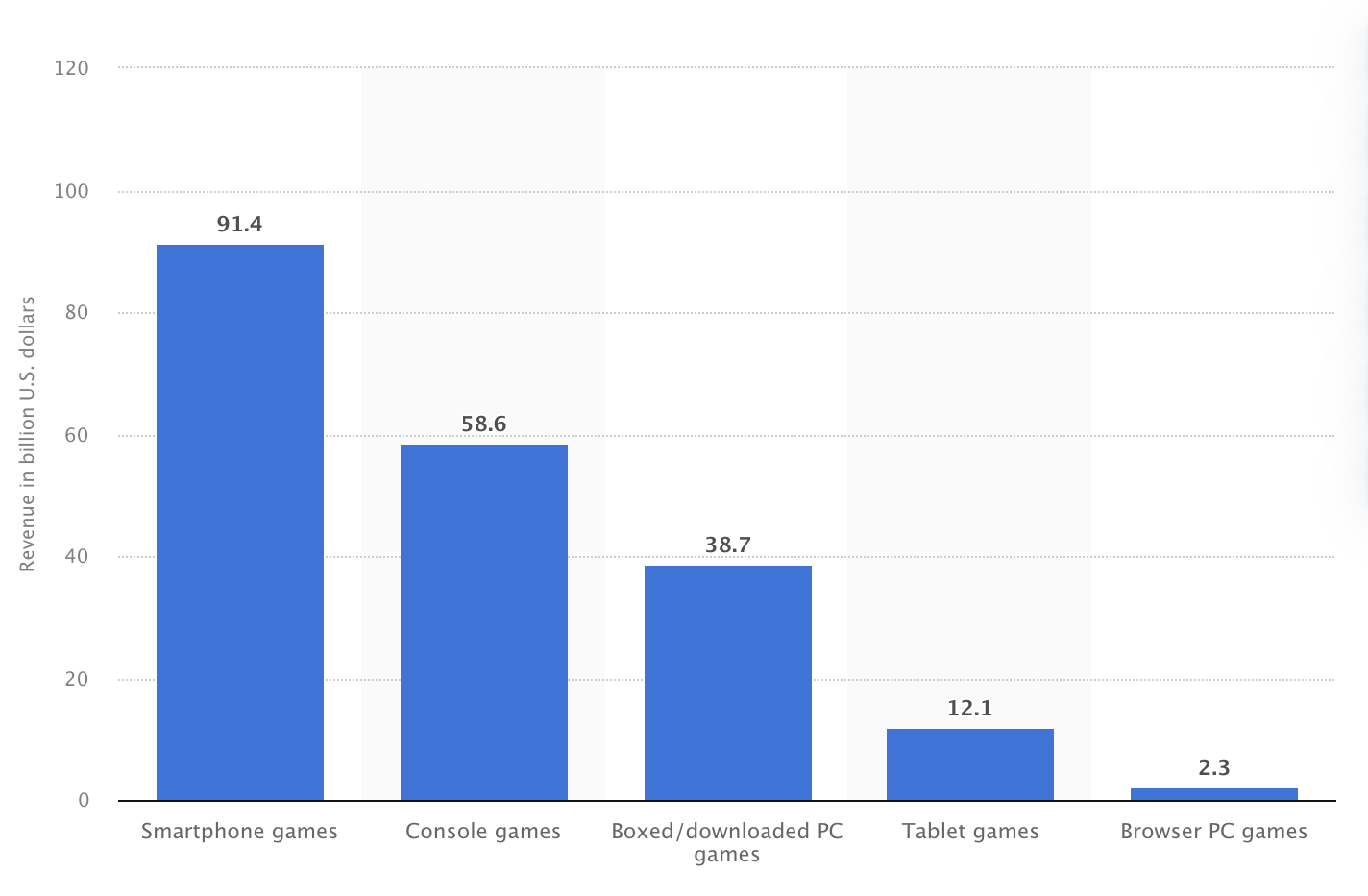

The gaming industry is dominant globally, with the largest portion of the market being in the Asia Pacific region. While organizations such as Nintendo and Sony will be discussed, this article focuses specifically on the effects and concerns of the gaming industry in the western part of the world, particularly the United States. It is also important to note how revenue is divided by types of gaming: smartphones are the most profitable globally, with console gaming placed as second, followed by PC games. This is important when considering what organizations are acquiring which studios, since the game type affects market impact.

