This is part one of a two-part series focusing on emerging trends in documentary program distribution. Read part one here.

Introduction

Documentary content has long been a staple of culture and entertainment in the United States, but emerging technologies are changing the way this programming is consumed. This includes the content distribution mechanisms, including broadcast, cable, premium cable, advertisement-supported video-on-demand (AVOD) and subscription-based video-on-demand (SVOD). Emerging Trends in Documentary Program Distribution focuses on understanding the current market for documentary programs and the current best practices to sell, distribute, and market documentary content. This research article is presented in two parts. The first lays out an overview of the documentary market and then moves into an analysis of how the consumption of video content has changed due to emerging technologies.

Part two of this research analyzes data and information collected through an audience survey and one-on-one interviews. This original research will be used in connection with the broader contextual research to provide recommendations for documentary filmmakers on the best paths for taking their work to the market.

Data Analysis and Survey Results

Among the data collection methods adopted to research this topic, the survey was arguably one of the most important sources of information about the documentary distribution landscape. Documentaries have become popular in the last decade largely due to their presence on SVOD platforms. As stated in the first article, SVOD platforms do not share viewership metrics with the public because they consider the information to be proprietary. The survey was therefore vital for gathering that data. The primary focus of the survey was to understand the documentary viewing habits of general audiences, going beyond content and viewing platform preferences. The survey included questions to determine:

Viewing habits of the general audience

Sources for recommendations

Genre, platform, and documentary format preferences

Podcast listening habits

Thoughts from people who don’t watch documentaries

The points above help inform an understanding of various aspects of the production, distribution, and marketing process. In particular, viewing habits and format preferences help determine whether a documentary should be feature-length or episodic. Sources for recommendations directly relate to identifying the optimal ways to reach and inform the target audience. Podcasts may represent an additional source of revenue in the long tail.

