Beyond Simple Giving: A New Model for DAFs

The Donor Advised Fund is a highly controversial instrument in the world of charitable giving. Part One of this research revealed how, while highly flexible and capable of transacting with complex assets, DAFs are also critically unregulated and notorious for both their anonymity and high barriers to entry for the average donor. The current state of this industry paired with its ballooning size has been a cause for concern among philanthropic thought-leaders and legislators alike, with multiple waves of legislation materializing to try to better define and regulate these funds.

With little success in larger-scale government oversight so far, it begs the question: how is the marketplace for DAFs changing and innovating in the response to these singularizing criticisms? Is the market listening and self-correcting as a way to preempt such legislation? Given the broad variety of DAF sponsor organizations, it is evident that the field, while large, is not a monolith and deserves to be measured at its innovative margins. Newer sponsors have revealed themselves to be particularly aware of the controversies yet remain focused on the opportunities these accounts provide and are demonstrating new approaches to DAF sponsorship aimed at greater payout rates and democratization of their platforms.

Image: Donor-Advised Funds vs. Qualified Charitable Distributions

Image Source: LinkedIn

The Social Sponsors - Daffy & CharityVest

Two sponsors founded within the past 5 years have been leading the way in transforming the role of the DAF sponsor:

Daffy - founded in 2020 and having created the first native IOS DAF-app, and

CharityVest - product of the famed Silicon Valley incubator Y-combinator, founded in 2019.

Similarly sized and similarly operating, these two sponsors represent a new approach to sponsoring and managing the donor advised fund. Both have taken strides to minimize fees and remove investment minimums to lower barriers to entry for newer, younger, and less wealthy users. Daffy sets flat monthly rates based on how much is in the account, beginning at zero when less than 100 is invested, maxing out at 20 per month given size and features desired. CharityVest similarly charged no minimum fees if funds are not invested, rising to four dollars per month when opting to invest the funds.

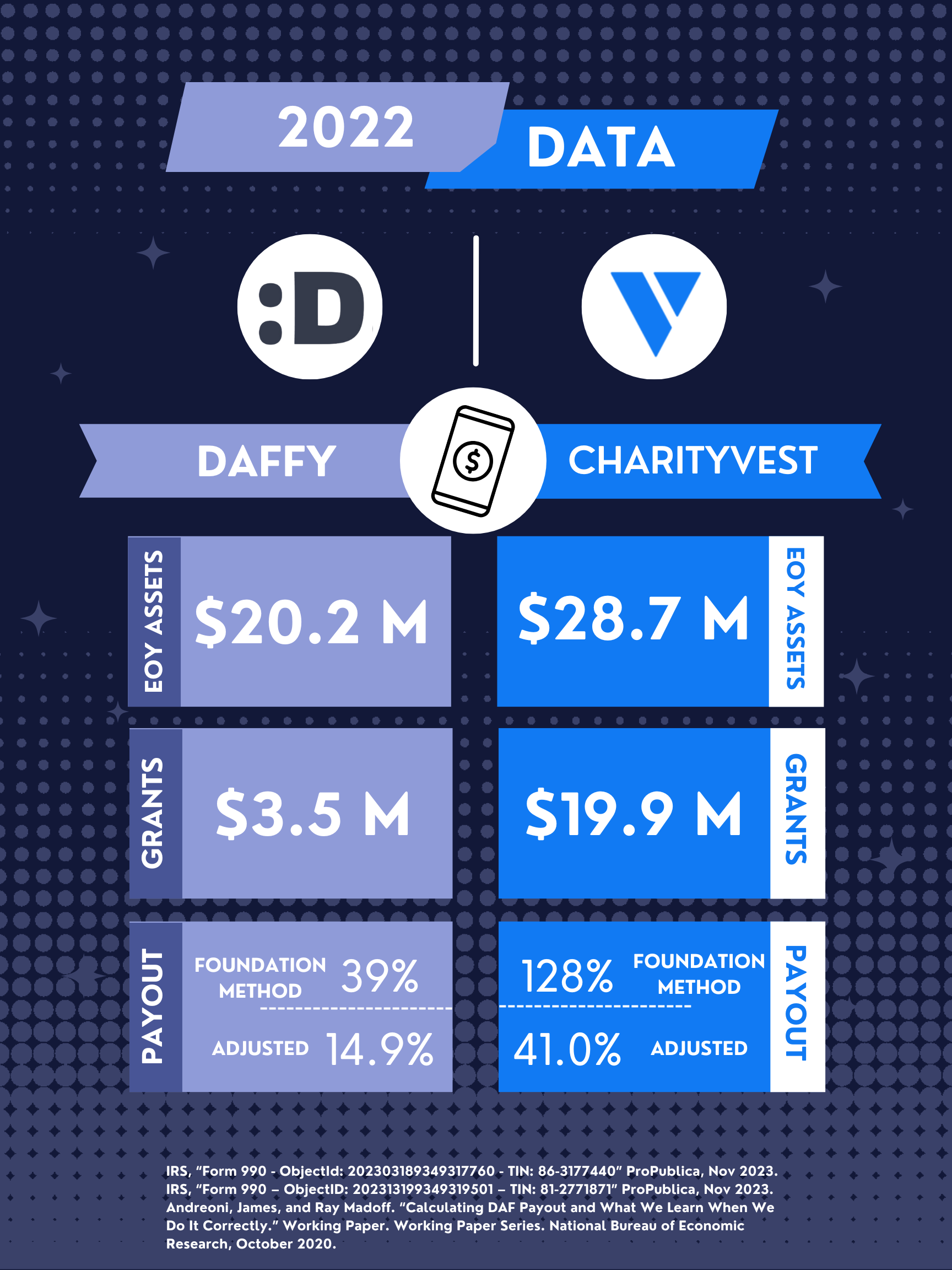

Infographic created by author.

