by Katie Remark

Fundraising is the lifeblood of any non-profit organization. It is the primary way to raise money for your organization’s work and keeps your organization running day-to-day to work on sustaining its mission. Your nonprofit should always be looking for new donation tools as part of your digital strategy. Non-profit fundraising has been made easier than ever before with the creation of technology and apps, such as Venmo.

Venmo is a peer-to-peer mobile payment service, primarily used to send money to friends and family, pay rent, or make purchases online. Using Venmo you can securely send and receive money instantly through an app on your phone. The Venmo app links to your bank account, credit, or debit card. Users can send payments to any other Venmo user in their network with the tap of a button. Venmo funds can be cashed out directly into your bank account as you receive them, with seamless, user-friendly integration.

Venmo is simplifying the fundraising process and allowing non-profits to reach a wider audience of supporters, including younger donors who could potentially become more involved with the organization over time.

More people are also using their mobile devices to browse the Internet, make purchases, and engage with organizations. In fact, in 2023, 25% of donors completed their donations on a mobile device. Many of those donors are also using Venmo. According to an article by Oberlo, there were 77.7 million active users of Venmo in the United States in 2022. In 2023, Venmo is forecasted to grow its number of active users by 9.5% to 85.1 million.

To use Venmo for fundraising, you have to register as a nonprofit. Registering as a Venmo nonprofit is a fairly straightforward process. Venmo’s FAQs explain: “Venmo charity profiles are available for charitable organizations (and 501c3s) that have created an account and confirmed their charity status with our parent company, PayPal.” Once your organization’s status is confirmed, you create a charity profile on Venmo and can begin collecting donations.

The Venmo app itself has a simple interface that new users can quickly pick up on. Instead of navigating to your website’s donation page, donors now have the ability to donate to as many non-profits as they wish, all within the same app.

Who are Venmo Users?

Image Source: Unsplash

Venmo has grown in popularity in recent years, especially among millennials and Gen Z. According to the Business of Apps, 50% of Venmo users are aged 25 to 34, while 33% are between ages 18 and 24. Your non-profit organization should make it as easy as possible for these users to donate! And if they stay committed to your cause, they could even become lifetime donors.

With such a young demographic of users, Venmo is the perfect platform to use to connect with a new generation of donors. According to an article by Balancing Everything, Venmo had over 50 million active users in 2019, and the app processed nearly $160 billion in total payment volume in 2020. Since the COVID-19 pandemic in 2020, the amount of Venmo users has continued to increase. In 2021, more than 70 million people had accounts. Thus, Venmo is quickly becoming a preferred method of sending and receiving money, and non-profit organizations should be taking note.

How is Venmo a Path Donors might prefer

Image Source: Newsroom

There are many ways Venmo will help take your non-profit organization to the next level. Incorporating Venmo will allow your donors to make secure donations directly from their phones, whether they are at a fundraising event or at home reading your organization’s latest newsletter. Venno will save them from having to fill out sensitive payment information, insert a credit card, or write a check. Since people use Venmo as part of their personal lives, making a Venmo account for your non-profit changes the game for donations. Instead of going through the formal process of filling out a donation form, donors can now just send you money as they would do for people they know. Venmo is a familiar and easy process for most social media users and many donors.

Why Venmo?

Image Source: Computerworld

As fundraising for nonprofits continues to evolve and adapt to new technologies and trends, we see a significant shift toward digital fundraising. This is predicted to continue due to a number of both social and generational changes to the giving landscape such as money, time, and costs.

Some donors no longer use cash as their primary payment method, relying instead on digital wallets and online banking transactions. Our ability to focus is changing as well. Prospective donors want to have access to giving options that are quick, frictionless, and embedded into platforms they already use. Most digital fundraising tools are free, which is another selling point for donors.

Venmo includes a social element to money exchange and Peer-to-peer fundraising is also a popular way for nonprofits to engage and mobilize their supporters. This is a type of online fundraising campaign in which non-profit supporters take a more active role in supporting their favorite organizations. Organizations recruit volunteers to launch personalized campaign pages. This model allows non-profits to expand their networks, allow supporters to get more involved, engage supporters virtually, and grow their social media presence.

