Written by Alice Zhao

In recent years, the advancement of cryptocurrencies and blockchain-based technologies has led to increased exploitation from criminals. From “pump and dump” scams to cybercrimes, the rapid rise of digital assets has raised questions about their exploitation by criminals to launder money and commit fraud in untraceable and anonymous ways.

Lawmakers and regulators have been trying to figure out ways to combat the threats that the growing sector imposes. On February 17, 2022, the Department of Justice announced its new National Cryptocurrency Enforcement Team (NCET) appointing Eun Young Choi as director. Many argue that the NCET and the FBI’s Virtual Asset Exploitation Unit that launched on February 18, 2022 signals more crackdowns on the crypto industry. As the possibility of regulations looms, what are some of the effects it may bring to the crypto and NFT markets? This article explores what some may look like.

Cryptocurrencies

A cryptocurrency is an encrypted virtual currency that makes counterfeiting and double-spending almost impossible. In theory, unlike traditional currencies, virtual currencies are not controlled by any central authority. Therefore, they are immune to government manipulation and intervention. Crypto refers to a range of encryption techniques and cryptographic approaches, including hashing algorithms, public-private key pairs, and elliptical curve encryption. Currently, Bitcoin is one of the most well-known and valuable cryptocurrencies on the market. It was invented and presented to the world in 2008 through a white paper by a mysterious entity known as Satoshi Nakamoto. Many new virtual currencies known as "altcoins" have sprung up due to Bitcoin's success. Some are forks or splits of Bitcoin, and others are new currencies established from the ground up. Among them are Solana, Litecoin, Ethereum, Cardano, and EOS.

NFTs

Non-fungible tokens (NFTs) are cryptographic currencies based on blockchains with unique identification numbers and information that differentiate them from one another, similar to a digital passport. Unlike virtual currency, NFTs cannot be traded and purchased for parts. Artifacts such as digital art, sports cards, and rarities make up a large portion of the current NFT market. Many believe that NFTs revolutionize the cryptocurrency world by establishing one-of-a-kind and irreplaceable tokens. In many cases, they are also made extendible, so users can combine two NFTs to get a third, distinct NFT. Non-fungible tokens may be used to electronically represent anything, including online-only assets like electronic artwork, and real-world assets such as real estate investment. Avatars, electronic and non-digital treasures, website domains, and concert tickets are examples of objects that NFTs might represent.

Why the Popularity?

“Fortune favors the brave.” This is a popular slogan that has been used in past months for a Crpyto.com marketing campaign. As Matt Damon cruises through the history of mankind praising those who are bold enough to “embrace the moment” determination and conviction, it perfectly translates one of the biggest ideas behind crypto’s unbeaten popularity—that crypto enthusiasts are risk takers and innovators who are willing to be the early adopters of a historical revolution.

Figure 1: "Fortune Favours The Brave" Campaign Commercial starring Matt Damon. Source: Crypto.com

However, with company marketing teams adopting such mindsets, it creates situations where investors may hold stake in being a part of something grander, putting them in a highly vulnerable position due to the risk and volatility of the crypto market. Nevertheless, the mass popularity of cryptocurrencies is appealing because of its possibility of profitability. Whether a long-term investment or a “get rich quick” opportunity, success stories do exist. Many people have become wealthy due to crypto investments.

Practically, however, low transaction fees are one of the critical reasons that cryptocurrencies and NFTs are so popular worldwide. There are often steep charges associated with other types of online payment methods, making the meager prices connected with cryptocurrencies a far better deal in comparison. Additionally, these currencies claim to be unrelated to any government. This indicates that virtual currencies may remain stable even when a country is in economic distress. Since some investors see cryptocurrencies as a realistic means of safeguarding their money, its value has increased over time.

In the realm of security, many believe that using cryptocurrencies can make online purchases far more secure than other conventional payment methods. Moreover, as purchasing and trading cryptocurrencies from reputable sources become easier and more accessible, their simplicity also contributes to its popularity. Compared to the era of its inception, cryptocurrency has become easier to use as more online companies adopt it as a valid payment method. More websites accept cryptocurrencies as a form of payment, and this trend is expected to continually grow.