Figure 1: Video Game Market global revenue in 2022, in billion dollars. Source: Statista.

Microsoft’s Lowly Gaming Beginnings

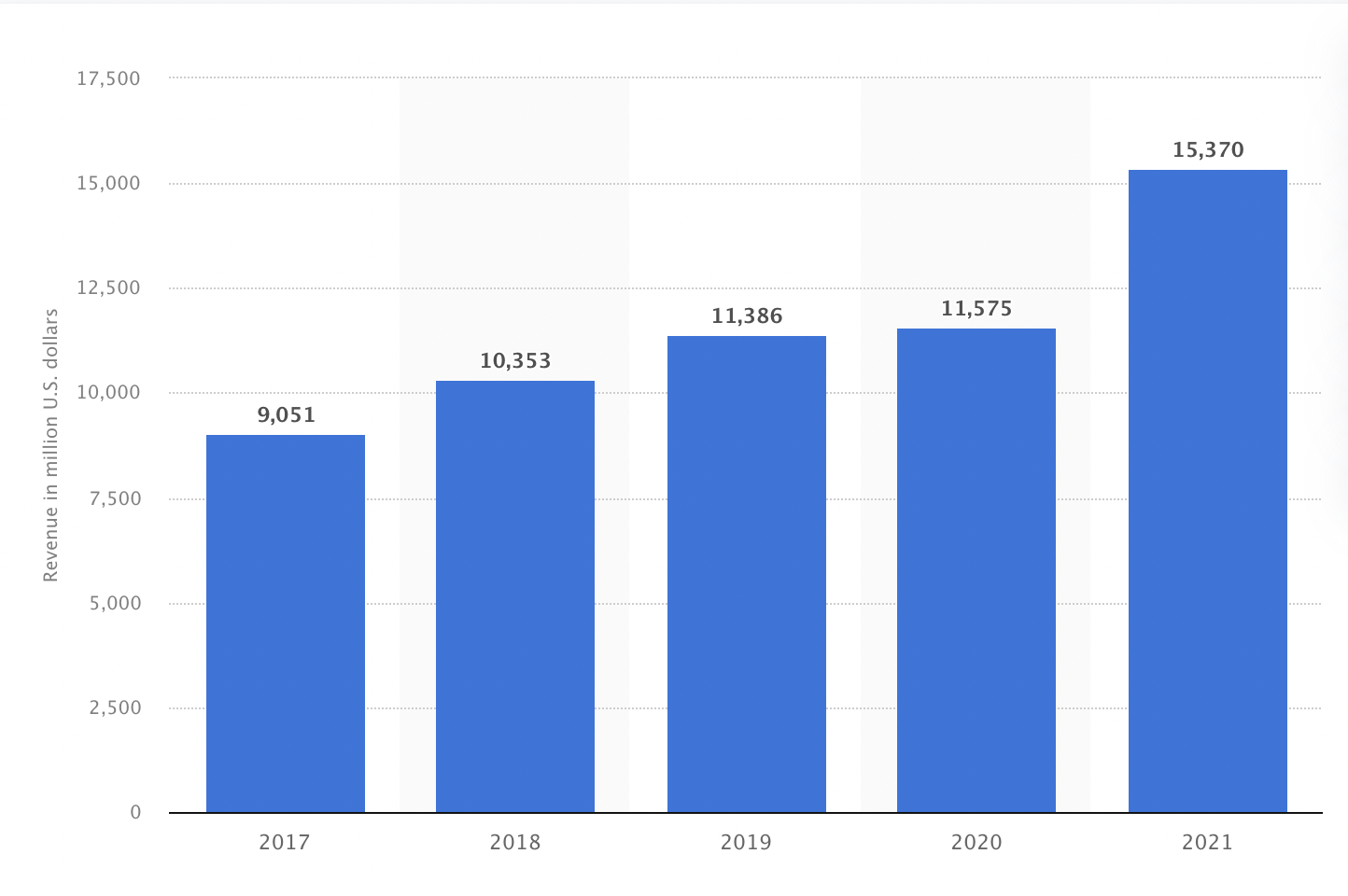

Microsoft first inserted itself into the gaming market in 2001 when it released its first gaming console, the Xbox. This initial release had a difficult start, as it was already in competition with Sony’s Playstation 2 and its lack of popularity required a $100 price drop to encourage purchases, yielding the company almost no profits. While this nasty start did not bode well for Microsoft’s full insertion into the market, the release of Xbox Live in 2002, Halo 2 from the blockbuster Halo series in 2004, and the Kinect in 2009, helped to hold its position as a name in gaming. After multiple generations of console releases with continuously less popularity than Sony’s Playstation iterations due to the requirement of internet connectivity and other similar restrictions, Microsoft began to gain a better position in the market with the release of the Xbox One in 2013, which included the release of the Game Pass (a cloud-base game rental service) and cross-platform multiplayer. After the 2020 release of the Xbox Series X and PlayStation 5 only 1 day apart, Sony took the lead in sales yet again. However, as of March 2022, consumer preferences have changed in favor of Microsoft. This trend can be seen through Microsoft’s increase of revenue from gaming, with a large increase from fiscal year 2020 to 2021. Microsoft has had difficulty in becoming a household name in the gaming industry over the past 20 years, but its recent successes and strong persistence fuels the company’s ambitious moves that nod to an industry take-over.

Figure 2: Gaming revenue generated by Microsoft from fiscal year 2017 to 2021, in million dollars. Source: Statista.