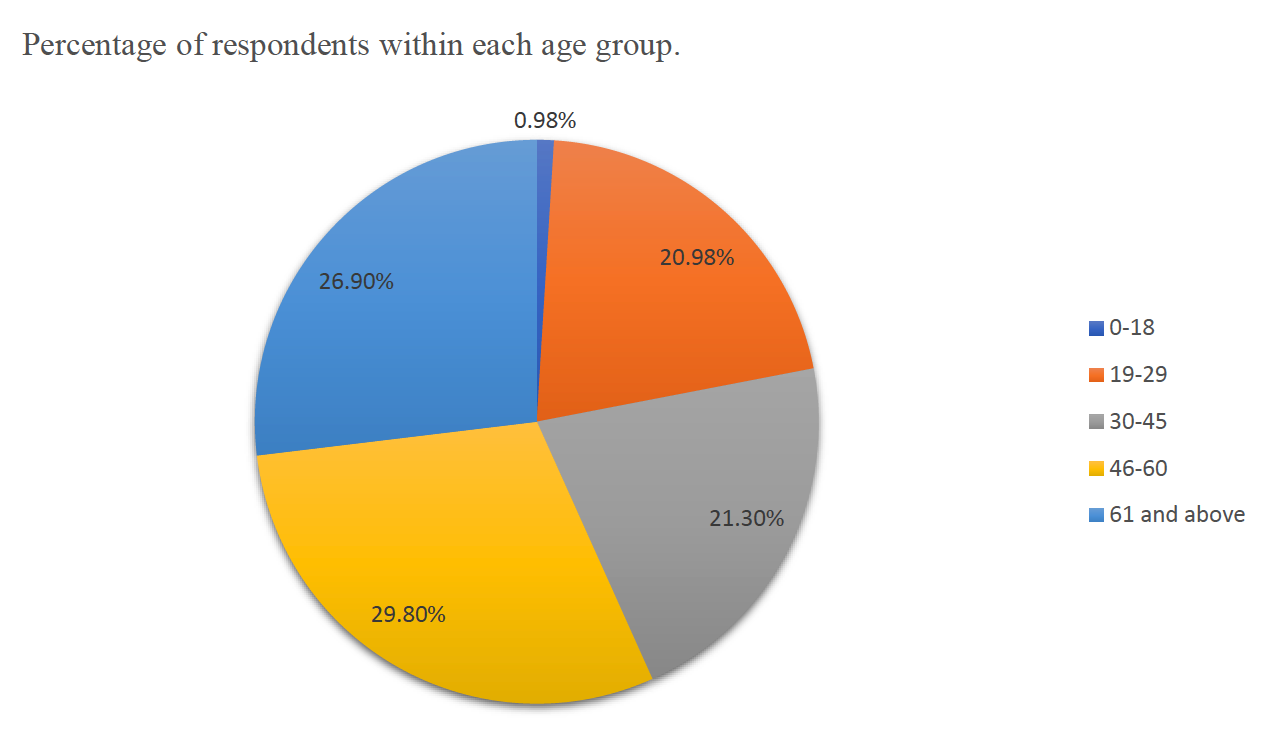

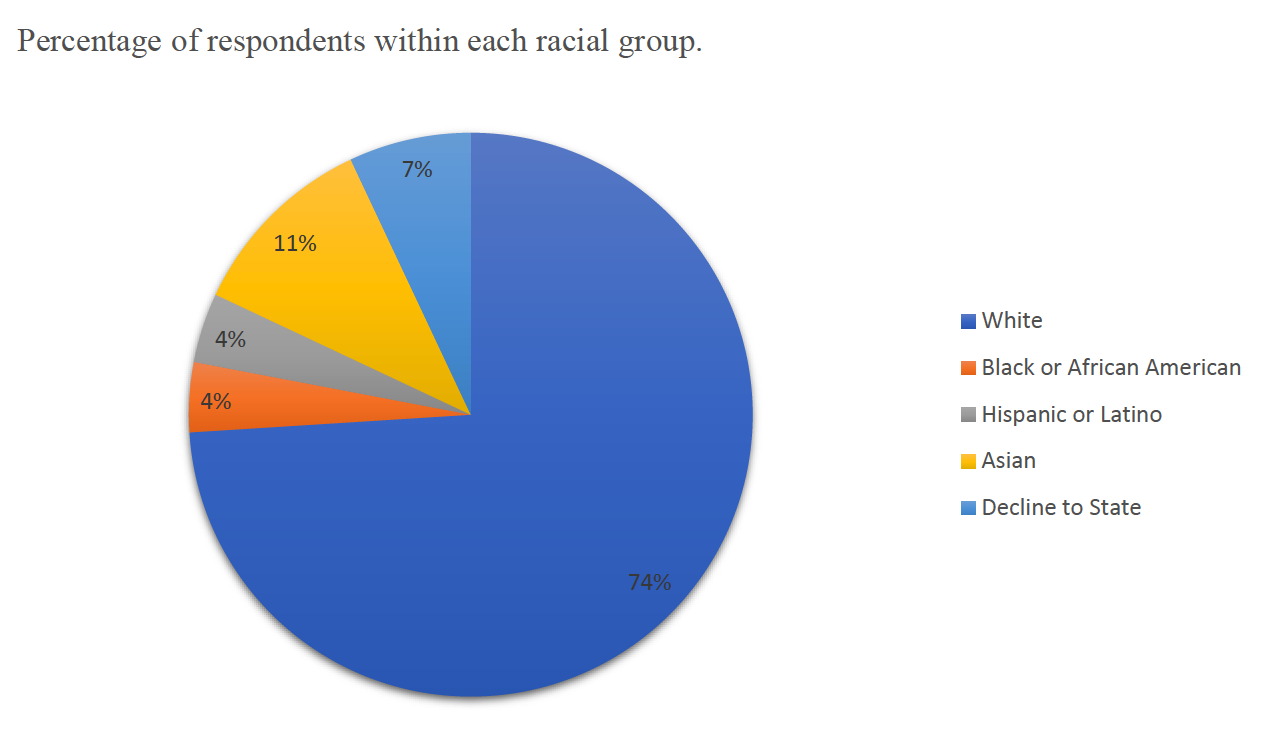

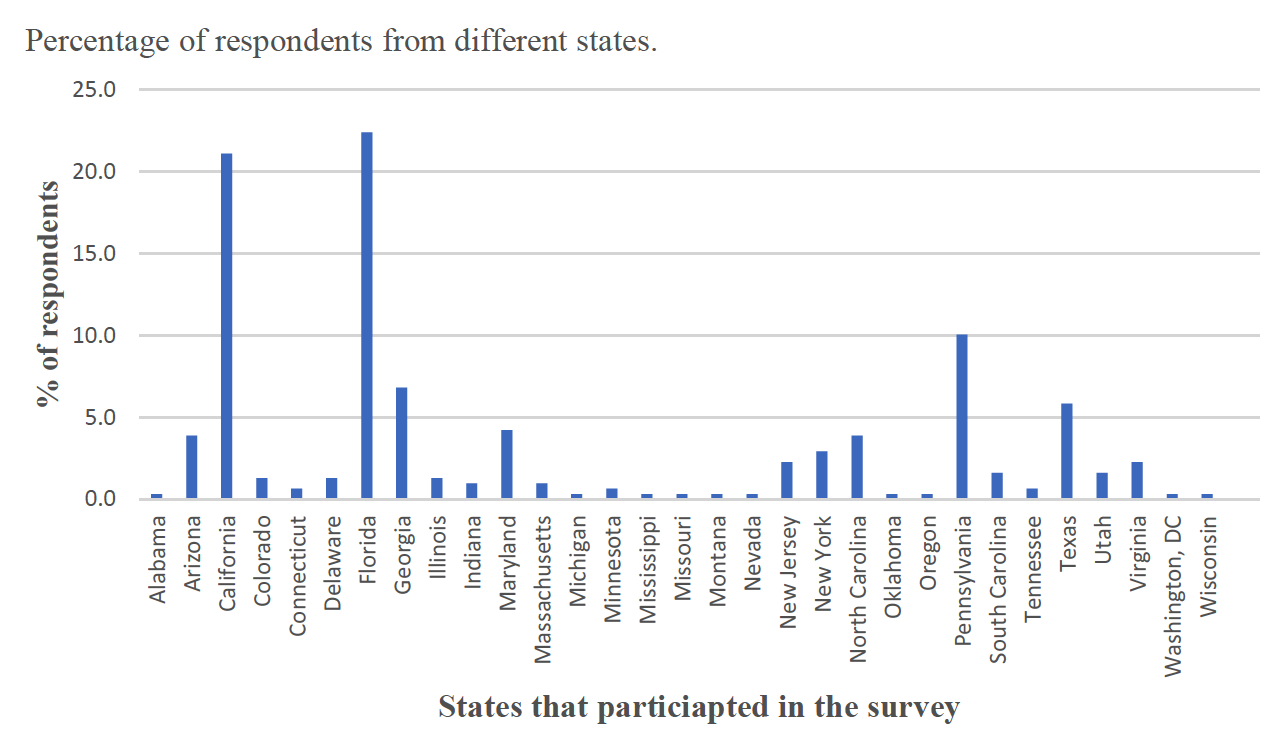

The survey was designed to get a sample with a healthy demographic representation among our survey respondents. Our survey had a total of 305 respondents out of which 95.7% reported that they enjoy documentary programming. Sixty-five percent of our respondents were female, with racial representation largely skewing Caucasian. The charts below provide further information about the sample’s demographics.

The survey results were strongly positive towards documentaries, with at least 70% of the population watching documentaries a few times a month and 25.4% watching them at least once a week. This frequency of documentary viewership is very similar across all age groups, as seen below in Figure 4. The 30-45 age group is watching documentaries more often than others, but only by a very small margin.

