Written by Yuxin Du

Our recent articles have examined NFTs’ recent rise and issues surrounding their environmental impact. This article looks more in depth at crypto art’s origins and the place it will hold in the future.

As defined in previous articles, crypto art is “a digital artwork that is published directly onto a blockchain in the form of a non-fungible token (NFT), which makes the ownership, transfer, and sale of an artwork possible in a secure and verifiable manner.” All crypto art exists in the form of NFTs, but not all NFTs are crypto art. The illustration below provides some clarification about this distinction.

Figure 1: NFT diagram.

How did Crypto Art develop?

Monegraph is considered to be the first marketplace to register art on the bitcoin blockchain, and it was launched in 2014. Artists could sign in to the website with their Twitter account and upload the URL of their digital work. In return, they received a blockchain key and value they could store in a NameCoin wallet. Monegraph detected the similarity between images and tweeted out an announcement of the ownership to commit it to public record.

In 2015, BitchCoin, a cryptocurrency for buying art and investing in the artist; Ascribe, a project aiming to help artists claim ownership of their work on the blockchain that is no longer active; and Verisart, a service that helps create certificates of authenticity securely registered on the blockchain, were launched. For the purpose of this research, I divided the development of crypto art from 2016 to now into three phases, identified as crypto art 1.0, 2.0, and 3.0.

Crypto art 1.0 was a time that members were motivated more by creative experimentation than any obvious financial benefit. Crypto art 1.0 started with Joe Looney’s Rare Pepe Wallet in 2016. Rare Pepe Wallet claimed to be the “first blockchain community where anyone can submit artwork to be bought, sold, traded, or destroyed on the blockchain.” The creation of Rare Pepe Wallet set the foundation and navigated the direction for the blockchain art market in the subsequent years.

Some firsts for Rare Pepe Wallet included:

First blockchain community where anyone could submit artwork to be bought, sold, traded, or destroyed on the blockchain;

First to offer the above service while taking zero commission;

First to create a gift card system that allows for gifting artwork to people who do not own any cryptocurrency;

First to conceive of VIP content like songs and games tied to the token in addition to the artwork;

First to move a digitally scarce artwork to a physical piece of hardware;

First to create a digital artwork tied to the blockchain that changes its representation based on what machine it is displayed on.

The Rare Pepe community proved the feasibility of the blockchain art market and sold over $1.2 million worth of digital art. With the success of Rare Pepe Wallet, many other platforms popped up, such as Crypto Punks, Dada.NYC, and Curio Cards. Because there was no template or experience for how art on the blockchain should work, all of these platforms were very different from each other.

Crypto Punks was an idiosyncratic art project created by two software developers, Matt Hall and John Watkinson, in 2017. Hall and Watkinson created this software program that would randomly generate different, strange-looking characters. This art project consists of ten thousands 24x24, 8-bit-style pixel art images. Each image has its own unique features. Hall and Watkinson created this project to express a raucous, anti-establishment spirit, which was a common sentiment in the early days of the blockchain movement. They explained that, “The art pieces needed to be a collection of misfits and non-conformists. The London punk movement of the 1970s felt like the right aesthetic.”

Figure 2: CryptoPunks project by Larva Labs. Source: Larva Labs.

Other platforms and projects in blockchain 1.0 were also driven by the “decentralized” ethos, developed more as creative communities than by a real business model for making money.

Crypto art 2.0 started with the explosion of CryptoKitties, which is a blockchain game on Ethereum that allows players to purchase, collect, breed, and sell virtual cats. CryptoKitties players used Ethereum to buy and sell unique digital kittens. Once players had two kittens, they could breed their own digital kittens and sell them in the market. It is one of the earliest attempts to deploy blockchain technology for recreation and leisure. The game's popularity in December 2017 congested the Ethereum network. It accounted for about 25 percent of Ethereum’s traffic, and more than 3.2 million transactions have occurred on CryptoKitties’ smart contracts.

