By: Kaylynd Brown, Walter Garay, Gabrielle Lossia, Luke Ressler, and Micah Tokiwa

introduction

This study aimed to identify how Bally Sports Regional Networks can attract, engage, and retain subscribers across demographics for their linear broadcasts and streaming platforms. With traditional cable subscriptions declining, cord-cutting rising, and an overpopulated streaming environment, it is vital for media providers to find ways to differentiate their offerings and grab consumers’ finite attention and money. The scope of this research includes assessments for marketing improvements, sports betting opportunities, technology enhancements, social media integration, diversified content offerings, and varied subscription models. This research shows that sports fans’ top priority is accessible, reliable, and interesting content. As a result of these findings, the recommendations for Bally Sports will focus on brand awareness, user experience, representative content, and potential partnership integrations.

Figure 1. Bally Sports Logo

Image Source: TV News Check

Bally Sports’ success hinges on its ability to accurately anticipate the direction of regional sports networks (RSNs) and its willingness to implement changes based on sports viewers’ preferences. RSNs like Bally Sports play a crucial role in broadcasting games via cable, satellite, and streaming services to local fans. Bally Sports launched its subscription video-on-demand (SVOD) service, Bally Sports+, at a time when the global trend in entertainment consumption was leaning towards on-demand streaming, due to its convenience and the high cable subscription costs of linear television (TV). To maintain its viewership and appeal to various sports viewer demographics, Bally Sports will need to focus on implementing new strategies to attract, engage, and retain subscribers.

importance of the study

The emergence of streaming and its subsequent changes in viewership have created challenges for providers like Bally Sports, which in turn affect their viewers' experience. This team analyzed how to mitigate these challenges and identified possible solutions.

Traditionally, cable networks provide limited sports channels that only broadcast select games. In this programming model, fans are left in sports viewership “blackouts” due to broadcasting rights constraints, dictating the viewer experience instead of tailoring it. Compounding these viewership inconveniences, are the high monthly subscription prices of RSNs and live television streaming providers, compared to traditional video-on-demand (VOD) services. Additionally, the teams locked into broadcasting contracts with RSNs are looking toward other distribution options to expand viewership numbers and increase profit margins. Shopping around broadcasting rights to new distributors creates leverage for sports leagues against RSNs.

Bally Sports must quickly identify an approach to contend with the dominant streaming services and evade irrelevance, but competition is not their only hurdle. Sports franchises and RSNs face modest viewership from Generation Z (Gen Z) (Burns, 2022). Bally Sports must convince this absent audience to add live sports to their already competitive streaming portfolio while continuing to service older demographics through a hybrid of streaming and traditional cable broadcasts. In response, Bally Sports has launched an SVOD service, Bally Sports+, providing viewers with the ability to watch their local teams without a traditional TV subscription. In addition to its broadcast and satellite channels, Bally Sports+ offers more autonomy to its current fan base and serves to attract new audiences. Unfortunately, this advancement is insufficient in addressing their attraction, engagement, and retention needs, which are vital to improving their financial adversity.

Figure 2. Streaming one game while viewing another in person

Image Source: Unsplash

Research Summary

The basis for this research was identifying best practices for Bally Sports to attract, engage, and retain subscribers through their new SVOD platform, their existing broadcast channels, and supplementary ventures. The team explored several areas including, but not limited to, gambling, advertising (ad) revenue measurements, piracy, and technological innovations. However, they focused on the following three research questions.

1. What is the future of RSNs, as streaming services are increasingly attracted to sports programming, and leagues consider the viability of creating team-owned platforms?

2. How can RSNs provide paramount service to next-generation viewers who either never had cable or recently cut the cord, while continuing to serve cable-friendly audiences?

3. What are the best ways to engage fans through gaming, technology, personalization, incentives, betting, and undiscovered opportunities?

the current state of the industry

In March 2020, the world of live entertainment would come to a standstill in the wake of Covid-19. The shutdown of live sports was further compounded by several powerhouse streaming services, including YouTube TV & Hulu + Live TV, dropping Bally Sports over high costs and low viewership (Fletcher, 2022a). DISH Network followed by excluding the RSNs from its renewed carriage agreement with Sinclair Broadcast Group (Fletcher, 2022a).

Due to these concerns, Bally Sports pursued crucial deals with Spectrum's parent company, Charter, “the second largest U.S. TV provider by subscribers,” and FuboTV “a general entertainment service with more than 1.2 million subscribers” to showcase their 19 RSNs (Fletcher, 2022a, paras. 7; Hayes, D, 2022, paras. 3). Inflation-accelerated cord-cutting has continued to impact Bally Sports and the traditional RSN model, with major distributors neither able to pay the carriage fees nor willing to pass them along to their users. A recent Deadline article succinctly described the changing relationships between RSNs and TV providers:

Established in the 1990s and 2000s when pay-TV subscriber numbers were climbing, the RSN business model features hefty fees paid by distributors, which had historically been able to reap advertising rewards from high local tune-in for games. While the elevated fee structure has always introduced a degree of friction in distribution talks, the decline of linear viewership and cord-cutting in recent years have undercut the original business proposition of RSNs (Hayes. D, 2022, paras. 4).