Cryptocurrency was often seen as a mysterious concept in the past, but it has now become more commonplace. Ultimately, there are still many people who believe that cryptocurrencies are the future of currency (of all kinds). People interested in crypto trading and cryptocurrencies also share an interest in significant technology advancements like blockchain. Blockchain technology is expected to revolutionize the world in various ways, including making crypto trades much more accessible.

Independent Fraud Tracking

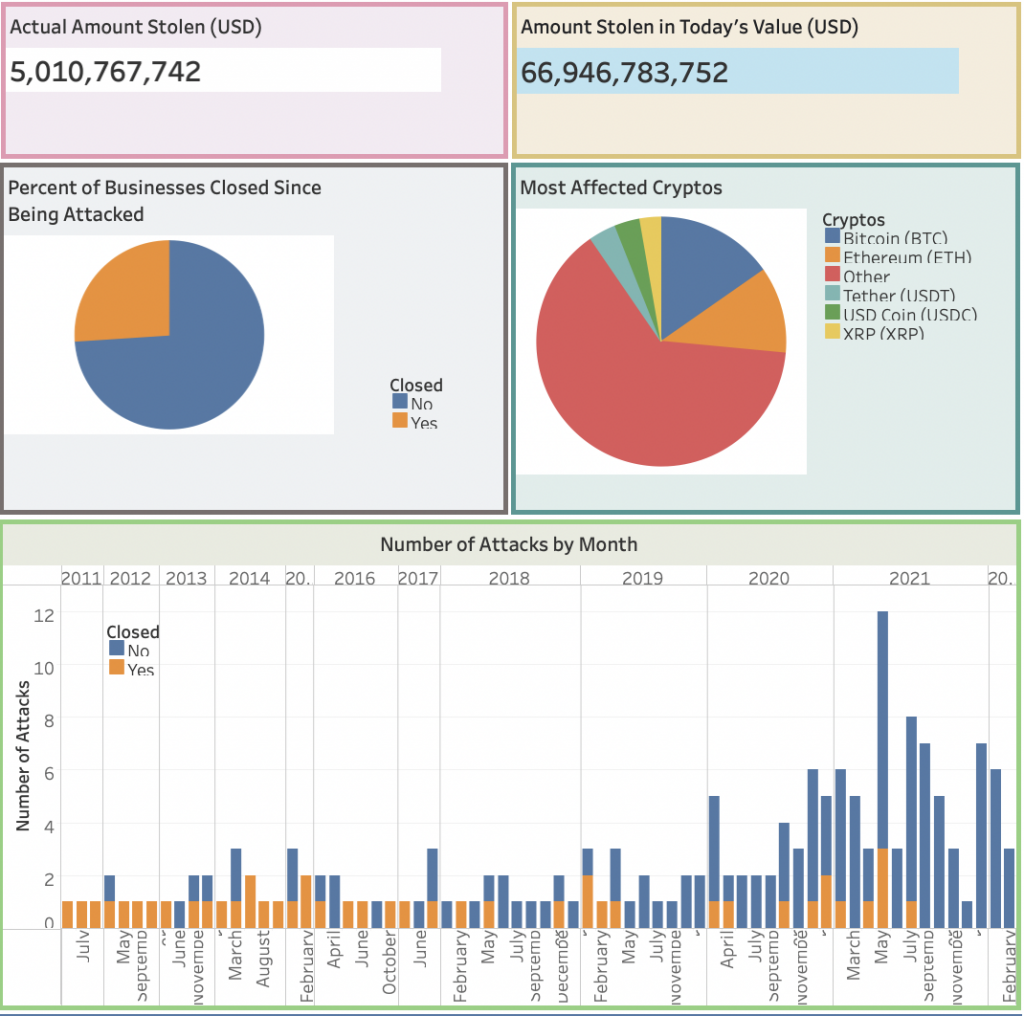

While innovative in format and technological use, there are severe risks associated with cryptocurrencies and NFTs regarding the obstruction of market acceptance and progress. “Web3 Is Going Great” is a website project created by software engineer Molly White, who tracks some of the biggest scams, thefts, and controversies of the crypto space since 2021 – providing a factual representation of how Web3 may not be going as great as some think. Another platform, “Worldwide Cryptocurrency Heists Tracker,” offers documentation of the amount of cryptocurrencies that have been stolen in recent years, which as of February 3, 2022, is $66,946,783,752 in today’s value (USD).