Both boast industry-leading payout rates as well, calculated using either the Foundation Center Method or more conservatively adjusted methods provided by economists like Andreoni. In 2022 Daffy’s adjusted rate was still almost 15%, still three times the minimum required distribution for foundations. CharityVest’s adjusted rate in 2022 stood at a staggering 41%.

At the time of publishing, 2023 financial data via IRS form 990s is not available for more recent financial analysis, but both organizations have published in-depth annual reports for 2023 to assess. Daffy saw impressive growth in assets while both maintained industry-leading payout rates, albeit self-reported using the Foundation Center method.

Both companies also enjoyed large percentages of their grants being unrestricted; both seeing over half of their grants given as unrestricted, with 94% of grants through Daffy being such. However, despite Daffy’s impressive growth, CharityVest still posted more than twice as many grant-dollars disbursed over 2023.

Impressive giving behaviors are supposedly incentivized by these sponsors thanks to recent improvements in their fintech integrations. Most notably the trends toward a social-networking of the giving form paired with the development of collaborative crowdfunding mechanisms; Analyzing how these innovations may impact sponsor’s data relating to such criticized metrics like payout, and participation can shed light on the effectiveness of these measures to both democratize and optimize this giving instrument in the shadow of more traditional DAF structures.

Platforms: DAFs as a Social Network

The first major shift in approach taken by both Daffy and CharityVest is the effective socialization of the DAF sponsor. Much in the way of Venmo or GoFundMe, these two companies have developed social ecosystems around user’s financial transactions adding another dimension to the already established phenomenon of mobile payments becoming a form of social media.

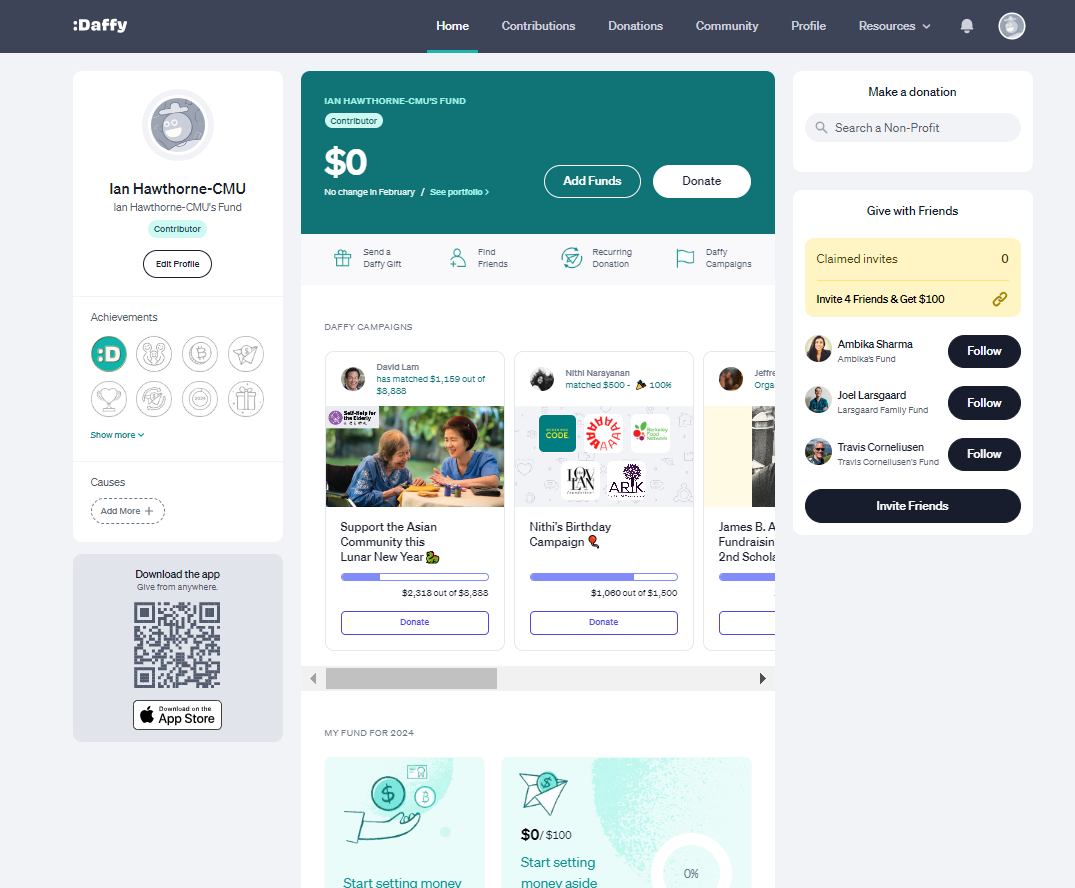

Daffy has already been referenced as the ‘LinkedIn for giving’, providing a public charitable profile highlighting recent giving activity, as well as the ability to pin favorite charities to user’s profiles to further highlight values and direct giving by other users.