Figure 3. Sports Live Streaming

Image Source: dacast

Recognizing the strong demand for local sports and the preferences of the streaming consumer, Bally Sports launched Bally Sports+, a direct-to-consumer (DTC) app for viewers in the RSNs’ regions to watch content without the need for a TV subscription. After a 7-day free trial, subscribers can pay $19.99 a month or $189.99 annually to watch on Roku, Amazon Fire TV, Apple TV, mobile and tablet devices (iOS, Android), and BallySports.com (Bally Sports+ FAQs, n.d.). Bally Sports+ offers interactive games and participation elements, as well as pre and post-game entertainment, in addition to their linear content, which mirrors those of TV subscribers (Fletcher, 2022b). Bally Sports+ was not the first in the RSN streaming space, as New England Sports Network (NESN) released its service in the summer of 2022, available to fans in the New England area (Fletcher, 2022b). It is important to note that RSNs, unlike national sports broadcasters, do not compete with each other for subscribers, as they are not providing content to the same regions.

Chief Executive Officer (CEO) of Bally Sports reported “74% of consumers who subscribed to Bally Sports+ converted to paid users after the end of a 7-day free trial,” (Fletcher, 2022b, paras. 11). Unfortunately, the app failed to subdue the overall erosion of RSN audiences caused by cord-cutting, as Bally Sports subscription levels fell at least 10% in 2022 resulting in cash flow being only half of the year's estimate (Kaplan, 2022). In an attempt to protect Sinclair from the losses suffered by Bally Sports, the RSNs became an independent subsidiary of Diamond Sports Group LLC. Diamond hired a new CEO and on March 14, 2023, filed for Chapter 11 bankruptcy protection (CBS News 2023). With debts estimated at $9 billion and billions more owed in sports media rights, the “NBA, NHL, and MLB have a keen interest in keeping Diamond afloat,” (Kaplan, 2022, para. 7). The company expects to continue operating and providing game coverage throughout the bankruptcy. Diamond Sports Group plans to eliminate most of its debt through restructuring (CBS News, 2023). Despite the bankruptcy, the recommendations address key issues that precede the current state of financial affairs.

Sports Media in the Streaming Landscape

Two of the key ways that live games provide revenue through traditional broadcasting are advertising dollars and carriage fees. Sports leagues understand the value of their product to media companies and, in turn, have continued to increase the cost of retransmitting their games. However, these rising costs contradict the decreasing cable subscribers, who are shifting to streaming services. Digital platforms reach the elusive 18-24 demographic and provide invaluable customer data, but linear channels have bottom-line value (Kirshner, 2022). Sports media companies must find a middle ground to support these incongruent realities.

Since the debut of Netflix’s streaming service in 2007, the TV and movie industries have been attempting to meet consumers' shifting preferences toward SVOD consumption. In less than 20 years, there are now over 200 streaming services, with 85% of US households using at least one service (Pattison, 2022). However, the sports entertainment industry has been slower to react to their audience's viewing habits, leaving an opportunity for streaming giants such as Apple TV+, Amazon Prime Video, and YouTube TV to compete in the live sports market. These same tech companies are not only impervious to the decline of traditional TV but benefit from its deterioration (Weprin, 2022).

Figure 4. Bally Sports Detroit Twitter Account

Image Source: Play Michigan

Furthermore, sports leagues and sports broadcasters are entering an oversaturated streaming market. With an expectation of top-notch user experience, consumers have become more discerning with their wallets and time. Unlike Netflix, where you can watch the entirety of your favorite show on a single service, sports streaming is “a patchwork in which games are spread across services,” as Kirshner (2022) notes, making it more expensive than ever for sports viewers and media companies alike (para. 5). The latter are continually straddling the past and future of sports entertainment.

Survey

In addition to reviewing existing studies, we created a survey that identified the habits and preferences of sports viewers in the U.S. while pinpointing enhancements to the viewing experience. The survey was designed using Qualtrics, a web-based survey creation and analytics software, and was administered online between February 17 and March 22, 2023. Given the diverse demographics of sports viewers, various communities were targeted, including U.S. Army soldiers, church groups, sororities, fraternities, and online communities such as Discord and Reddit. The survey consisted of 30 questions and took less than 10 minutes to complete. The team collected survey responses from 502 participants, primarily men and women aged 18-65. Their findings provided a general profile of sports viewers.

