After explaining the concept of network theory previously, this article will look at strategies used by online media companies and their effectiveness at leveraging network theory. This article will look at three companies, an established ‘big fish’ company, a late entrant to the market, and a ‘blue ocean’ company. Blue Ocean refers to the idea that a new marketplace with untapped potential can exist between two common marketplaces and one can create their own supply and demand. The companies this article will look at are; Twitch.tv, Mixer.tv, and Voxpop Games.

Twitch and Mixer are both streaming platforms where users generate content and consume it. Voxpop Games is a studio that seeks to connect indie developers with indie streamers to help generate sales through peer to peer interactions. While many arts non profit managers may be asking themselves how video game streaming companies apply to the field of non profit arts, video games and streaming platforms are excellent examples of arts and technology coming together to create an unique experience. If more context on Twitch.tv or streaming is needed, please read this article first.

Twitch is an online streaming platform that began to increase in popularity in 2013. Today it is the 4th most visited website in the United States and raised over $75 million for 100 Different charities in 2019. Recently, Twitch has been highlighted as a premiere location for raising significant funds from dedicated fans who are moved by a cause. With a 72.2% market share, Twitch is dominating the live streaming marketplace, with its next closest competitor being youtube gaming at 19.5%.

3 Case Studies

Case Study 1: Twitch

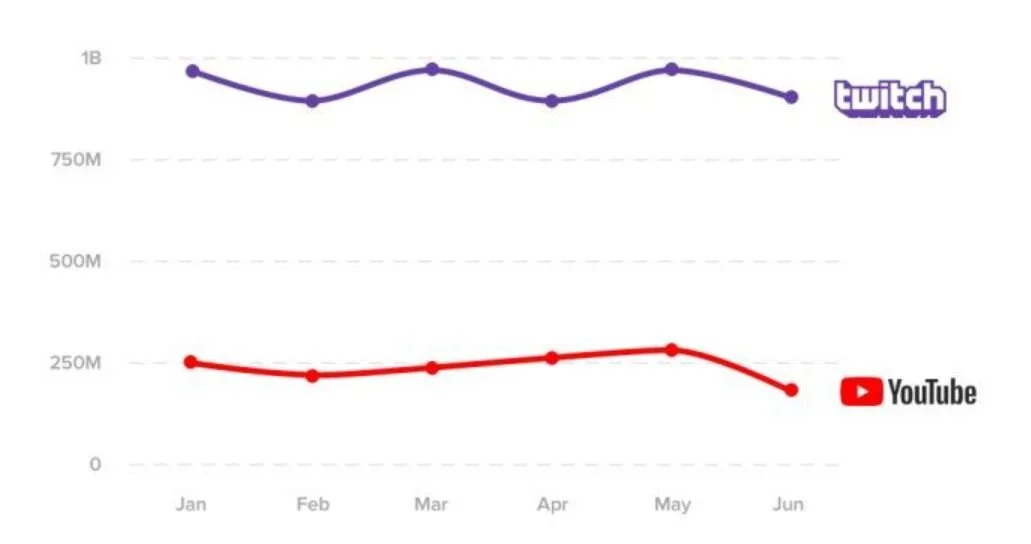

Figure 1: Total live streaming hours watched by streaming platform for the year 2019. Source: Graphic created by streamelements and reported by Techcrunch.

How did Twitch manage to capture such a large portion of the market? How can non profit art organizations achieve similar success rates for their digital programs?

To answer these questions, one needs to understand how Twitch distributes content and incentivizes users to stay on their platform.

At its core, Twitch is an online social media community platform. Users come to the platform to watch streamers play games, but stay because of the social interactions between streamer and viewer as well as viewer to viewer interactions.

Figure 2: Total live streaming hours watched by streaming platform per month in the year 2019. Source: Graphic created by streamelements and reported by Techcrunch.

Twitch includes a number of gamified elements in their user interface that further engagement and retention on the platform, including; Follow/Subscriber Alerts, Donation Alerts, Host/Raid Alerts, mini games, API overlays, and community specific emotes. In its earliest form, Twitch simply had donation/sub/follower alerts and the steady development and implementation of additional gamified elements helped increase retention rate on the platform over time

Figure 3: Average number of concurrent viewers for the twitch platform by year. Source: Business of Apps.

In 2019 Twitch seems to have achieved stability in its concurrent user base, capping at 1.44 million viewers per month. In the previous graph showing the number of hours watched, one can observe a sin wave like structure where the number of hours seems to fluctuate between 800,000,000 and 1 billion hours. While its unclear what this graph means for the platform, it could signify that Twitch has reached a type of market homeostasis where it will be difficult to grow past the 1-billion-hour milestone. While it will be difficult for Twitch to break the 1 billion hour ceiling, Their UXD team should be able to push Twitch past their most recent milestone, by continuing their strategy of creating new gamified elements that incentivize users to interact on their platform.