Daffy user homepage - provided by author

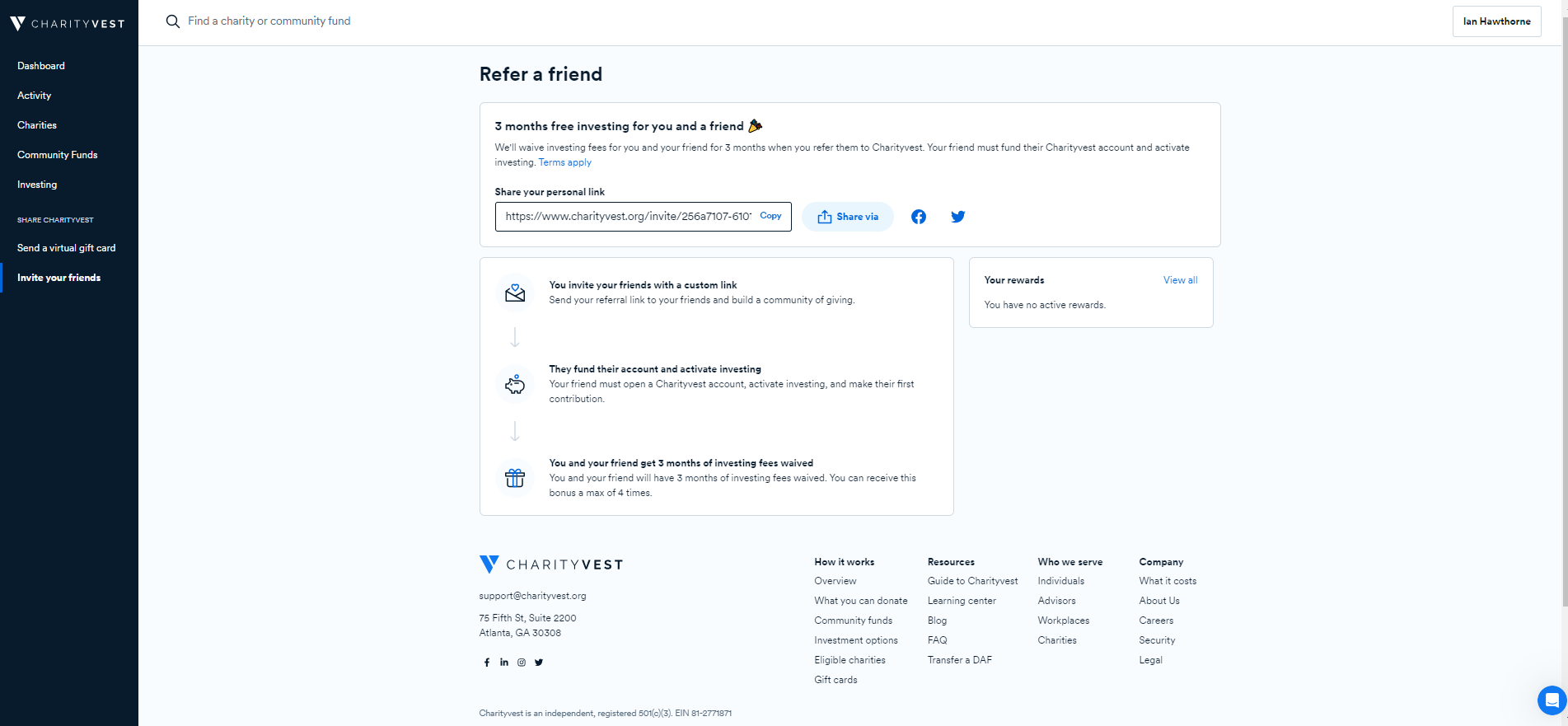

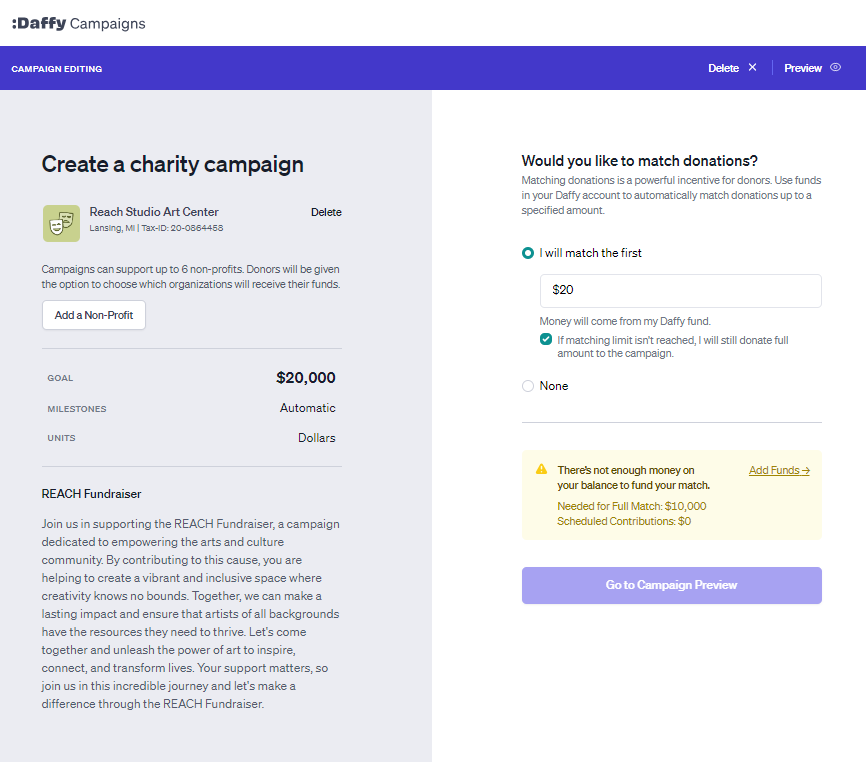

While CharityVest has not so fully networked by comparison, it does incentivize social collaboration in a more indirect manner. Offering CharityVest gift cards and the ability to refer friends is one method of increasing the donor base and give donors the ability to influence other users giving and approach the platform as a social space.