Venmo users tend to keep money in their accounts to easily have access to funds the next time they need to pay someone back. This increases the likelihood of them donating even greater—the money is already in their Venmo account! They won’t need to transfer funds from a bank or card, so they may feel more inclined to donate. Since users tend to keep extra money in their Venmo accounts, they don’t consider it a part of their budget. People can feel comfortable giving $10, $100, or $1,000 through Venmo because of the nature of the app. Small-dollar and informal fundraising initiatives have become especially popular on Venmo.

The potential new audience you can reach through Venmo also factors into your involvement with your organization’s supporters within the app. Venmo utilizes a social media feed that shows your friends and who they are sending money to and allows people to like and comment on transactions. This can be a useful tool for your organization as a way of creating involvement with donors. Through this feature, you can also see all of the donations being made to your organization and instantly like and comment on them. This is a great way to thank and interact with your supporters after they donate.

Venmo is a reputable payment processing platform with encryption. The platform protects users’ account information while monitoring account activity to prevent suspicious transactions. Donors will feel comfortable contributing to your organization without having to worry about their information being compromised.

How Does Venmo Benefit Non-Profit Organizations?

Image Source: Merchant Maverick

Although Venmo is an excellent tool for prioritizing the donor experience, it also boasts many advantages for non-profits that create an account. Venmo is highly affordable to non-profit organizations. It doesn’t charge any monthly fees. It also doesn’t charge fees for sending money with a linked bank account, debit, or credit card. Non-profit organizations just pay a low transaction fee of 1.9% + $0.10.

Venmo’s social media feed aspect makes it easy to add family and friends to see their transactions and vice versa. This feature allows donors to show off their support of your organization and encourage others to do the same.

With other platforms, it’s often up to your staff to manually send out confirmations and tax receipts. That takes time away from more meaningful work. Plus, the margin of error is greater when procedures like this are performed manually. Using Venmo, donors also automatically receive a gift confirmation and tax receipt. After a user sends a donation, Venmo will issue a transaction receipt to both the user and the charity. In the transaction receipt, the charity will be given the email address associated with the donor’s Venmo account, where the charity can send a written acknowledgment, if applicable.