So what can arts nonprofit managers learn from Twitch.tv’s success in the online streaming marketplace? Arts nonprofit managers should be aware of several concepts before implements or creating a digital strategy. First, know your audience as well as Twitch does. Twitch attributes a lot of its success from 2013-2017 to their focus on gaming. Early on Twitch found that a majority of their audience engaged with video game media. When they figured that out they pivoted from ‘Life-streaming” to Video game streaming. Second, Twitch is constantly implementing new features. Many of these features are user generated and are often experimental. While many of these extensions are popular, a decent chunk of new features are removed due to user feedback or functionality issues. Arts nonprofit managers should think about what types engagement elements their audience would appreciate and use. Do you think that your audience would enjoy a live notification of their donation with a message to the institution? Twitch’s audience loved it! Finally, Twitch is a pioneer in fostering authentic community interactions between viewers and streamers. Arts nonprofit managers should think deeply on how best to foster these types of authentic interactions within their own community and digital strategy.

Case Study 2: Mixer

Mixer.tv was the first major competitor to Twitch.tv but has historically been far behind Twitch in market share (only 3.2%). Mixer was launched in 2016 and was acquired by Microsoft as a way for the company to compete with Amazon who had purchased Twitch.tv in 2015. Twitch.tv was originally founded in 2011 as justin.tv and could explain why Mixer has historically had a hard time capturing market share from Twitch.tv. Twitch, with a 5-year head start on mixer, surely put Mixer in a state of catch up. It is potentially because of this head start, that Mixer decided to implement extremely aggressive and expensive strategies to capture market share from Twitch.

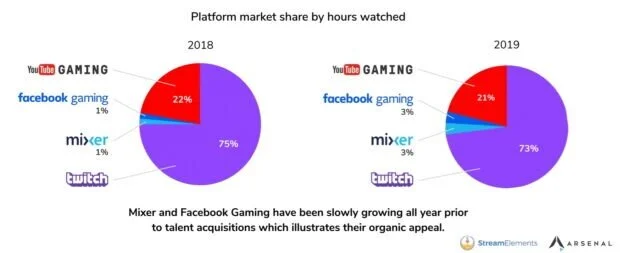

Figure 4: Total market share by hours watched: a 2018 and 2019 comparison. Source: Graphic created by streamelements and reported from Gadgets 360.

The above graph shows the difference in market share between the years 2018 and 2019, the years that Mixer has implemented these strategies. Was a 2% increase in market share worth the cost of Mixers strategies? Probably not. Mixer utilized extremely aggressive and expensive content creator acquisition strategies that could potentially bankrupt the company, even with the backing of a major US corporation like Microsoft.

So, what were the strategies Mixer used? Other than mimicking the gamified elements of the Twitch UI and implementing a more generous profit-sharing model, Mixer spent millions of dollars buying popular streamers from Twitch.tv. By paying Twitch streamers a yearly salary, such as Ninja and Shroud, Mixer was able to bring more viewers and streamers to their relatively small platform. While a 2% overall increase may seem small, until Mixer started buying popular content creators, there was no real incentive for streamers to stream on the Mixer platform. With the acquisition of both Ninja and Shroud, there was a significant difference in the number of streamers who gave the platform a second look. The total hours of gaming content streamed on mixed increased to 32.6 million, a 188% increase from the 3 months prior. However, this increase in content did not translate to an increase in hours watched, in fact, hours watched decreased by 10.6%. While the validity of this strategy has yet to be established, Mixer continues to spend millions of dollars on acquiring them. Mixer spent $20-30 million on Ninja alone.

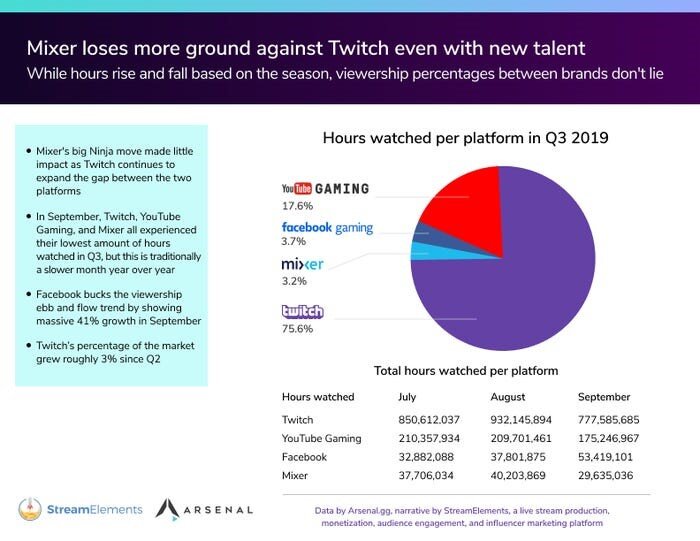

Figure 5: Total live streaming hours watched by streaming platform for Q3 of 2019. Source: Graphic created by streamelements and reported by Business Insider.