Screenshots of friend-referral and gift card functions on CharityVest - Provided by author

This general pattern lays the foundation for a second significant feature introduced by both platforms, building on the notion of connectivity: multi-donor collaborative giving capabilities.

‘DAF-Drives’: DAFs as Crowd-Funders

In 2023 both Daffy and CharityVest launched features allowing users to effectively fundraise for nonprofits on their platforms, soliciting fellow DAF advisors for funding and features went public.

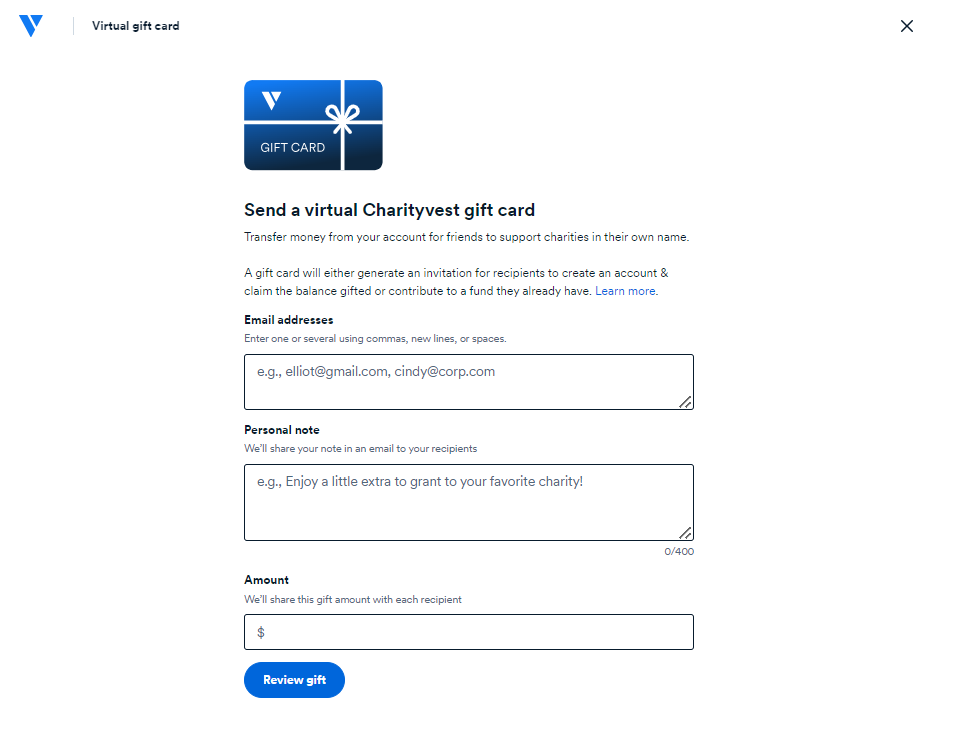

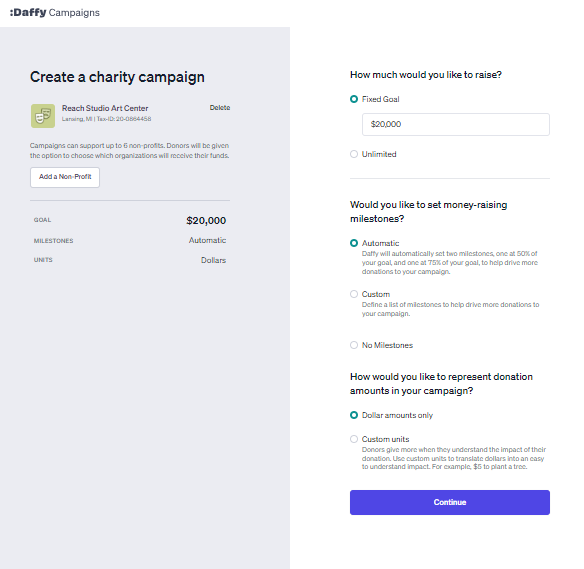

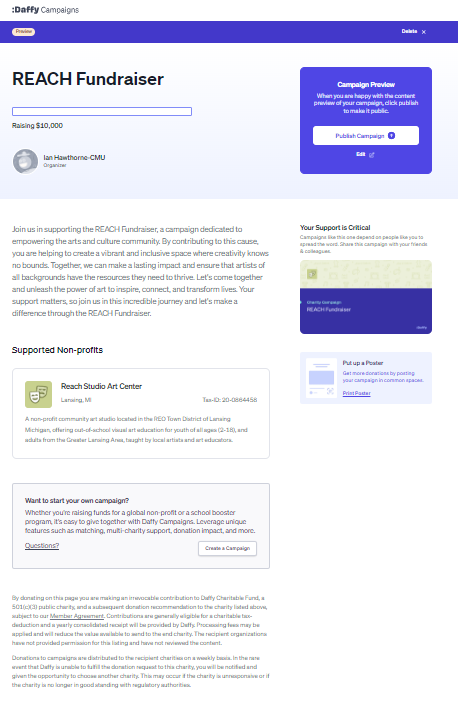