From the CryptoKitties example, people saw the opportunity to make money with digital art on the blockchain and came into this marketplace, based on Ethereum. The 2.0 marketplace structure was more organized and business-like than 1.0. The 2.0 marketplaces were run more like businesses than the experimental grassroots community projects. Organizations included investors, legal advisors, and advertising budgets. Some projects in 2.0 include Super Rare, Known Origin, Portion, Rare Art Labs, and Digital Objects.

Crypto art 3.0 is focused on the artists’ control of their work in this marketplace—for example, how their work is displayed and what artworks appear next to their pieces. Some artists cared a lot on how their work was shown and context of their work. In crypto art 3.0, artists could easily tokenize artwork without knowing code or having extra technical knowledge.

Disruption in the Art Market

Crypto art disrupted the landscape of the art world in the following three aspects. First, because of the blockchain’s digital scarcity features, it creates a huge market for crypto collectibles and digital artwork. In the past, it was easy to duplicate and pirate digital artworks from digital artists. The piracies damage the value of artwork, have a negative effect on the economy, and might cause imbalances in the market. Things with scarcity have more value. Blockchain introduces the idea of "digital scarcity" to the digital market, which means “issuing a limited number of copies and tying them back to unique blocks proving ownership.”

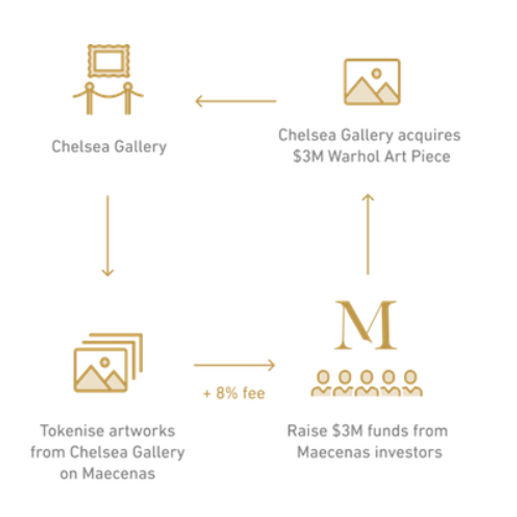

Second, the blockchain makes fine art investment more accessible and democratic. Company Maecenas is a good example to illustrate this point. Maecenas is the first blockchain-based art investment platform. It allows “anyone to buy, sell, and trade part ownership in masterpieces on a liquid exchange, aiming to make fine art investment accessible to everyone.” On this platform, individuals can buy shares in paintings from well-known artists, while organizations like galleries and museums can bid their collection to raise money. The biggest advantage of using the blockchain platform is to reduce the transaction costs by cutting out the intermediary. There are some examples, shown on the Maecenas website, about how it works to save money for buyers:

Gallery

Chelsea Gallery wants to acquire a $3 million piece to expand its Warhol collection.

Instead of getting a 3-year art-secured loan at a 13.5% annual interest, it can raise funds from Maecenas investors by listing some of their artwork at a 8% one-off fee.

This represents a saving of over $400,000 in fees for the gallery.

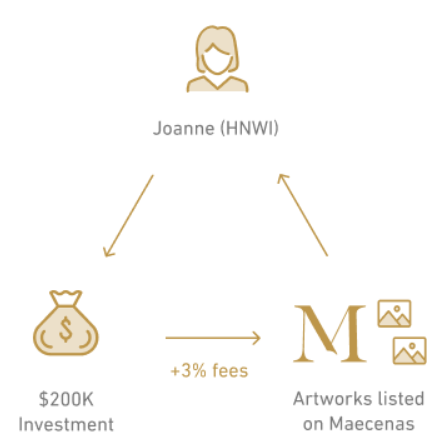

High Net Worth Investor

Joanne is a HNWI who wants to invest $200,000 in fine art to diversify her portfolio.

Her capital is too small for a Fine Art Fund, and she is not interested in long maturity terms. Auctioneers would charge her a 20% fee in buyer’s premium, which would make the investment considerably more expensive.

In comparison, Maecenas allows her to invest in a number of different art pieces easily, paying only 3% in fees via bank transfer or credit card.