Twitch has over 20 times the amount of viewership that Mixer does, so what can we learn from the strategies implemented by Mixer? For Arts nonprofits, its important to realize that when entering into a saturated marketplace, expensive and aggressive strategies may not be the best way to expand your market. Most nonprofits will not have access to the type of capital a Microsoft would anyways.

The Mixer case study demonstrates the importance of several elements of online distribution of content. First, content is king. Mixer struggled since its inception at incentivizing streamers to join their platform. Streamers are the content creators and without them there are no viewers. Yet, we also see that without viewers, streamers do not want to join the platform. Arts nonprofit managers will need to strategize around this two sided market, ensuring there is both content for distribution and people who are ready and willing to consume and engage with content.

Case Study 3

While Twitch and Mixer are both streaming platform companies that engage in a two sided market- viewers that consume content and streamers that create the content- Voxpop Games engages the two sided market in a slightly different way. Rather than becoming a platform where streamers and viewers engaged with each others content, Voxpop aims to connect indie development companies with Indie game streamers. In this way, Voxpop has found a blue ocean business and can capitalize on a niche. Additionally Voxpop operates much like a nonprofit organization and an especially interesting case for nonprofit managers to examine.

Voxpop Beta graphic. Source: Vox Pop Games.

Voxpop, at the time this report was written, just launched its closed beta, so the strategies this article will examine have yet to be demonstrated in the marketplace. Voxpop utilizes a Peer to Peer distribution network much like the software LimeWire and Napster of the late 90’s and early 2000’s. While there were legal implications for softwares like Napster, Voxpops model is based on the business model of the Girl Scouts of America. Using their business model, Voxpop seeks to link under-served communities (Indie Developers/streamers) with profit sharing tools that will increase their marketing reach and profit potential.

Voxpop has several unique strategies that make it applicable to nonprofit arts managers. First, they implemented the Peer to Peer distribution network, which allows users on the platform that own games to “seed” or send information to be downloaded by another software owner. In this way, Voxpop has eliminated the need to invest in expensive server capacity for their business. Arts managers with limited budgets should be looking for areas in which they can reduce costs without reducing the quality of their services or content. Second, Voxpop looked at its competition and the customers that it ignored, before deciding on the niche marketplace of Indie Gaming. Identifying the problem, Indie games with limited budgets could not afford the cost of marketing and launching their product on a marketplace platform, Voxpop is able to lower the initial cost of launching a game for their customers and assists them with marketing. Its important for arts nonprofit managers to survey the marketplace they are entering and understanding how their organization can better serve those whose needs are not being met. Finally, Voxpops profit sharing model leverages the immense marketing potential of word of mouth and fandom. Streaming communities often are made up of individuals with similar tastes in game genres and are a good place to convert sales. Arts nonprofit managers should evaluate what their community enjoys and engage the communities around topics they can all participate in.

Conclusions and Recommendations

While online streaming platforms such as Twitch and Mixer may not seem applicable business cases for an Arts nonprofit managers, these companies are at the intersection of art and technology. Additionally, these streaming platforms often implement donor stewardship in more creative and engaging ways than most charities and nonprofits. For arts nonprofit organizations that are seeking to transition their content and/or organization to a digital environment, examining and understanding how the different marketplaces and networks interact with one another, as well as what strategies have and haven't worked, will be important to the success of ones organization.

Having explored several business examples and the lessons they teach, there are several high level concepts arts managers should keep in mind when planning their organizational digital strategy.

First know your audience. This simple concept is something all arts nonprofit mangers are aware of, but the idea of knowing your audience is especially important in a digital environment. Content costs money to produce and market, and marketing to the wrong customer base can be disastrous. There are numerous digital tools that can help one understand their audience and they should not be ignored.

Second, find a business that is currently working in your desired marketplace and evaluate the strategies that have worked and have not worked for it. Understanding the nuances of your marketplace and the already tried methods of distribution and marketing will be key in an organizations growth and success long term.

Finally, find a way to make engaging with your content fun! Both Twitch and Mixer have found unique and creative ways to encourage users to donate to their streamers or charity drives. Experimenting with different types of fundraising methods will be key to the long term survivability of your organization, both physically and digitally.