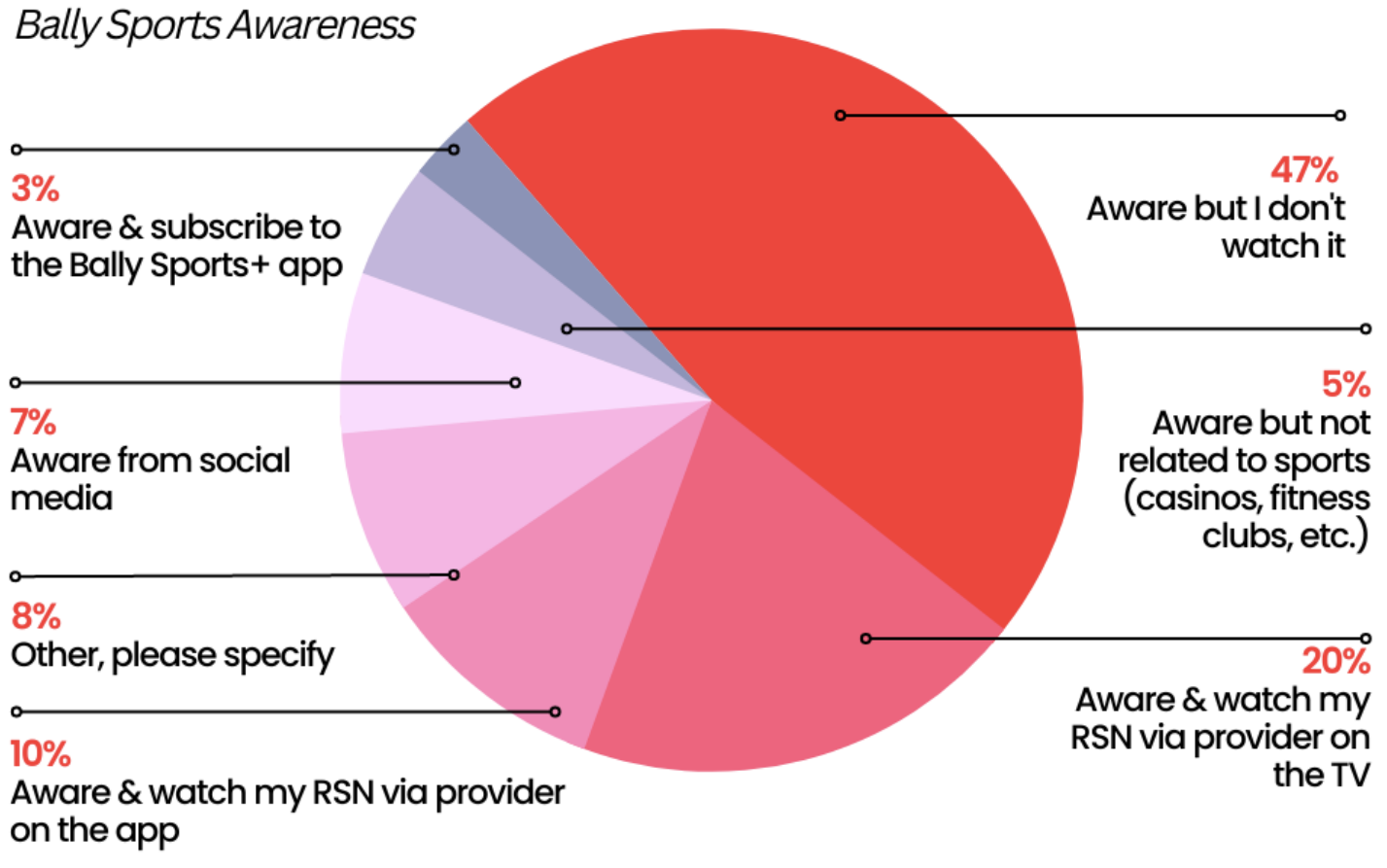

Addressing the Marketing Dilemma

Marketing is essential to the success of any product or service. The work of the VP of Marketing for Bally Sports focuses on resolving issues of awareness and conversion by creating marketing items that can scale across each region. The team found that three in five (61%) survey respondents reported that they are aware of Bally Sports. The key issue is conversion, as nearly half of those survey respondents who are aware of Bally Sports (47%) noted that they do not watch sports using the service. More concerning is that of those who do utilize Bally Sports, only 3% report subscribing to the new DTC app, Bally Sports+.

Take this in contrast to ESPN+, the top choice among sports providers for our survey respondents. The VP’s goal is for Bally Sports to be relatable to diehard fans, casual fans, and everyone in between, but this is a heavy burden in an oversaturated market where fan preferences differ by age, location, and a myriad of other factors (personal communication, December 16, 2022).

Figure 5. Marketing Sports Streaming Services

Image Source: The Atlantic

A Senior Analyst of Research for ESPN, stated that it has become even more difficult to earn consumers' money and attention (personal communication, January 17, 2023). Among the survey respondents who purchase sports programming, almost half (49%) indicate paying $20 a month or less, while 8% pay at least $80 or more. Even though a strong majority of our survey takers (70%) report watching five hours or more of sports programming per week, the congested media landscape is making it difficult to market sporting events and create automatic recall in consumers’ minds. The Senior Analyst adds that once sports media providers have grabbed their audience's attention, enhanced privacy laws and password sharing can make it difficult to obtain accurate viewership data (personal communication, January 17, 2023). Moreover, a surprising 43% of the survey viewers claim they do not pay to watch sports, and some admit to watching illegal streams. This hesitancy from audiences to spend their own monetary resources on watching live sports legally may be a consequence of high subscription costs or blackout restrictions, which are the leading viewing frustration claimed by more than a third (35%) of survey respondents.

Figure 6. Question: Which one of the following options best describes how you have experienced Bally Sports?

Image Source: Creation of Research Team

Bally Sports has an intrinsically valuable product in each RSN that carries a unique identity built around local teams and their domain. Bally Sports Director of Marketing, shared that the company intends to be the bridge between the fans and their teams. This goal can be achieved primarily through distribution deals and co-branded marketing campaigns with locally owned businesses. This would help the brand reflect an authentic portrayal of each sports region's culture, experience, and values while also creating digital content to be reposted through traditional and digital advertising that resonates with consumers (personal communication, December 16, 2022). Effectively communicating the value of Bally Sports to audiences is essential, but marketing improvements are just one area that needs to be addressed.

enhancing the user experience

User experience, specifically within the Bally Sports+ application is a prevailing grievance among the survey respondents, who lament that Bally Sports has a troublesome app user interface, inadequate broadcast visuals, and makes watching their teams more difficult. As the survey respondents indicated, the most important aspect of the viewing experience is on-time streaming with minimal ads. Watching their team live without interruption was selected as the top priority for 73% of sports viewers in our survey. VP of Product Development for Bally Sports+, explained that the company is producing thousands of live-stream games a year without satellites (personal communication, December 12, 2022). Compared to broadcast, where a single signal is picked up by separate devices, streaming requires multiple signals to be sent to multiple receivers, which can cause disruptive delays and discontent among viewers, like the Bally Sports+ users (Whalen, 2023).