The Consolidation Race

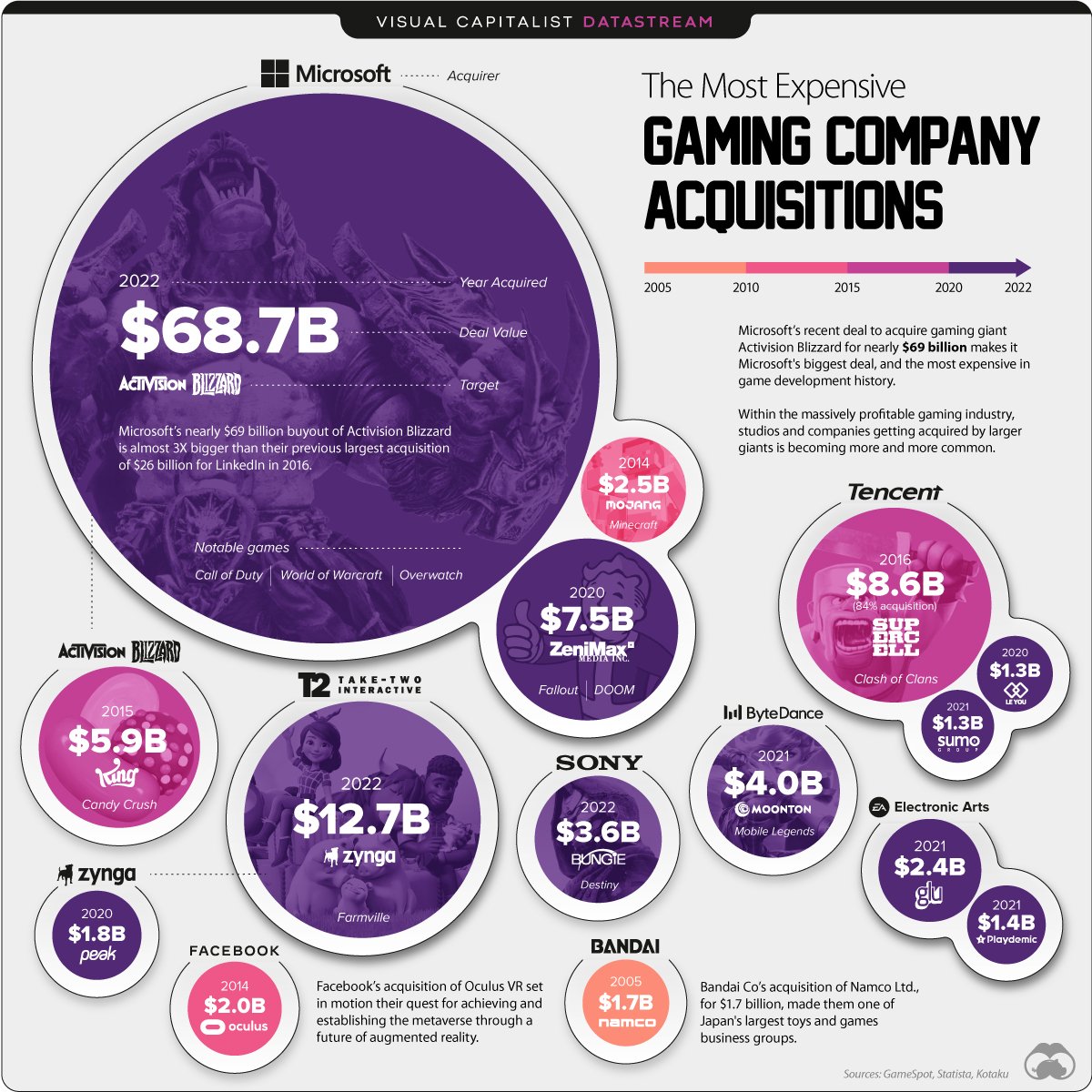

The first major acquisition that rocked the gaming world occurred in 2020 when Microsoft acquired Zenimax Media for $7.5 billion, one of the largest deals in the industry to date (2020). This acquisition was not only notable in price, but in content. Zenimax Media is the publisher of multiple iconic console franchises, including Doom, Fallout, and The Elder Scrolls, produced by Bethesda, a studio under its ownership. At this point in Microsoft’s acquisition journey, the organization now owned 23 gaming studios. However, Microsoft was far from complete with its purchasing plans. On January 18, 2022, Microsoft announced its acquisition of Activision Blizzard for a staggering $68.7 billion in an all-cash deal. Activision Blizzard is a massive gaming company that owns iconic titles, such as Candy Crush, Call of Duty, Overwatch, World of Warcraft, and many more. This announcement is alarming on multiple levels. It shows the organization’s unfathomable wealth. More importantly, Microsoft bought a company that was known for its prominence in console, PC, and mobile gaming. This deal became the catalyst for the United States Federal Trade Commission and Justice Department to release a joint statement about stricter enforcement against illegal mergers just a few hours later.

While Microsoft’s acquisition of Activision Blizzard is the largest the industry has seen, it was not the only notable – and alarming – deal publicized in January 2022. A week before, Take-Two Interactive, publisher of Grand Theft Auto, acquired the mobile gaming titan Zynga for $12.7 billion. This was the largest acquisition for the company, following three successive purchases of different studios in 2021. Later in the month, Sony acquired Bungie, creator of the Destiny games, for $3.6 billion. These acquisitions shifted the industry’s nature, generating worries of which studios will be bought next. Nintendo, which seldom buys other companies, purchased its partner of 40 years, SRD Co., in February 2022. Some speculate that Nintendo initiated the deal in order to ensure that its longtime collaborator stayed a secure resource in light of industry consolidation. Another gaming titan of note is Electronic Arts (EA). EA is the largest mobile gaming company in the industry, who made two important acquisitions in 2021, Glu and Playdemic, and plans to continue