Figure 2: Worldwide cryptocurrency heists tracker, UPDATED: February 3, 2022. Source: Comparitech.

Money laundering is another issue with the continued growth of the crypto market. There have been cases where perpetrators utilize virtual currency to launder proceeds from various crimes, ranging from conspiracies to cybercrime, electronic theft, and cryptocurrency theft from internet interactions. To cover their digital footprint, criminals use multiple techniques that deliver money to different locations or corporations. Subsequently, those assets are returned to a target location or an exchange liquidated from a legal source. This procedure makes tracing laundered money back to illegal activity challenging. Crypto digital assets are also victims of "wash trading," where users influence transactions by trading amongst themselves to boost the value of the NFT. The purpose of NFT wash trading is to make a particular NFT look like a better deal than it is by 'selling' it to a different wallet that is controlled by the actual owner.

Concerns over intellectual property are another critical factor on the list of NFT and cryptocurrency problems. It's crucial to assess a person's complete ownership of an NFT. Numerous cases report that NFTs were in fact photographed or copies of it have been distributed. Consequently, when NFTs are purchased, the buyer is purchasing the right to use it rather than its intellectual property rights. The metadata of the entire contract defines the terms and conditions for holding an NFT. The intellectual property risks and constraints associated with NFTs imply that purchasers only have the right to exhibit NFTs and are the sole proprietors. Inside the Metaverse, the French luxury company Hermès is suing an individual for creating knock-off designer bags that are selling for over six figures on a secondary market, which is a clear case of copyright infringement. Early last month, the business launched a trademark infringement case against Mason Rothschild, a virtual designer, arguing that his MetaBirkins NFTs – virtual recreations of the classic Hermès handbag – were trademark infringement.

Figure 3: Examples of Mason Rothschild's "MetaBirkins." Courtesy of the artist. Source: Artnet.

Government Regulation

As a fast-growing industry with relatively uncharted territories, the regulation of cryptocurrencies and NFTs have received mixed reactions from their enthusiasts and investors. With any form of regulation, there are pros and cons to its enforcement.

Pros

Avoiding Scams: Scammers run rampant in the crypto world, producing a variety of fraudulent currencies. Cryptocurrency laws would verify that each cryptocurrency that enters the system satisfies specific standards. Individuals that invest in digital money will feel safer about their assets as a result.

Getting Institutional Funds to Invest in the Market: More interested individuals would invest large amounts of money into digital currencies if the market was regulated and precise operating mechanisms were in existence. The industry's stability would improve, making it more efficient, and possibly more lucrative, for investors. Additionally, the vast pricing differences between markets would likely vanish.

Providing Moral Legitimacy to the Cryptocurrency Market: For a long time, virtual currencies were perceived to be a tool used to purchase drugs, sex trafficking, and other illegal activities on the black market, causing a continual government threats against the use of crypto. China, along with few other countries, have successfully implemented aggressive campaigns against this market because of said risks, believing they represent a danger to the financial sector. With cryptocurrencies regulation, this unfavorable label could cease to exist. No nation would prohibit them if a worldwide regulatory framework directed the market. They would be seen as a much more viable investment option.

Cons

One of the biggest threats regulation imposes on cryptocurrency is a risk of capital flight. Implementing government restrictions forces the governments into the industry, which crypto enthusiasts abhor – this freedom from government entities is why cryptocurrencies are attractive to many. As a result, conventional assets would see a flight to safety, as they are more secure. Such change makes it pointless to invest in a hazardous asset whose ideological goal is no longer evident. For example, since the Middle East nations began discussing regulation, the market has collapsed, with cryptocurrency plummeting by more than 50% (Matherson, 2021). If this trend is true for all crypto markets if global regulation were to occur, the value of cryptocurrencies would laregely diminish, and likely become a mere relic of the past.