Family Office

A client at a London Family Office has given the mandate to further diversify their portfolio by investing $15 million in fine art.

Purchasing art pieces from Christie’s would incur fees (buyer premium) of approximately $2 million.

By investing via Maecenas in an art-based financial instrument with similar performance, but a drastically lower fee, the client’s portfolio increases in value by more than $1.5 million.

Third, due to the blockchains’ characteristics of authentication and provenance, it effectively reduces counterfeit. Because blockchain is a distributed ledger, record from origin to current owner cannot be changed, which enables maximized authentication.

Conclusion

Knowing crypto art’s origins and place in the art market, artists and arts managers can consider how it fits into their operations. Crypto art will continue to advance and evolve, so understanding its current impact will help those in the art world maximize its potential.

+ Resources

Bailey, Jason. “Blockchain Art 3.0 - How To Launch Your Own Blockchain Art Marketplace.” artnome.com. February 27, 2019. https://www.artnome.com/news/2019/2/27/blockchain-art-30-how-to-launch-your-own-blockchain-art-marketplace

Bailey, Jason. “Rare Pepe Wallet & The Birth Of Crypto Art.” artnome.com. January 25, 2018. https://www.artnome.com/news/2018/1/23/rare-pepe-wallet-the-birth-of-cryptoart

Bailey, Jason. “The Blockchain Art Market Is Here.” artnome.com. December 27, 2017. https://www.artnome.com/news/2017/12/22/the-blockchain-art-market-is-here

Cheng, Evelyn. “Meet CryptoKitties, the $100,000 digital beanie babies epitomizing the cryptocurrency mania.” cnbc.com. December 6, 2017. https://www.cnbc.com/2017/12/06/meet-cryptokitties-the-new-digital-beanie-babies-selling-for-100k.html

Christies. “10 things to know about CryptoPunks, the original NFTs.” April 8, 2021. https://www.christies.com/features/10-things-to-know-about-CryptoPunks-11569-1.aspx

Constine, Josh. “Monegraph Uses Bitcoin Tech So Internet Artists Can Establish ‘Original’ Copies Of Their Work.” techcrunch.com. May 9, 2014. https://techcrunch.com/2014/05/09/monegraph/

Dansky. “How to Sell CRYPTO ART - Step By Step Guide!” YouTube video, 4:30. March 12, 2021. https://www.youtube.com/watch?v=7dtin91E-fU

Edward, Derek. “You’re Sleeping on Crypto Art.” medium.com. September 10, 2020. https://medium.com/collab-currency/youre-sleeping-on-crypto-art-7df920ec038e

Ehrenkranz, Melanie. “How blockchain technology reached Christie's and changed the art world along the way.” nbcnews.com. Octorber 27, 2020.https://www.nbcnews.com/tech/tech-news/how-blockchain-technology-reached-christie-s-changed-art-world-along-n1244951

Maecenas. “What is Maecenas.” Accessed May 9, 2021. https://www.maecenas.co/whats-maecenas/

Rhett / Mankind. “What is Crypto Art? A basic explanation.” YouTube video, 3:56. Feb 11, 2021. https://www.youtube.com/watch?v=DYyW_tTPAhU

Takahashi, Dean. “CryptoKitties explained: Why players have bred over a million blockchain felines.” venturebeat.com. October 6, 2018. https://venturebeat.com/2018/10/06/cryptokitties-explained-why-players-have-bred-over-a-million-blockchain-felines/

The outer realm. “Crypto Art: A Brief History.” March 31, 2021. https://www.theouterrealm.io/blog/crypto-art-a-brief-history

Verisart. “Helping Creators Do Businees.” Accessed May 9, 2021. https://verisart.com/

Wikipedia. 2021. “Crypto art.” Last modified May 7, 2021. https://en.wikipedia.org/wiki/Crypto_art

Wikipedia. 2021. “CryptoKitties.” Last modified May 3, 2021. https://en.wikipedia.org/wiki/CryptoKitties