acquiring in the future. The acquisitions cost a total of $3.8 billion, placing EA’s market value at $38 billion. While this would previously show signs of being a strong, untouchable force in gaming, the price of Microsoft’s recent acquisitions shows that even EA is vulnerable to buy-outs. The infographic below shows the largest M&As in recent years, and indicates why the increasing volatile nature in the gaming market raises widespread concern of monopolistic behavior.

Figure 3: Infographic of the most expensive acquisition deals in the video game industry. Source: Visual Capitalist.

Ulterior Motives?

Each purchase in 2022 has far exceeded what the industry has experienced before. However, not only does Microsoft’s purchase stand out in value, but so does its underlying goal. Microsoft announced that this acquisition would “provide building blocks for the metaverse… and will play a key role in the development of metaverse platforms” in its initial press release. In addition to these claims, the Activision Blizzard purchase made Microsoft the third largest gaming company in revenue behind Sony, its direct competitor, and Tencent. Microsoft and Sony have been longtime competitors, especially in console sales. However, Sony’s PlayStation has always performed better than the Xbox. Not only does the scale of Microsoft’s recent activity show an attempt to best Sony in revenue, but it infers a new form of competition. In the January 2022 press release, Microsoft Gaming CEO Phil Spencer states, “Together we will build a future where people can play the games they want, virtually anywhere they want.” This directly refers to the current rivalry between the two companies: Xbox exclusives vs PlayStation exclusives. This means that there are certain games that are only available to play on a specific console based on a contract between the development studio or publisher and a console provider. Thus, this Microsoft deal indicates two industry goals. First, to become a key player in shaping its metaverse, which falls into Big Tech territory. Second, a vision to make console sales ancillary which renders the rivalry obsolete, as it puts Sony in an inferior position in the industry with an ownership of only 13 gaming studios, compared to Microsoft’s now 30 studios. These events have not only incited an attitude change in the industry, but they have created real and valid worry of a monopoly.