Figure 4. Source: Authors.

The fact that such a big portion of the population is regularly watching documentaries may also have to do with their increased availability on streaming platforms. Netflix alone spent an estimated $350 million on unscripted documentaries in 2019. Therefore, it is no surprise that 65% of the respondents watch documentaries on SVOD platforms. Over-the-top (OTT) platforms and broadcast television have the least viewership with less than 5% between them (as seen below).

Figure 5. Source: Authors.

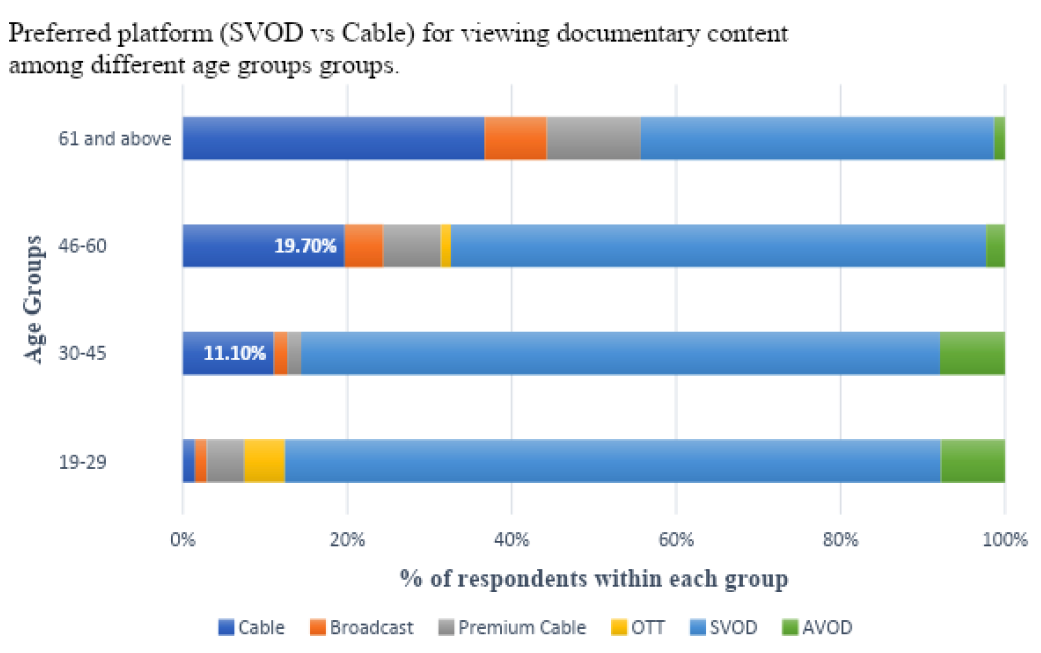

By analyzing by age group (as seen in Figure 6), some consumption patterns emerge. Seventy-eight percent of 19 to 45-year-olds are consuming documentary content on SVOD platforms. Unsurprisingly, cable garners interest from older demographics. On the other hand, the younger generation is leaning towards OTT services.

Figure 6. Source: Authors.

Another statistic that points to the popularity of SVOD platforms is respondents’ preference for episodic docuseries (as seen in Figure 7). While feature-length documentaries aren’t too far behind, SVOD platforms provide the option for consumers to enjoy content that is spread out over six to ten episodes. The respondents favor it with 53.40% enjoying episodic docuseries over feature-length documentaries.

Figure 7. Source: Authors.

Age makes a difference in the exact nature of content that respondents enjoy. In response to the question about favorite documentary genres, our respondents’ top five picks were historical (23.3%), true crime (18.5%), cultural/societal (12.7%), biographical (12%), and music (8.2%). While historical documentaries received the greatest percentage, when asked to name their favorite documentary in recent times, seven out of eleven names selected most often were in the true crime genre (as seen below in Figure 8). When analyzed by age group, interests vary by age (as seen in Figure 9).