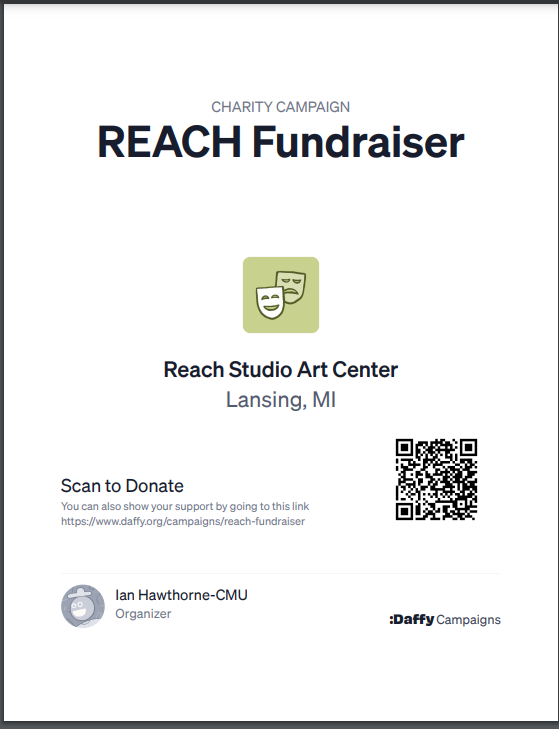

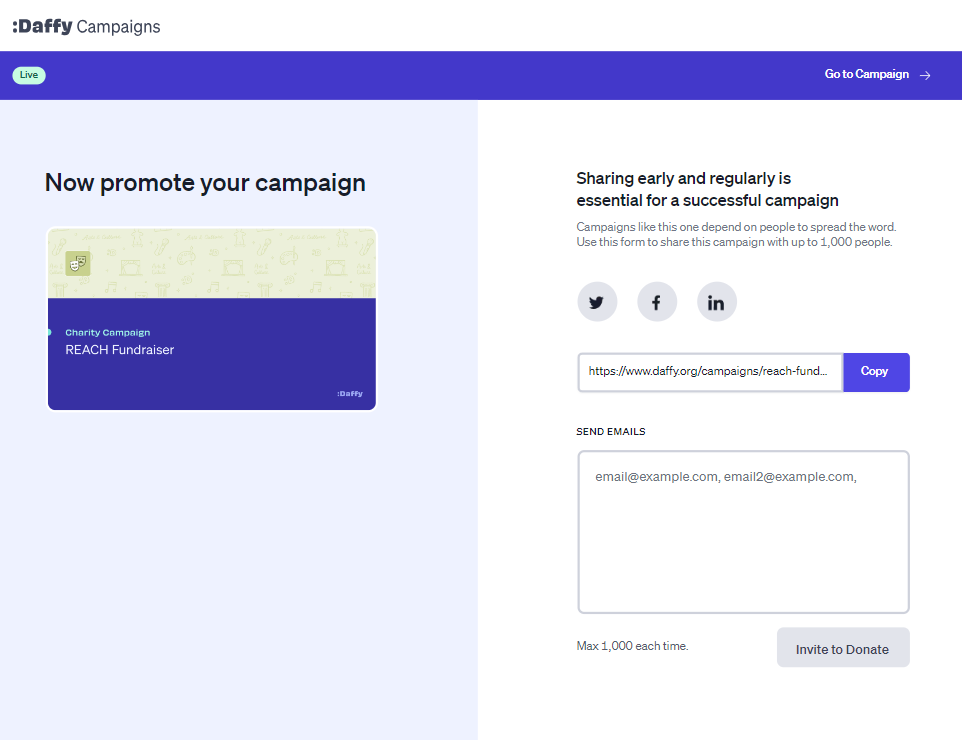

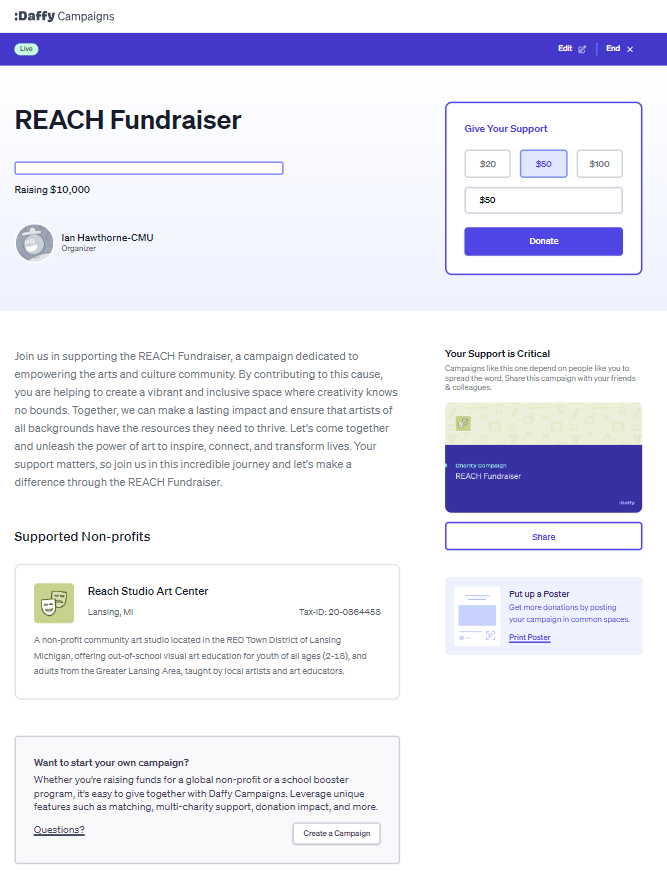

‘Campaigns’, as Daffy labels them, are pages any user can set up to direct funds to nonprofits of their choice, either individually or as a group, similar to a traditional peer-to-peer solution via platforms like Bonterra (fka Salsa). These funds allow the founder to introduce multiple incentives into their fundraiser, including matching funds as well as giving minimums and benchmarks. Daffy’s campaigns are also unique in their use of AI assistance in writing campaign narratives, allowing anyone the ability to quickly and easily publish a campaign.