Sound the Monopoly Alarm

The frequency and caliber of acquisitions in gaming has garnered the attention of governments, possibly even more with Microsoft’s metaverse plans that align with Big Tech, who are already under scrutiny. In order for the Activision Blizzard deal to be finalized, it would need to be approved by 17 governments around the world. This may prove to be hard in the United States, as Lina Khan, chair of the FTC and Big Tech critic, has become more aggressive against vertical mergers, which would possibly include this deal. It could be impossible elsewhere, such as the EU, where Big Tech regulation is much stricter.

Amongst industry critics, there is an argument that recent acquisitions are not enough to curb competition. Article author Mike Fahey states after noting this action only creates vertical integration, “Microsoft buying Activision Blizzard King is a huge deal that some consider a sign of the industry’s inevitable consolidation, but it’s not hugely anti-competitive and certainly not a step toward total domination of the video game industry.” However, not only does this fail to mention how there is a clear, planned trajectory to stifle competition on multiple levels, but it fails to consider an important component of these acquisitions: data. Data, no matter in what form of discussion, is a top priority when speaking about Big Tech and potential monopoly. When these larger organizations take over smaller studios, they are essentially conducting a form of user acquisition and obtaining all recorded data of their consumers. This enables them to consolidate massive amounts of user data, cross-promote on different devices, and better retain customers. This has become more useful for studios that mostly produce mobile games, as they have had difficulty with data acquisition since the iOS 14 update (Activision Blizzard was one such studio).

Others in the industry have already flagged effects of past consolidation, citing that games feel less risky and exciting, blaming the time and money that games now take to produce, garnering unwanted feelings of similarity to Hollywood. This can be attributed to the fact that independent gaming studios that have consolidated now have less freedom to produce a product that reflects their intended vision, a classic example of monopolistic repercussions. Additionally, with large companies hinting at providing games in streaming service-style, the potential for having to pay high prices for multiple services due to exclusivity is probable.

In the United States, there is hope that the risk of monopoly will be stifled. Other than the signals sent by the same-day government press release as Microsoft’s announcement, the potential for groundbreaking legislation for Big Tech reform seems to be on the horizon. A bill named the American Innovation and Choice Online Act will soon be voted on in the Senate. If passed, it would prohibit prominent tech companies (Amazon, Apple, Meta, and Alphabet) from prioritizing their own services in their own marketplaces. This would be the strictest legislation enacted on Big Tech in the United States. While this particular law has no direct effect on Microsoft’s actions in the gaming industry, it presents a case of success for antitrust crack-down in tech, which is a parallel sector to gaming. Additionally, Microsoft’s connection to Big Tech has been primarily as a computer hardware and software company. With its recent public plans to liaise between gaming and the Big Tech buzz around the Metaverse, it is now a prominent target for antitrust scrutiny.

For the Sanctity of Gaming

Due to the expanding value of the video gaming industry at over $300 billion, mergers and acquisitions seemed an obvious destiny bound for the trials and tribulations of antitrust litigation. Microsoft has successfully inserted itself into the gaming industry, incited the largest wave of consolidation that it has ever seen, and merged its dominant position in the sector with its Big Tech-skewed Metaverse goals. While governments are more strongly voicing concerns of monopoly following these decisions, it is important to stay current with the industry’s position and relation to Big Tech. Not only is gaming a massive sector of entertainment, but monopolies stifle creativity and innovation – an effect already experienced in video game releases over the past few years. Additionally, consolidation includes the integration of consumer data, which is already a red flag in the tech sphere. Therefore, keeping monopolies out of gaming will ensure that the companies in the industry can create products that are unstifled and stand true to their genuine artistic vision, keep some form of consumer data disaggregation, and slow the meddling of Big Tech in the largest sector of entertainment.

+ Resources

Byers, Justin. “Sony Acquires Another Gaming Studio.” Front Office Sports. March 22, 2022, https://frontofficesports.com/sony-continues-to-add-to-gaming-acquisitions/.