Figure 7. Bally Sports+ Announcement

Image Source: Bally Sports

Once these core technological issues are addressed, Bally Sports should leverage consumer preference data gathered from Bally Sports+ to create value-adding services. These enhancements will drive customer loyalty by increasing the benefits derived from being a member of the Bally Sports community through elements such as membership rewards, reaction features, and discussion rooms. As learned in the survey, 45% of respondents report relying on social media for updates, with Reddit and Twitter being the most popular. Of those who use social media while viewing sports, more than half (51%) signify they interact by posting, liking, or commenting on sports content and a majority (60%) prefer to “like” or comment on others' content. Interconnectivity and information sharing are essential to sports viewers.

ESPN and other national broadcasters may have the vast market dominated, but there is an appetite for customized content for the local fan. Manager of Youth Engagement and Development at Orlando Magic, added that the biggest opportunities lie in incentivizing the viewing of sports through offers like in-app gamification, loyalty badges, giveaways, and trivia (personal communication, December 9, 2022). Similar tactics are being used in MLB, explains their Creative Director, “to keep people within the app, we have these games…where they can play for hours. But at the same time, it is creating content that [resonates] with [users]” (personal communication, December 8, 2022). VP of Product Development for Bally Sports+ agrees with his colleagues throughout the industry and notes that, beyond gamification, the Bally Sports+ app is attempting to combat declining viewership by selling segments of games, personalizing the viewing experience through local partnerships, and offering tier-based subscription models (personal communication, December 12, 2022).