Page-by-page demonstration of setting up a campaign on Daffy:

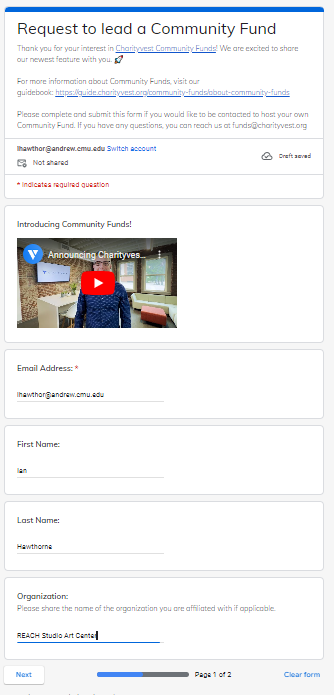

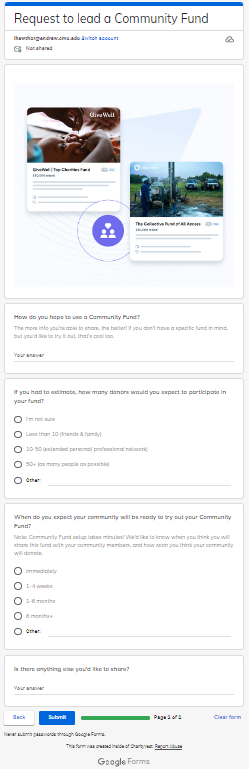

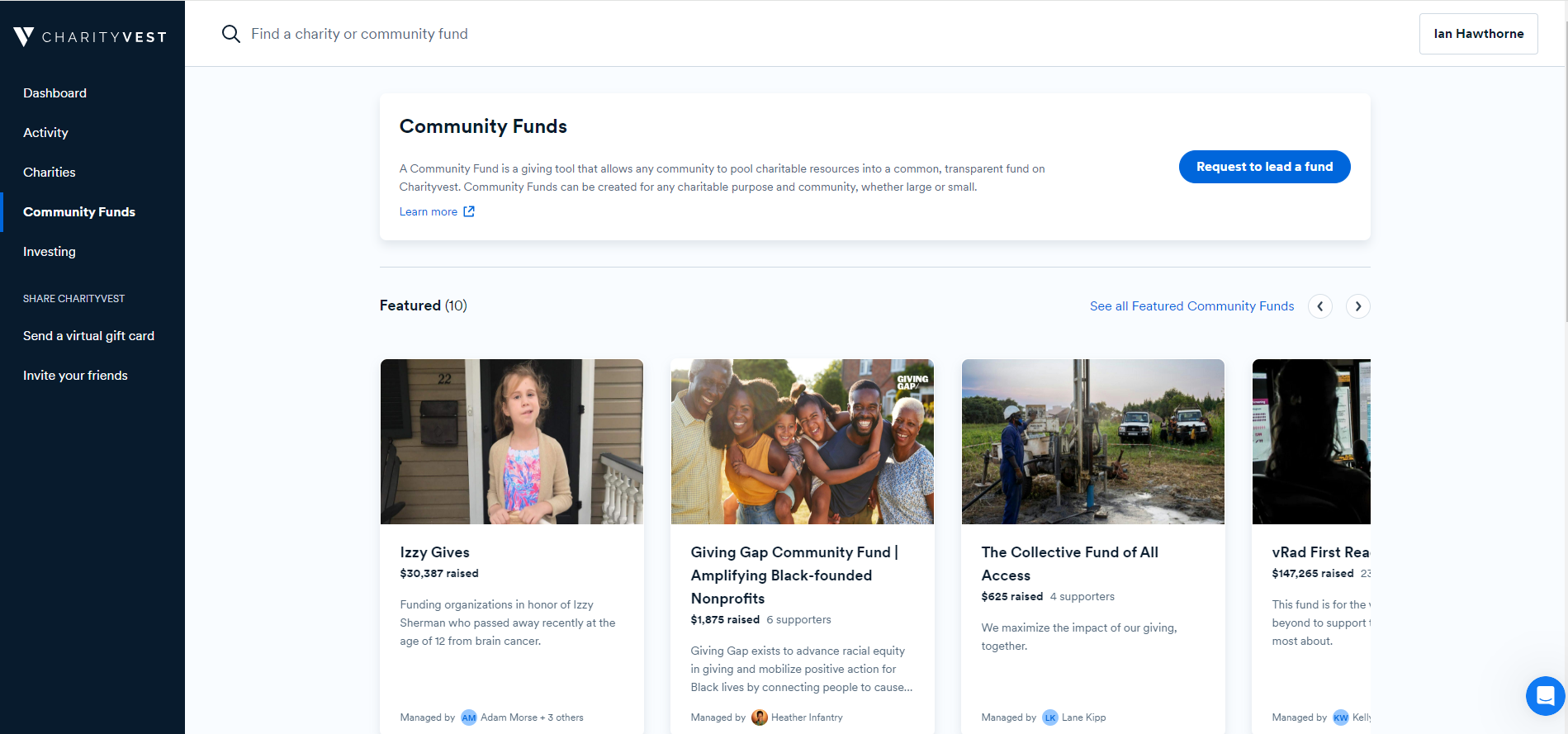

Known as community funds in CharityVest, these funds allow any user to create a “tax-deductible giving pool branded for their community, group of friends, organization, audience, or cause.” Emphasizing the power of collaborative giving backed by giving groups, influencer-type lead donors, or workplace giving pools, Community Funds are given their own individual webpage after a user submits a simple form requesting their creation.