Carpenter, Nicole. “Microsoft, Sony acquisitions are just the start of massive video game industry consolidation.” Polygon. Vox Media, LLC. February 2, 2022, https://www.polygon.com/22914859/microsoft-activision-blizzard-sony-acquisitions-consolidation-2022.

Chan, Anson. “Call of Dystopia: Microsoft's Activision Blizzard Acquisition and the Worry of a Monopoly.” TechRaptor. TechRaptor, LLC. January 24, 2022, https://techraptor.net/gaming/opinions/call-of-dystopia-microsoft-activision-blizzard-acquisition.

Clement, J. “Gaming revenue generated by Microsoft from fiscal 2017 to 2021.” Statista. February 25, 2022, https://www.statista.com/statistics/963263/microsoft-annual-gaming-revenue/.

Clement, J. “Largest video game industry acquisitions worldwide as of January 2022, by deal value.” Statista. May 2022, https://www.statista.com/statistics/1248063/biggest-video-game-industry-acquisitions/#:~:text=Up%20until%20January%202022%2C%20Tencent%27s,mobile%20title%20Clash%20of%20Clans.

Clement, J. “Video game market revenue worldwide in 2022, by segment.” Statista. June 13, 2022, https://www.statista.com/statistics/292751/mobile-gaming-revenue-worldwide-device/.

Colantonio, Giovanni. “”2021’s biggest games were too Hollywood for their own good.” DigitalTrends. Digital Trends Media Group. December 13, 2021, https://www.digitaltrends.com/gaming/2021-hollywood-games/.

Crunchbase. Gaming Acquisitions in the past year. (2022), Distributed by Crunchbase, Inc, https://www.crunchbase.com/lists/gaming-acquisitions-in-the-past-year/9e210423-e267-4ee1-9e92-31e911f87c1c/acquisitions.

D’Angelo, William. “PS5 vs Xbox Series X|S Sales Comparison - March 2022 - Sales.” VGChartz. VGChartz, Ltd. April 17, 2022, https://www.vgchartz.com/article/453293/ps5-vs-xbox-series-xs-sales-comparison-march-2022/.

Deshmukh, Anshool. “Visualizing the Biggest Gaming Company Acquisitions of All-Time.” Visual Capitalist. February 3, 2022, https://www.visualcapitalist.com/visualizing-the-biggest-gaming-company-acquisitions-of-all-time/.

EA will 'keep looking at' new acquisitions going forward” TweakTown. Tweak Town Pty Ltd. February 1, 2022, https://www.tweaktown.com/news/84355/ea-will-keep-looking-at-new-acquisitions-going-forward/index.html.

Electronic Arts. “Electronic Arts Completes Acquisition of Mobile Game Creator Playdemic from AT&T.” Electronic Arts press release, September 20, 2021. Company News. https://ir.ea.com/press-releases/press-release-details/2021/Electronic-Arts-Completes-Acquisition-of-Mobile-Game-Creator-Playdemic-from-ATT/default.aspx.

Fahey, Mike. “Microsoft’s Activision Blizzard Purchase Isn’t Great, But Isn’t An Illegal Monopoly Either.” Kotaku. G/O Media, Inc. January 19, 2022, https://kotaku.com/microsoft-s-activision-blizzard-purchase-isn-t-great-b-1848386247.

Federal Trade Commission. “Federal Trade Commission and Justice Department Seek to Strengthen Enforcement Against Illegal Mergers.” Federal Trade Commission press release, January 18, 2022. Office of Public Affairs. https://www.ftc.gov/news-events/news/press-releases/2022/01/federal-trade-commission-justice-department-seek-strengthen-enforcement-against-illegal-mergers.

Fortune Business Insights. Gaming Market Size, Share & Covid-19 Impact Analysis, By Game Type (Shooter, Action, Sports, Role Playing and Others), by Device Type (PC/MMO, Tablet, Mobile Phone, and TV/Console) By End User (Male and Female), and Regional Forecast, 2021-2028. India: Fortune Business Insights, August 2021, https://www.fortunebusinessinsights.com/gaming-market-105730.

Gilliam, Ryan. “Nintendo doesn’t see acquiring other game studios as ‘a plus’.” Polygon. Vox Media, LLC. February 3, 2022, https://www.polygon.com/22916059/nintendo-acquisition-plans-sony-microsoft-activision-blizzard-bungie.