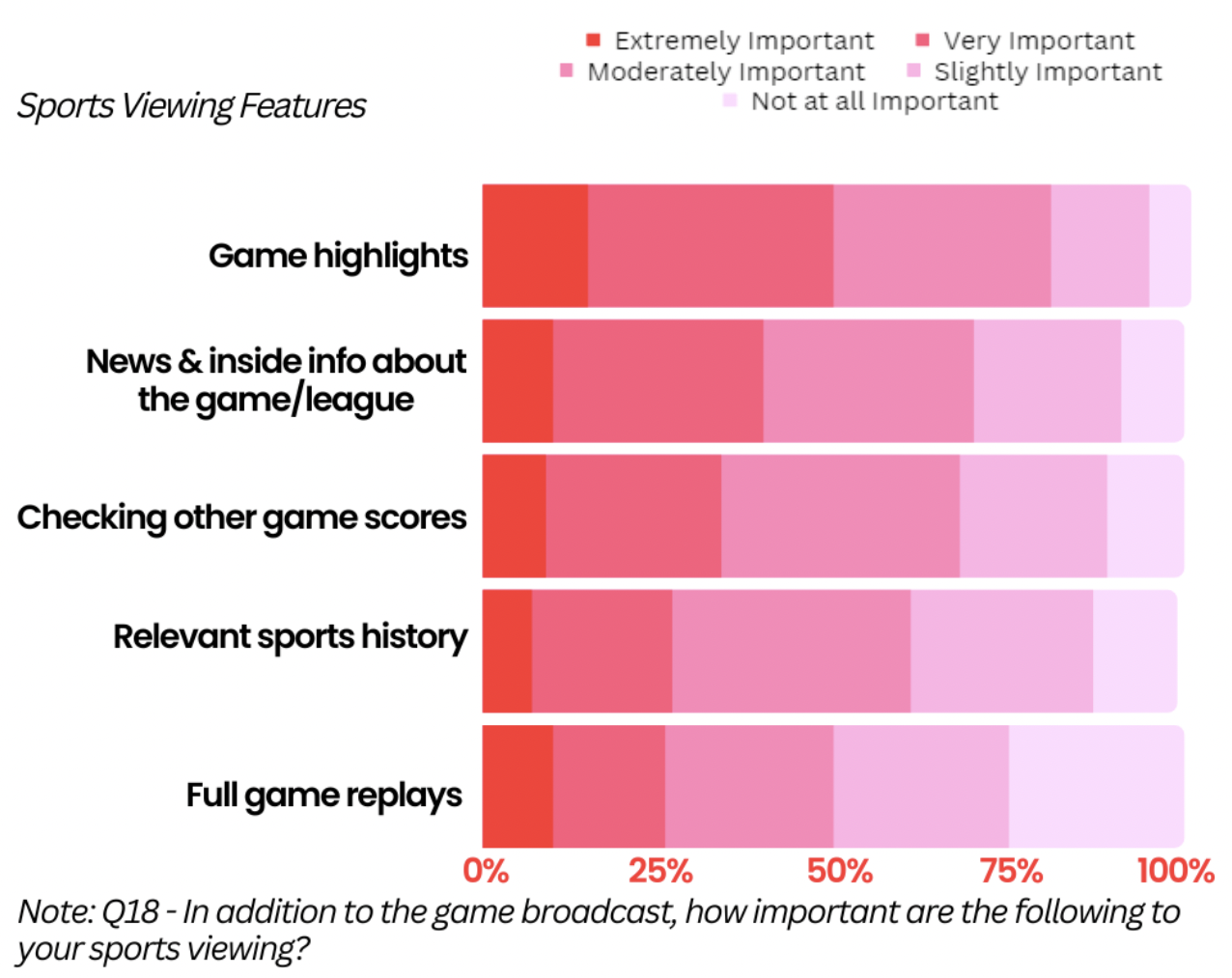

improving current offerings

All of the tactics being implemented by sports professionals are supported by research, according to EVP, Head of Sports at NRG. He believes that as an RSN, Bally Sports must focus on unique offerings and niches that other sports media companies are not providing. However, he concedes that finding value for the fans is a challenge, especially in the digital age where content and audiences are more fragmented than ever before (personal communication, February 15, 2023). While he lauds customized camera angles, non-fungible tokens (NFTs), and betting as opportunities fans are looking for, our survey contradicts these assertions. The respondents indicated that relevant content, such as game highlights, insider news, and timely score updates are extremely important features of their sports viewing experience.

Figure 8. Question Asked

Image Source: Creation of Research Team

In comparison, when asked about their interest in buying, selling, or trading NFTs, 92% of the survey respondents reported having no interest. Customized camera angles and betting opportunities garnered similar disinterest from 35% and 64% of respondents, respectively. It must be acknowledged that there is no one-size-fits-all solution to attracting, engaging, and retaining sports viewers. This problem requires analysis across all fandom demographics. For example, in determining the method consumers use to view sports, the survey found that the majority of audiences (81%) claim to primarily watch live games on a TV via broadcast, cable, satellite, fiber optic, or streaming. A computer, phone, tablet, or game console is the reported primary viewing mode for 17% of audiences, and 2% attest that they opt to attend the games in person. Looking at generational preferences, an ESPN representative stated that younger audiences are more engaged on digital devices (as we all might have expected), but they are also more likely to stay and watch complete games than their older counterparts (personal communication, January 17, 2023). This may be due to the increased difficulty of “flipping” channels on streaming services versus the ease of traditional cable

Furthermore, he asserts that younger viewers are fans of fewer sports than older fans and have a lower interest i following specific athletes but are attracted to human interest pieces. Additional research from the VP of Content & Strategy at NRG supports these claims. She adds that Gen Z does not consider the live nature of sports as a major selling point, as Gen Z is more interested in playback features that can be engaged on demand. (personal communication, February 3, 2023). In contrast, 92% of the respondents claim to watch the game live instead of viewing the full game or only the highlights of the game after it airs.