Less streamlined than Daffy, in this way ChairtyVest still acts as a gatekeeper for the creation of such funds. These two approaches will be important to note when studying the impacts of these crowdfunding techniques to see which level of control may incentivize or disincentivize the proliferation of successful fundraising efforts by its users.

Page-by-page demonstration of setting up a community fund on CharityVest:

These “DAF-Drives” inject crowdfunding capabilities into the realm of DAF-giving, recentering sponsors around the user ecosystem and further expanding the idea of DAFs-as-social-media. Daffy founder Adam Nash views campaigns as another way that Daffy is bringing the “power and ease of modern tech tools to charitable giving.”, while ChairtyVest founder Stephen Kump emphasizes the importance of making giving more “purposeful, accessible, and dynamic” through the use of collaborative funds. He highlights the nature of giving as an expression of social values and frames Community Funds as a means through which donors can “connect more meaningfully” over such shared values, furthering the notion that new DAF sponsors are turning the giving platform into a more socially mediated experience; The donor advised fund acts more as a multifaceted, all-purpose social-philanthropy account rather than a mere investment account.

Shifting Landscapes - New Horizons

Traditionally siloed and individualized like bank or IRA accounts, the act of bringing crowdfunding and socializing capabilities to the doorstep of DAF accounts is an evolution of the role of the sponsor.

The tendency for crowdfunding vehicles to attract younger donors and maintain positive sympathy in society conveniently make it an effective tool for DAF sponsors to use in order to diversify their donor-base and attempt to rebrand in light of the critiques plaguing the broader field. It will be important to monitor any further adoption of this approach among other sponsors going forward.

DAFs are not the only platforms experiencing such shifts either. Converging from the other direction, traditional crowdfunding platform GoFundMe has moved into the nonprofit fundraising arena through its acquisition of Classy in 2022.

DAF sponsors developing proprietary crowdfunding functionalities while crowdfunders venture into nonprofit-fundraising further blurs the distinction between the two while simultaneously making clear the integration of digital crowdfunding throughout structured philanthropy post-pandemic. This could signal an important change within digital giving trends and signify a broader wave of institutional isomorphism throughout contemporary American philanthropy.

Improving Digital integrations

Further changing the marketplace for DAF-donations, alongside the technological developments seen among sponsors themselves, are developments taking place in supporting businesses like Chariot - a DAF-adjacent fintech corporation specializing in payment processing.

Chariot’s newly developed DAFPay payment processing software has already been integrated into DonorDrive, a leading donation processing platform used by hundreds of nonprofits. Allowing users to donate through their selected DAF sponsor online with merely a few clicks makes granting through any DAF now no more difficult than your average credit card purchase.

Increased integration of DAF-payment methods online with innovations such as DAFPay are further streamlining donor’s ability to give electronically with their DAF accounts. By marketing such integrations as an improvement on the donor’s ability to “contribute directly to the organization of their choice, especially as part of high impact peer-to-peer campaigns” it signals a direct awareness of the growing trend toward collective giving strategies on such platforms and an attempt by ancillary ventures to reshape the giving landscape along such lines.

New Roles and Opportunities for DAF advisors

DAFs have also begun to be targeted as fertile ground for catalytic capital. Impact philanthropists like Upstart Co Labs have already used donor advised funds to raise capital for larger scale impact-investments alongside more established sources like foundations and endowments.

Multi-donor funds, or MDFs, are particularly noteworthy given their structural similarities to collaborative giving methods being pioneered by sponsors like Daffy and CharityVest. MDFs effectively aggregate multiple donor funds into one large ‘synthetic fund’ housed within a single DAF account with governance structures, grant thesis, and advisory roles outlined separately among stakeholders. It will be particularly interesting to follow how the rise of collaborative giving and crowdfunding methods available among more DAF sponsors may aid in the proliferation of MDFs or similar arrangements of donor capital going forward.

Image provided by author

The rapid developments within both the DAF field as well as the impact philanthropy field make for limited peer-reviewed data to illustrate the magnitude and significance of these linkages, but at minimum these developments substantiate DAFs as large and viable sources of philanthropic capital being proactively solicited for opportunities. Avenues are further opened for direct fundraising efforts by nonprofits and the establishment of increasingly sophisticated giving ventures by enterprising donors through the social mediatization and multi-donor fundraising features introduced by the aforementioned sponsors. Instead of just hoping to get lucky, savvy nonprofits can platform themselves and their boards to maximize exposure and impact within this field.

Conclusion

Ultimately the adoption of crowdfunding approaches and increased technological integration among DAFs points to a broadening of interest in transparency, direct impact, and giving efficiency among donors. Tech-savvy sponsors are using collaborative giving as a counterweight to address previously mentioned controversies surrounding inefficiencies and opacity. Preliminary data suggest favorable payout rates among the sponsors adopting such features, and rapid growth over a short timeframe may further demonstrate endemic demand for such features among donors.