Grand View Research. Video Game Market Size, Share & Trends Analysis Report By Device (Console, Mobile, Computer), By Type (Online, Offline), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts, 2022 - 2030. San Francisco, California: Grand View Research, 2022, https://www.grandviewresearch.com/industry-analysis/video-game-market.

Gurwin, Gabe. “The history of the Xbox.” DigitalTrends. Digital Trends Media Group. March 16, 2021, https://www.digitaltrends.com/gaming/the-history-of-the-xbox/.

January 19, 2022, https://www.theverge.com/22889435/microsoft-activision-blizzard-game-pass-cloud-gaming-monopoly-ftc-questions.

Kang, Cecilia and David McCabe. “Microsoft starts a charm offensive to push through its Activision deal.” The New York Times. The New York Times Company. February 9, 2022, https://www.nytimes.com/2022/02/09/technology/microsoft-activision.html?searchResultPosition=2.

Kratky, Otto. “Will Activision Blizzard games be Xbox exclusive? Look at history.” DigitalTrends. Digital Trends Media Group. January 18, 2022, https://www.digitaltrends.com/gaming/call-of-duty-xbox-exclusive/.

LeBlanc, Wesley. “Nintendo Acquires SRD, A Development Studio It Has Worked With For Decades.” GameInformer. February 24, 2022, https://www.gameinformer.com/2022/02/24/nintendo-acquires-srd-a-development-studio-it-has-worked-with-for-decades.

LeBlanc, Wesley. “Take-Two Acquires Zynga For Nearly $13 Billion.” GameInformer. January 10, 2022, https://www.gameinformer.com/2022/01/10/take-two-acquires-zynga-for-nearly-13-billion.

Lennox, Jesse. “Microsoft’s Activision Blizzard purchase is a disaster for gaming.” DigitalTrends. Digital Trends Media Group. January 18, 2022, https://www.digitaltrends.com/gaming/microsoft-activison-blizzard-monopoly/.

Liang, Lu-hai. “Nintendo Acquires Co-Developer Of Its Biggest First-Party Games, SRD Co.” The Gamer. Thegamer.com. February 24, 2022, https://www.thegamer.com/nintendo-acquires-srd-co-developer-biggest-first-party-games/.

Matney, Lucas. “Nintendo buys Canadian game studio in rare acquisition.” TechCrunch. Yahoo. January 5, 2021, https://techcrunch.com/2021/01/05/nintendo-buys-canadian-game-studio-in-rare-acquisition/.

McWhertor, Michael. “GTA publisher Take-Two acquiring mobile games giant Zynga in $12.7B deal.” Polygon. Vox Media, LLC. January 10, 2022, https://www.polygon.com/22876218/take-two-zynga-acquisition-deal-price.

McWhertor, Michael. “Sony acquiring Bungie, creators of Destiny, in $3.6B deal.” Polygon. Vox Media, LLC. January 31, 2022, https://www.polygon.com/22910849/sony-buys-bungie-destiny-2-multiplatform-playstation.

Metz, Cade. “Sony to buy game maker Bungie in $3.6 billion deal.” The New York Times. The New York Times Company. January 31, 2022, https://www.nytimes.com/2022/01/31/business/sony-bungie-destiny-halo.html?searchResultPosition=3.

Microsoft. “Microsoft to acquire Activision Blizzard to bring the joy and community of gaming to everyone, across every device.” Microsoft press release, January 18, 2022. Microsoft News Center. https://news.microsoft.com/2022/01/18/microsoft-to-acquire-activision-blizzard-to-bring-the-joy-and-community-of-gaming-to-everyone-across-every-device/.

Mordor Intelligence. GAMING MARKET - GROWTH, TRENDS, COVID-19 IMPACT, AND FORECASTS (2022-2027). India: Mordor Intelligence, 2021. https://www.mordorintelligence.com/industry-reports/global-gaming-market#.

Mukherjee, Srishti. “Will Electronic Arts be acquired?” AIM. Analytics India Magazine Pvt Ltd. February 8, 2022, https://analyticsindiamag.com/will-electronic-arts-be-acquired/.

Murphey, Brian and Einav Mar-Samuels. “The great merger – acceleration in Gaming M&A is changing the face of the industry.” AppsFlyer. AppsFlyer, Ltd. October 7, 2021, https://www.appsflyer.com/blog/trends-insights/gaming-mergers-acquisitions/.