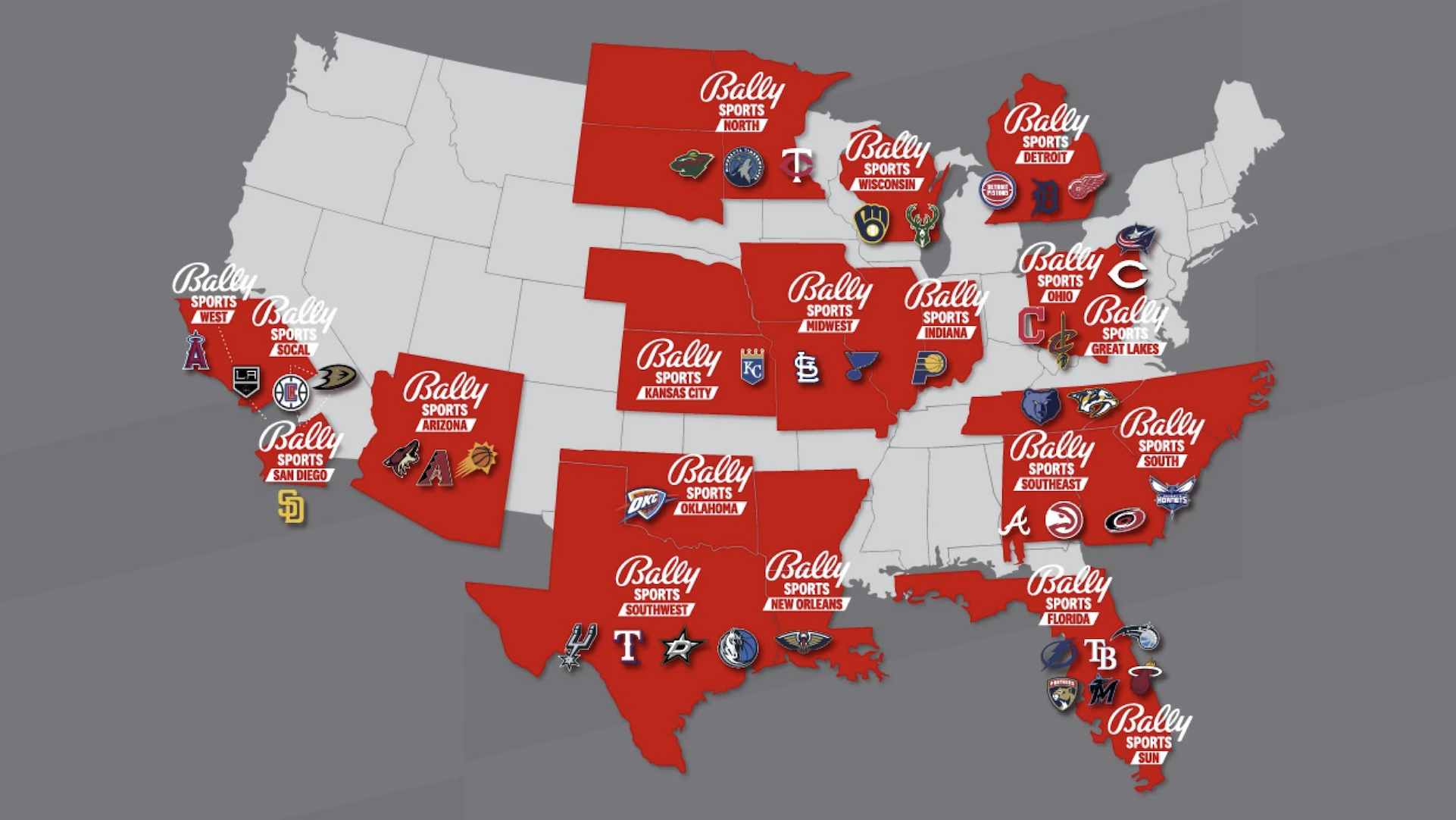

Figure 9. Bally Sports Current Reach

Image Source: Cord Cutters News

Viewing methods are not the only difference across audience demographics. For instance, not all teams currently have SAP (secondary audio program) commentators, which prevents non-English speakers from enjoying sports to their full ability. (personal communication, December 9, 2022). As a representative from Athletes First reaffirmed, “Content is key,” and leveraging the personal side of sports with human interest pieces can create a more enduring connection with fans (personal communication, December 9, 2022). In an ultra-competitive media landscape, creating content that is representative of its audiences’ needs must be a priority for Bally Sports.

Streaming vs. Broadcast: A Fight to the Death?

During the interviews, we asked many of the industry professionals if they believed the current state of broadcast and streaming was sustainable. Most admitted that it is not financially realistic for consumers to have a multitude of streaming subscriptions, and consolidation could create ease of access for users (personal communication, February 15, 2023). One respondent added that technology will continue to become more intertwined with sports, providing further viewership data and ideally elevating the fan experience. In the future, he believes there will be more innovative deals for premium sports carriage agreements, especially for digital rights and packaging, though linear broadcast still plays an integral role in sports viewership (personal communication, February 15, 2023). Citing the Major League Soccer (MLS) licensing deal with Apple TV, another respondent maintains it is not in the best interest of any league to take all of their games to one streaming service. MLS now has to figure out how to get more viewers without using linear cable providers (personal communication, December 16, 2022). In response to these concerns, MLS is partnering with FOX to broadcast select games, but scaling and attracting new consumers will still be a challenge for the league. A representative of Bally Sports Marketing understands better than most the importance of straddling both the broadcast and streaming worlds. He explained that partnerships with FuboTV, Xfinity, and other linear and paid TV distributors act as gateways for more users to become aware of Bally Sports. This awareness engages new subscribers by keeping them in a singular viewing ecosystem and generates major revenue through advertising fees and carriage agreements (personal communication, December 16, 2022). The main goal is for Bally Sports to be a provider and aggregator in partnership with these platforms, offering convenience to consumers (personal communication, December 16, 2022).

If Bally Sports can manage this balancing act and leverage its expertise in production, these advantages will help them (at least in the short-term) from being overtaken by technological companies or the leagues themselves. In our last chapter, we propose practices for improving Bally Sports' attraction, engagement, and retention of sports viewers based on our research and analysis.

CONCLUSIONS

Using multiple avenues, Bally Sports can appeal to and grow audiences of all demographics. Attracting new subscribers through partnerships with SVOD and advertising video-on-demand (AVOD) providers will be important for combatting areas of low brand awareness. These partnerships can also address user frustration with locating game broadcasts, switching between multiple platforms, and additional login steps. Targeted advertisement within localized regions and influencer partnerships will also be crucial to enhancing marketing. Furthermore, creating short-form content exclusive to mobile platforms and social media is key to garnering younger audiences. Each of these targeted groups can convene through in-person events and online forums.

Bally Sports’ biggest challenge is improving user experience. Fans want to watch high-quality video broadcasts without delays. Improving on-screen graphics and diversifying game commentary are baseline advances. The next steps are to increase viewership duration, frequency, and brand loyalty through incentives like elevated loyalty programs. At the outset, they incorrectly presumed that gambling, Web3, and other cutting-edge technologies were necessary to satisfy viewers. However, the survey suggests the interest in gamification and sports betting opportunities are niche among audiences, with 64% of respondents expressing no interest in betting as an additional feature to their sports viewing experience and only 5% expressing extreme interest. As more states legalize sports gambling, this exponentially growing industry must be given deeper consideration.

The sports media landscape was irrevocably changed by the Department of Justice’s intervention in Disney’s purchase of 21st Century FOX. By forcing the ESPN parent company to divest its FOX Sports Networks, a precedent was set for streaming providers to enter the market and grab their share of the potential profits (Bucaille, 2022). RSNs have traditionally been a distribution vehicle for local sports broadcasting in a designated area, but what was once considered a secondary afterthought to the streaming content library, is now being viewed as a lucrative opportunity to attract subscribers and increase advertising revenue by using RSNs to enter the sporting arena. Many satellite providers have monetized RSNs for years by requiring viewers to pay extra for add-on sports tier packages, but streaming services are now offering a competitive alternative with embedded sports programming without the friction of traditional broadcast subscriptions.