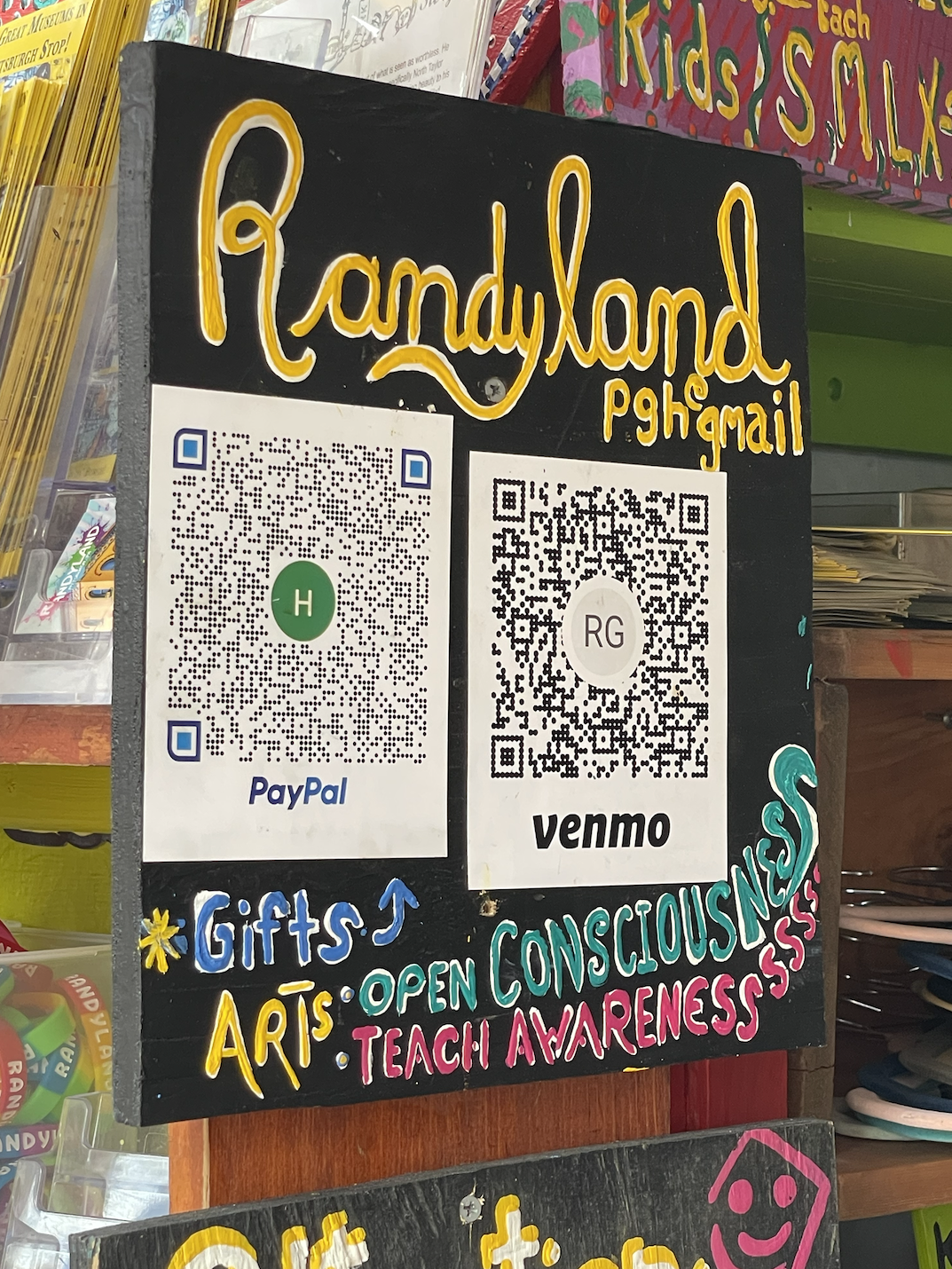

Using Venmo will also alleviate your donors from having to search for your account in the app. Venmo provides each user with a QR code that can be shared easily. Once the QR code is scanned, the user will be redirected to your organization’s Venmo page, allowing you to connect accounts and transfer money immediately. You can add this QR code to your organization’s emails, newsletters, and other marketing materials.

When implementing Venmo into your non-profit's digital strategy, it’s essential that you send out an introductory onboarding email to let donors know it’s an option, whether or not your audience is on Venmo. In the email, it is important to outline what Venmo is, why your organization has decided to use it, and how your audience can use it to donate. If there are particular captions you want your donors to say, let them know.

Why are Arts Nonprofits Using Venmo?

Image Source: Unsplash

Case Example: How Save the Children is Using Venmo

Image Source: Save the Children

In 2017, Save the Children became one of the first charities to accept Venmo. The organization knows that Venmo users are a digitally engaged and mobile-first audience. Save the Children was also an early adopter of other digital payment options for charitable giving, such as PayPal, Apple Pay, Bitcoin, PaySafeCard, G2A Pay Wallet, YouTube donate cards, and Facebook donate buttons.

Case Example: Randyland Has Donations & Trust-Based Purchasing

Image Source: Brett Ashley Crawford

A well-known, free to the public Pittsburgh arts venue known as Randyland is operating on a trust-based purchasing & donation system using PayPal and Venmo. Visitors have the option to explore the art outdoor courtyard free of charge, but also have the option to purchase various memorabilia from the store contained within the courtyard or donate any amount to Randy, the artist himself.

Event-Oriented Giving

Image Source: Venmo

Another important aspect of Venmo is that it can be utilized to make event giving more seamless. A way to make use of the social media feed aspect of Venmo is to live stream it, whether it be during an in-person or virtual fundraising event. All of your supporters attending or viewing the event can see donations coming in and interact with them as well. When attendees see this live stream, they will be more inclined to donate themselves.

Charities using Venmo can also request a QR code kit that includes physical items such as stickers and lanyards with your charity profile QR code printed on them. You can take these items with you to events!