Figure 8. Source: Authors.

Figure 9. Source: Authors.

The younger respondents had a strong preference for true crime documentaries and very little interest in music, biographical, or historical subjects. The opposite was true for older respondents who seem to enjoy historical, biographical, and music the most. This can be helpful for producers to understand who their potential target audience is depending on the genre that a particular documentary falls into.

The survey also asked respondents to choose which music genre they preferred to see covered in a music documentary. The data followed the same trend as before with clear preferences differing by age. Once again, younger respondents were more interested in a very different set of music genres (including hip-hop/rap, rock, and pop) compared to older respondents who were interested in rock, blues, and classical (as seen below in Figure 10).

Figure 10. Source: Authors.

Insight From Industry Interviews

In addition to collecting and analyzing data from a survey, key interviews from industry professionals offered perspectives from within the distribution system. Our interviewees were professionals with expertise in music licensing, sales and distribution, music production, film acquisition, media journalism, and talent management. The immediate goal of these industry interviews was to collect information from industry professionals to complement information from the survey with the overarching goal of distilling this information into clear and concise strategic recommendations.

Interviews highlighted that typical deals with buyers are based on a full “buy out” of the content they purchase. In other words, such buyers prefer to buy content upfront and own it in perpetuity across all media. This model eliminates opportunities for producers who agree to these kind of terms and forego future ancillary revenue streams.

To sell to key buyers, content producers need to leverage specific elements including star power, strategic production partnerships, and enhanced promotional potential. According to our interview subjects, highly visible purchases of documentary content, such as the previously cited $20 million-and-up purchases of documentaries about Taylor Swift and Billie Eilish, may indicate an optimistic market for music documentaries. However, the reality is that the market is more depressed than it appears, and sellers’ offerings must represent a clear win for buyers to buy. One interviewee added that producers shouldn’t worry about making an offering that appeals to all potential buyers because there is no such thing as “one size fits all” in the documentary space

Other recommendations included bringing in a producer with a recognized name and experience in music documentaries to have more clout as a “package'' when approaching buyers. Interviewees also suggested finding opportunities in the documentary format to feature popular artists with star power to reach younger audiences. Additionally, SVOD buyers, like Netflix and Amazon Prime Video, are looking to buy content with enough star power to help drive subscriptions, so producers must be mindful of this core element when attempting to sell to these buyers.

Interviewees also recommended that independent filmmakers make their projects as intrinsically marketable as possible and to be prepared to do much of the marketing work themselves. Given that distributors in the current marketplace tend to focus their marketing budgets and efforts on their “tentpole” projects, the more that independent filmmakers can be prepared to market their product to potential distributors and audiences alike, the better. In opposition to the marketplace, one interviewee recommended that documentary film producers keep their rights and avoid selling them off. He reiterated previous comments from interviewees on the likelihood that most SVOD buyers will seek to buy out a documentary for all rights and all media worldwide in perpetuity. Additionally, it is prudent that all documentary content producers strive to use as much original footage as possible since licensing footage can be expensive. In their experience, it can cost up to $7,500 to license just one minute of high-quality footage.

Distribution Recommendations

Based on survey results, SVOD is the preferred format among documentary watchers. Within SVODs, YouTube Premium, Amazon, and Apple represent key distributors to target. Each of these has existing distribution platforms for music in the form of YouTube Music, Apple Music, and Amazon Music. This kind of outlet allows filmmakers to leverage a documentary soundtrack as a potentially compelling sales component.

However, SVODs such as Netflix and Amazon base their buying decisions on content that can add new subscribers or retain existing ones. In addition, SVODs are trying to target younger audiences. As seen in the survey results, younger audiences have very different interests from older audiences, especially concerning taste. Therefore, it is important to recognize who the target audience is before identifying which platform will be the best home for any documentary.