RSNs must find avenues to contend with over-the-top (OTT) streaming services that have the disposable income available to compete in licensing deals, while also diversifying from traditional broadcast methods and finding ways to connect fans more directly to their teams. RSNs come from a position of strength due to the barriers of entry for other media companies, like licensing fees and broadcast infrastructure that are necessary to support live games (personal communication, February 15, 2023). To move from a defensive stance to an offensive one, the team believes that Bally Sports must offer ease of access and high-quality coverage at a reasonable price point. Currently, “62% of sports fans say that it’s too expensive for them to pay for all the channels and streaming services that carry their favorite sports,” (Cumberbatch et al., 2022).

Furthermore, “only 25% of viewers can correctly identify which TV channels or streaming services carry the rights to which sports,” (Cumberbatch et al.,). The creation of Bally Sports+ presents an opportunity to address these issues while adding a unique value proposition beyond their traditional broadcasts. The team has identified many ways in which this can be accomplished. For instance, niche sports that lack the pervasiveness of larger leagues have a chance to expand their reach through the platform. Moving beyond the confines of traditional TV broadcast also affords Bally Sports+ the freedom to implement additional socialization and customization features to their broadcasts, and experiment with disruptive ad formats. It is maintained that the success of these recommendations is contingent upon providing high-quality entertainment above all else.

-

Bally Sports+ FAQs. (n.d.). Www.ballysports.com. https://www.ballysports.com/plus/faqs

Bally Sports North. (2021, March 30). The Heart Of The Team.… [Video]. Facebook. https://www.facebook.com/BallySportsNorth/videos/bally-sportsnorth/244844167340884/

Bally Sports owner declares bankruptcy, citing $8 billion in debt. (2023, March 15). Www.cbsnews.com. https://www.cbsnews.com/news/diamond-sports-bankruptcy-ballysports-network/

Bally Sports South. [@ballysportsso]. (n.d.). The official Instagram account for Bally Sports https://www.cbsnews.com/news/diamond-sports-bankruptcy-bally sports-network/

South and Bally Sports Southeast. [Instagram profile]. Instagram.https://www.instagram.com/ballysportsso/?hl=en

Barstool Sports. [@brstoolsports]. (n.d.). Viva La Stool [Instagram profile]. Instagram. https://www.instagram.com/barstoolsports/

Bearden, S. (2022, January 19). The most important direct mail marketing statistics for 2022. Linemark. https://www.linemark.com/the-most-important-direct-mail-marketing statistics-for2022/#:~:text=Direct%20mail%20shows%20a%2037,brands%20they're%20interested%2 0in.

Bouma, L. (2023a, January 29). As Bally Sports Prepares for Bankruptcy, We Explain Why. Cord Cutters News. https://cordcuttersnews.com/as-bally-sports-prepares-for-bankruptcywe-explain-why/

Bouma, L. (2023b, February 16). Pluto TV now has nearly 79 million monthly active users. Cord Cutters News. https://cordcuttersnews.com/pluto-tv-now-has-nearly-79-millionmonthly-active-users/

Bridge, G. (2022, December 27). U.S. Online Sports Betting Breaks Record in 2022. Variety. https://variety.com/2022/sports/tech/u-s-online-sports-betting-breaks-record-in-2022-80-billion-nfl-march-madness-1235467345/

Bucaille, A. (2022, November 30). Live sports: The next arena for the streaming wars. Deloitte Insights. https://www2.deloitte.com/us/en/insights/industry/technology/technologymedia-and-telecom-predictions/2023/live-sports-streaming-wars.html

Burns, M. J. (2022, December 13). Gen Z Keeps Sports Executives Up at Night. Here’s What They’re Doing About It. Morning Consult. https://morningconsult.com/2022/12/13/gen-zinterest-in-watching-sports/

Carriage Agreement Definition. (n.d.). Law Insider. https://www.lawinsider.com/dictionary/carriage-agreement

Cumberbatch, M., Miller, G., Chaidell, A., Mauri, R., Cook, B., Navaratnam-Blair, F., & Kaufman, J. (2022). Live sports: The streaming wars’ next frontier? In National Research Group. National Research Group. https://www.nrgmr.com/ourthinking/live-sportscould-be-the-next-frontier-in-the-streaming-wars/

Definition of cord cutting. (n.d.). PCMAG. https://www.pcmag.com/encyclopedia/term/cordcutting

Dellatto, M. (2023, February 17). Paramount gains subscribers as Disney+ reports losses: Where all the major streaming services stand. Forbes. https://www.forbes.com/sites/marisadellatto/2023/02/16/paramount-gains-subscribers-as disney-reports-losses-where-all-the-major-streaming-services-stand/

Emrich, S. (2022, June 6). The importance of print media and how it can benefit your brand. Entrepreneur. https://www.entrepreneur.com/growing-a-business/the-importance-of-print-media-and-how-it-can-benefit-your/426749

Fletcher, B. (2022a, April 14). Charter, Sinclair reach distribution deal for Bally Sports RSNs [Review of Charter, Sinclair reach distribution deal for Bally Sports RSNs]. Fierce Video. https://www.fiercevideo.com/video/charter-sinclair-reach-distribution-deal-ballysports-rsns-broadcast-stations

Fletcher, B. (2022b, August 18). Sinclair happy with early response to Bally Sports+ RSN service, plans September full launch. Fierce Video. https://www.fiercevideo.com/video/sinclair-happy-early-response-bally-sports-rsnservice-plans-september-full-launch

Donner, A., & Klar, N. (2000). Design and analysis of cluster randomized trials in health research. Arnold, New York.