Conclusion

It’s time for your non-profit organization to consider moving into the new age of digital donations using Venmo. With the payments industry experiencing considerable changes in the last decade, non-profits need to start embracing technology to help them achieve success with their fundraising campaigns.

-

C., Chiara. “Digital Fundraising 101: Exploring the New Frontier of Digital Giving.” Charity Village, July 7, 2023.

https://charityvillage.com/digital-fundraising-101-exploring-the-new-frontier-of-digital-giving/.

Davis, Kylie. “Nonprofit’s Complete Guide To Venmo Fundraising.” Givebutter. Accessed July 5, 2023. https://givebutter.com/blog/venmo-for-nonprofits.

Ensor, Kristine. “Using Venmo to Increase Nonprofit Donations [Venmo for Nonprofits].” Nonprofit Blog (blog), April 20, 2022. https://donorbox.org/nonprofit-blog/venmo-for-nonprofits.

Esquivel, Meredith. “Venmo for Nonprofits: Our Predictions and Strategic Suggestions.” Whole Whale (blog). Accessed July 5, 2023. https://www.wholewhale.com/tips/venmo-nonprofits/.

GiveCampus. “Using Venmo for Nonprofit Donations.” Accessed July 5, 2023. https://go.givecampus.com/blog/why-venmo-and-why-now/.

Kier, Nicolette. “The Complete Guide To Venmo For Nonprofits: How & Why To Use Venmo For Donations & Fundraisers.” Merchant Maverick, December 7, 2022. https://www.merchantmaverick.com/venmo-for-nonprofits/.

Love, Jay. “Peer-to-Peer Fundraising: The Ultimate Guide for Success.” Bloomerang. Accessed July 27, 2023. https://bloomerang.co/blog/peer-to-peer-fundraising/.

Megaphone, Nonprofit. “How to Use Venmo to Take Fundraising to the Next Level.” Nonprofit Megaphone (blog), June 1, 2021. https://nonprofitmegaphone.com/venmo-nonprofit-fundraising/.

Nonprofits Decoded. “Venmo for Nonprofits: A Digital Fundraising Secret or Potential Trap?,” January 4, 2022. https://nonprofitsdecoded.com/venmo-for-nonprofits/.

Oberlo. “How Many People Use Venmo? (2019–2026).” Accessed July 27, 2023. https://www.oberlo.com/statistics/how-many-people-use-venmo#:~:text=In%202023%2C%20the%20company%20is,in%202024%20and%202025%2C%20respectively.

PRIDE Philanthropy. “Top 5 Trends in Fundraising for Nonprofits in 2023 (so Far!).” Accessed July 5, 2023. https://pridephilanthropy.com/blog/top-5-trends-in-fundraising-2023.

Save the Children. “Save The Children Now Accepts Donations Using Venmo.” Accessed August 1, 2023. https://www.savethechildren.org/us/charity-stories/save-the-children-now-accepts-donations-using-venmo.

The Raisely Blog. “Should You Be Using Venmo for Nonprofits?,” November 10, 2022. https://www.raisely.com/blog/venmo-for-nonprofits/.

“The Ultimate List Of Charitable Giving Statistics For 2023,” n.d. Venmo. “Sending Donations FAQ,” December 12, 2022. https://help.venmo.com/hc/en-us/articles/9750507590163-Sending-Donations-FAQ.

Venmo Help Center. “Charity Profile FAQ.” Accessed July 27, 2023. https://help.venmo.com/hc/en-us/articles/6678084998291-Charity-Profile-FAQ.

Weinger, Adam. “How Venmo for Nonprofits Can Help Organizations Raise More.” Double the Donation (blog), August 3, 2022. https://doublethedonation.com/venmo-for-nonprofits/.

Woloszyn, Jess. “Venmo Donations for Nonprofits: How to Convert Support Into Fundraising Dollars.” Classy, July 19, 2023. https://www.classy.org/blog/venmo-donations/#:~:text=Venmo’s%20peer%2Dto%2Dpeer%20model,directly%20into%20their%20bank%20account.