SVODs have the largest audience base, among both younger and older audiences. To sell to an SVOD, however, the documentary will need content that is targeted primarily to serve younger audiences as that is the current market focus.

On the other hand, if a prospective target demographic is older, then both SVOD and cable are viable distribution options for the documentary series. Licensing to cable also has the advantage of producers retaining ancillary rights to the documentary, including in foreign markets like Japan, Germany, the United Kingdom, and Scandinavian countries. In contrast, SVODs want to buy rights for worldwide usage, in perpetuity. Their global presence does allow a larger audience to view the documentary, but giving away the rights can also have implications for future revenue.

Production Recommendations

The top five documentary genres are historical (23.5%), true crime (18.4%), cultural/societal (11.9%), biographical (11.9%), and music (8.3%). However, this is not the consensus as these interests are split between different age groups. As can be seen from Figure 9, younger audiences are interested in true crime and cultural/societal sub-genres. On the other hand, older audiences are interested in historical and biographical subjects. The best way to engage these audiences is to find the “sweet spot” at the intersection of these topics. It would make the documentary more marketable, and as a result, more valuable to distributors. Examples of such documentaries include “Conversations With A Killer: The Ted Bundy Tapes” (2019), “Tiger King” (2020), “Unsolved” (2018), and “LA 92” (2017).

Figure 10. Aspects of documentary production that interest respondents. Source: Authors.

Survey respondents also indicated that they enjoy historical footage and informational interviews in documentaries. The interest in these aspects of documentaries is shared among all age groups as well. Producers must ensure these are essential elements of their production.

Survey results also revealed that the episodic documentary format is the most popular with 53.40% of our respondents favoring the format above all others. Throughout our research, we have noticed trends in episode numbers among SVOD-distributed docuseries and limited docuseries. Traditional, multi-season docuseries typically consist of six to ten episodes per series, with notable examples including “Making A Murderer” (2015–present), “Last Chance U” (2016–present), and “Chef’s Table” (2015–present). Limited docuseries such as “Wild, Wild Country” (2018), “Flint Town” (2018), and “Wormwood” (2017) are typically made up of six to eight episodes total. Thus, a limited series documentary with six to eight episodes would be the ideal format for audiences.

Finally, we recommend that producers explore the possibility of partnering with another producer or production entity. Many acquisition decisions are based on relationships between the decision-making entities on both sides. Working with a producer who has a track record of working with certain networks or streaming services can be vital in ultimately selling the docuseries. Examples of notable production companies with a proven track record in documentary filmmaking include Higher Ground Productions, Imagine Docs, and Participant Media. The producers can also add value by leveraging their relationships with distributors to develop a better understanding of how the docuseries can be made more valuable for them. Alternatively, partnering with a major figure in the music industry can be just as helpful for acquiring music rights and attaching contemporary music artists to the project.

Conclusion

The information provided by these survey results and interviews should be helpful for documentary filmmakers and producers deciding how to create and distribute their content. Based on research into various distribution platforms from part one and insights from surveys and industry professionals, important considerations include the documentary’s target audience, content focus, and format. While the documentary landscape is changing, their popularity remains clear as SVOD platforms, in particular, continue to invest in them and people of all age groups watch them.

About the Authors

This analysis was part of a capstone project by Carnegie Mellon Master of Entertainment Industry Management students Sasly Ma, Mariel Nardi, Mohammed Mandraswala, and Manuel Vallarino.

Resources

Hamilton, P. (n.d.). Netflix 2020: What You Need To Know Now. New York, NY: Peter Hamilton Consultants. Retrieved from documentarybusiness.com.

Kaufman, A. (2017, April 18). Documentary Sales Are Surging, But What's Driving the Competition? Retrieved from https://www.indiewire.com/2017/04/documentaries-sales- netflix-amazon-hulu-bubble-1201806552/.