Fatemi, F. (2022, November 14). How TV Viewing Habits Have Changed. Forbes. https://www.forbes.com/sites/falonfatemi/2022/11/14/how-tv-viewing-habits-havechanged/?sh=b8e176e48885

Grand View Research (2022). Sports betting market size & share analysis report, 2030. Sports Betting Market Size & Share Analysis Report, 2030. https://www.grandviewresearch.com/industry-analysis/sports-betting-market-report

Green, D. T. (2022). Capstone Project I and II [Syllabus]. Los Angeles, CA: Master of Entertainment Industry Management, Carnegie Mellon University.

Hayes, D. (2022, December 21). Bally Sports Regional Networks Seal Carriage deal with FuboTV, ending lengthy absence from major streaming bundles. Deadline. https://deadline.com/2022/12/bally-sports-seals-carriage-deal-with-fubo-tv-streaming1235204339/

Kaplan, D. (2022, November 30). Bally Sports reports continued subscriber losses, lower cash flow as RSN model teeters. The Athletic. https://theathletic.com/3953550/2022/11/30/bally-sports-rsn-nhl-mlb-nba/

Kirshner, A. (2022, September 12). Sports streaming makes losers of us all. The Atlantic. https://www.theatlantic.com/technology/archive/2022/08/sports-streaming-makes-losersus-all/671231/

Kujawa, T. (2022, April 22). What Is a Regional Sports Network? CableTV.com. https://www.cabletv.com/blog/regional-sports-network

Lafayette, J. (2023, January 2). 12 Television Business Execs To Watch as 2023 Unfolds. Broadcasting Cable. https://www.nexttv.com/news/12-television-business-execs-towatch-as-2023-unfolds

McCammon, S. (2021, March 28). New study reveals young sports fans prefer highlights over Real games. NPR. https://www.npr.org/2021/03/28/982035026/new-study-reveals-young-sports-fans-preferhighlights-over-real-games

Merriam-Webster. (n.d.). Gamification. In Merriam-Webster.com dictionary. https://www.merriam-webster.com/dictionary/gamification

Pattison, S. (2022, May 28). 35 Streaming Services Statistics You Need to Know in 2022. Cloudwards. https://www.cloudwards.net/streaming-servicesstatistics/#:~:text=Although%20we%20may%20only%20think

Potrel, V. (2022, September 12). Council post: Five insights into the popularity of short-form video content. Forbes. https://www.forbes.com/sites/forbescommunicationscouncil/2022/09/06/five-insights-intothe-popularity-of-short-form-video-content/?sh=27b49dbf79

Schneider, M. (2022, December 30). Top 100 telecasts of 2022: 'Yellowstone' rules, Oscars recover, NFL dominates and Amazon makes history. Variety. https://variety.com/2022/tv/news/top-rated-shows-2022-yellowstone-ncis-oscars-fbisuper-bowl-1235475629/

Sinclair Broadcast Group (2022). 2022-2023 RSN NBA & NHL Ad Effectiveness Questionaire (Draft V3.0.) [Data set]. Lieberman Research Worldwide.

Staff, S. B. (2022, December 8). Global value of sports media rights hits $55bn, to top $60bn by 2024. SportBusiness. https://www.sportbusiness.com/news/global-value-of-sports-mediarights-hits-55bn-to-top-60bn-by2024/#:~:text=At%20present%2C%20around%2097%20per,the%20new%20Global%20Media%20Report.

TV screen saver. Bally Sports TV Screen Saver. (2023, April 17). https://savemyscreen.net/

US AVOD Viewers, 2022-2026 (millions and % of population). (2022, February). Insider Intelligence. https://www.insiderintelligence.com/chart/255563/us-avod-viewers-2022-2026-millions-of-population

VAB. (2023, March 14). What is TV? new report by Video Advertising Bureau (VAB) provides a modern look at how consumers define TV--and the implications for marketers.

PR Newswire: press release distribution, targeting, monitoring and marketing. https://www.prnewswire.com/news-releases/what-is-tv-new-report-by-video-advertisingbureau-vab-provides-a-modern-look-at-how-consumers-define-tvand-the-implications-formarketers-301771753.html

Weprin, A. (2022, December 22). With YouTube Deal, the NFL Cements Itself as the Most Powerful Force in Entertainment. The Hollywood Reporter. https://www.hollywoodreporter.com/business/digital/youtube-nfl-sunday-ticket1235286848/

Whalen, S. (2023, January 6). Broadcasting vs. Streaming: What’s the Difference? Wowza. https://www.wowza.com/blog/broadcasting-vs-streaming-whats-the-difference#h-live broadcasting-vs-live-streaming-key-differences

What Are Sports Blackout Rules? (2020, June 30). Cordcutting.com https://cordcutting.com/blog/what-are-sports-blackout-rules/

YES Network. [@yesnetwork]. (n.d.). New York Yankees, Brooklyn Nets, New York Liberty and so much more. #YANKSonYES [Instagram profile]. Instagram. https://www.instagram.com/yesnetwork/