While these innovations are so new that there is a lack of data confirming their impact, tracking the proliferation of these trends among other sponsors and monitoring the performance of different social functionalities will help to shed light on the complex evolution of DAF-sponsors currently underway.

-

alphaGrid. “The Rise of Collaborative Giving.” Accessed March 3, 2024. http://www.ft.com/partnercontent/gates-philanthropy-partners/the-rise-of-collaborative-giving.html.

Andreoni, James, and Ray Madoff. “Calculating DAF Payout and What We Learn When We Do It Correctly.” Working Paper. Working Paper Series. National Bureau of Economic Research, October 2020. https://doi.org/10.3386/w27888.

“Charityvest Looks to Socialize DAFs | Wealth Management.” Accessed March 3, 2024. https://www.wealthmanagement.com/technology/charityvest-looks-socialize-dafs.

“Daffy Adds Over $100M in Charitable Contributions in 2023, 425% Growth from 2022 - Year in Review 2023,” January 23, 2024. http://www.daffy.org/resources/year-in-review-2023.

“Donor Advised Funds Are Hot! Key Takeaways from Giving USA’s *NEW* Special Report - BDI.” Accessed March 18, 2024. https://bdiagency.com/donor-advised-funds-are-hot-key-takeaways-from-giving-usas-new-special-report/.

“DonorDrive Announces Support for Donor Advised Fund Payments with Chariot Collaboration | Nasdaq.” Accessed February 18, 2024. https://www.nasdaq.com/press-release/donordrive-announces-support-for-donor-advised-fund-payments-with-chariot.

FORVIS. “Proposed Regulations for Donor Advised Funds.” Accessed February 14, 2024. https://www.forvis.com/forsights/2024/02/proposed-regulations-for-donor-advised-funds.

“Giving USA Limited Data Tableau Visualization | Giving USAGiving USA,” October 6, 2021. https://givingusa.org/giving-usa-limited-data-tableau-visualization/.

“Global Philanthropy Report: Perspectives on the Global Foundation Sector.” Accessed February 18, 2024. https://www.hks.harvard.edu/centers/cpl/publications/global-philanthropy-report-perspectives-global-foundation-sector.

“GoFundMe to Acquire Classy | Business Wire.” Accessed March 30, 2024. https://www.businesswire.com/news/home/20220113005248/en/GoFundMe-to-Acquire-Classy.

Grantmakers in the Arts. “What We’re Watching: Upstart Co-Lab: Inclusive Creative Economy Strategy.” Accessed March 19, 2024. https://www.giarts.org/blog/jaime-sharp/what-were-watching-upstart-co-lab-inclusive-creative-economy-strategy.

“How a Tide of Tech Money Is Transforming Charity.” The Economist, February 11, 2023, NA-NA.

Hoyes, Erin. “The Global Rise of Structured Philanthropy.” NPT UK, September 8, 2018. https://www.nptuk.org/philanthropic-resources/giving-perspectives/the-global-rise-of-structured-philanthropy/.

Marks, Sam, and Guest Contributor |. “The Inside Track: Using Donor-Advised Funds Creatively to Solve Nonprofit Problems.” Inside Philanthropy, October 24, 2023. https://www.insidephilanthropy.com/home/2023/10/24/the-inside-track-using-donor-advised-funds-creatively-to-solve-nonprofit-problems.

Melendez, Steven. “Now You Can Start a Fundraiser for Any Charity of Your Choice in Seconds.” Fast Company, November 3, 2023. https://www.fastcompany.com/90977276/daffy-fundraiser-tool-exclusive.

Mosser, Michelle. “Tapping the Catalytic Capital Potential of Donor Advised Funds.” GreenMoney Journal (blog), September 30, 2022. https://greenmoney.com/tapping-the-catalytic-capital-potential-of-donor-advised-funds/.

“Multi-Donor Funds Emerge as a Creative Architecture for Collaborative, Catalytic Capital - ImpactAlpha.” Accessed February 23, 2024. https://impactalpha.com/multi-donor-funds-creative-architecture-for-collaborative-catalytic-capital/?utm_campaign=The%20Brief&utm_medium=email&_hsmi=295359984&_hsenc=p2ANqtz-8TePCVyiAkkwraRVTVNlwerLezcU2PhU8JtrwCJXk6Jk-yo-41_V1nTqTXhl3kCuBeYaYRktMIdd1LvcAtZCnQCUDFGQ&utm_content=295359984&utm_source=hs_email.

“Next Generation of Generational Giving: Who Gives the Most and Why.” Accessed March 18, 2024. https://www.idonate.com/blog/next-generation-of-generational-giving-who-gives-the-most-and-why.

Pactor, Andrea. “Crowdfunding in the Digital Age.” Lilly Family School of Philanthropy, April 9, 2021. https://blog.philanthropy.iupui.edu/2021/04/09/crowdfunding-in-the-digital-age/.

Upstart Co-Lab. “2022 Impact Report: Investing for an Inclusive Creative Economy.” Accessed March 30, 2024. https://upstartco-lab.org/impact-report/.

Upstart Co-Lab. “Investors.” Accessed March 30, 2024. https://upstartco-lab.org/investors/.

Wyland, Michael. “Donor-Advised Fund Giving Reflects Larger Philanthropy Patterns—Mostly.” Non Profit News | Nonprofit Quarterly, February 28, 2018. https://nonprofitquarterly.org/donor-advised-fund-giving-reflects-overall-us-philanthropy-patterns-mostly/.