O’Brien, Matt. “Microsoft buys game maker Activision Blizzard for about $70B.” AP. The Associated Press. January 18, 2022, https://apnews.com/article/microsoft-activision-blizzard-acquisition-call-of-duty-7a9e2bcc8f0b7b9049e4f93fe3e0a4dd.

Robertson, Ali. “Is Microsoft building a gaming monopoly?” The Verge. Vox Media, LLC. Sharma, Rakesh. “How Sony's (SNY) Bungie Acquisition Affects Microsoft's (MSFT) Gaming Ambitions.” Investopedia. Dotdash Meredith. February 2, 2022, https://www.investopedia.com/how-sony-bungie-acquisition-affects-microsoft-gaming-5217881.

Simelane, Smangaliso. “All the Studios PlayStation Has Acquired in 2021.” GameRant. Gamerant.com. December 13, 2021, https://gamerant.com/playstation-all-studio-acquisitions-2021/.

Strickland, Derek. “Take-Two acquisition spree is 'just getting started,' exec says.” TweakTown. Tweak Town Pty Ltd. July 3, 2021, https://www.tweaktown.com/news/80370/take-two-acquisition-spree-is-just-getting-started-exec-says/index.html.

Sweney, Mark. “Microsoft takeover of Call of Duty maker wipes $20bn off Sony shares.” The Guardian. Guardian News & Media Limited. January 19, 2022, https://www.theguardian.com/technology/2022/jan/19/microsoft-takeover-call-of-duty-games-firm-wipes-20bn-off-sony-shares-playstation-activision-blizzard-games.

Tassi, Paul. “Xbox And PlayStation's Acquisition Battle Has Taken A Strange Turn.” Forbes. Forbes Media, LLC. February 11, 2022. https://www.forbes.com/sites/paultassi/2022/02/11/xbox-and-playstations-acquisition-battle-has-taken-a-strange-turn/?sh=2f6beca82b84.

Tolbert, Sam. “Biggest video game acquisitions: From Activision Blizzard to Oculus.” Windows Central. Future US, Inc. February 7, 2022, https://www.windowscentral.com/list-biggest-video-game-acquisitions.

Tracxn. “Acquisitions by Electronic Arts.” Tracxn. Trcxn Technologies Private Limited. April 24, 2022, https://tracxn.com/d/acquisitions/acquisitionsbyElectronic-Arts.

Warren, Tom. “Microsoft completes Bethesda acquisition, promises some Xbox and PC exclusives.” The Verge. Voz Media, LLC. March 9, 2021, https://www.theverge.com/2021/3/9/22319124/microsoft-bethesda-acquisition-complete-finalized.

Weise, Karen. “Microsoft’s profit continue to climb.” The New York Times. The New York Times Company. January 25, 2022, https://www.nytimes.com/2022/01/25/technology/microsoft-earnings-q2-2022.html?searchResultPosition=4.

WePC. “Video Game Industry Statistics, Trends and Data In 2022.” WePC. January 18, 2022, https://www.wepc.com/news/video-game-statistics/.

Wikipedia. “List of acquisitions by Electronic Arts.” Wikipedia. Wikimedia Foundation, Inc. Accessed July 18, 2022, https://en.wikipedia.org/wiki/List_of_acquisitions_by_Electronic_Arts.

Wikipedia. “List of acquisitions by Take-Two Interactive.” Wikipedia. Wikimedia Foundation, Inc. Accessed July 18, 2022, https://en.wikipedia.org/wiki/List_of_acquisitions_by_Take-Two_Interactive.

Wikipedia. “Xbox (console).” Wikipedia. Wikimedia, Foundation, Inc. Accessed July 18, 2022, https://en.wikipedia.org/wiki/Xbox_(console).

Wikipedia. “Xbox Cloud Gaming.” Wikipedia. Wikimedia, Foundation, Inc. Accessed July 18, 2022, https://en.wikipedia.org/wiki/Xbox_Cloud_Gaming.

Wise, Jason. “HOW MUCH IS THE GAMING INDUSTRY WORTH IN 2022? (REVENUE & STATS)” EarthWeb. Earthweb.com. July 6, 2022, https://earthweb.com/how-much-is-the-gaming-industry-worth/#:~:text=7.1.