"This regulation by enforcement that we're seeing is not the way to go because it doesn't create good policy. Regulators — in particular the SEC — think that the laws and regulations are crystal clear and that they're very easy to interpret. But for those of us on the other side of the table that are working in the industry and its ecosystem, the laws aren't clear, and it's very difficult to figure out how to apply them."

Kristin Smith, Executive Director at the Blockchain Association

Moreover, many have claimed that society simply have yet to understand enough to conceive a sustainable framework in regulating the crypto markets. Thus, while rushing to implement regulation through policy may seem viable in the short-run, it would likely harm the NFT ecosystem and crypto-development overall.

+ Resources

Auer, Raphael and Claessens, Stijn, Regulating Cryptocurrencies: Assessing Market Reactions (September 1, 2018). BIS Quarterly Review September 2018, Available at SSRN: https://ssrn.com/abstract=3288097

Burns, Grayce. “Congress Shouldn't Jump the Gun on NFT Regulations.” Reason Foundation, December 20, 2021. https://reason.org/commentary/congress-shouldnt-jump-the-gun-on-nft-regulations/.

Chohan, U. W. (2017). Cryptocurrencies: A brief thematic review. Available at SSRN 3024330. https://papers.ssrn.com/SOL3/PAPERS.CFM?ABSTRACT_ID=3024330

Clark, Mitchell. “NFTs, Explained.” The Verge. The Verge, March 3, 2021. https://www.theverge.com/22310188/nft-explainer-what-is-blockchain-crypto-art-faq.

Conti, Robyn. “What Is an NFT? Non-Fungible Tokens Explained.” Forbes. Forbes Magazine, February 16, 2022. https://www.forbes.com/advisor/investing/nft-non-fungible-token/.

Dafoe, Taylor. “Hermès Is Suing a Digital Artist for Selling Unauthorized Birkin Bag NFTS in the Metaverse for as Much as Six Figures.” Artnet News. Artnet News, January 26, 2022. https://news.artnet.com/art-world/hermes-metabirkins-2063954.

Dasgupta, N., Freifeld, C., Brownstein, J. S., Menone, C. M., Surratt, H. L., Poppish, L., ... & Dart, R. C. (2013). Crowdsourcing black market prices for prescription opioids. Journal of Medical Internet Research, 15(8), e2810. https://www.jmir.org/2013/8/e178/.Are

“Justice Department Announces First Director of National Cryptocurrency Enforcement Team.” The United States Department of Justice, February 17, 2022. https://www.justice.gov/opa/pr/justice-department-announces-first-director-national-cryptocurrency-enforcement-team.

Kevin Helms A “FBI Launches 'Virtual Asset Exploitation Unit' with Specialized Team of Crypto Experts – Regulation Bitcoin News.” Bitcoin News, February 19, 2022. https://news.bitcoin.com/fbi-launches-virtual-asset-exploitation-unit-specialized-team-of-crypto-experts/.

Krion, Adrian. “NFT Regulation Looms Large, so Let's Start with the Proper Framework.” Nasdaq. Accessed February 25, 2022. https://www.nasdaq.com/articles/nft-regulation-looms-large-so-lets-start-with-the-proper-framework.

Kurutz, Steven. “Teens Cash in on the NFT Art Boom.” The New York Times. The New York Times, August 14, 2021. https://www.nytimes.com/2021/08/14/style/teens-nft-art.html.

Likos, Paulina. “The History of Bitcoin, the First ... - US News Money.” Accessed February 25, 2022. https://money.usnews.com/investing/articles/the-history-of-bitcoin.

Martinez, Jose. “Soulja Boy and Lil Yachty Are among Celebs Being Sued over Alleged 'Pump and Dump' Cryptocurrency Scheme.” Complex. Complex, February 22, 2022. https://www.complex.com/music/soulja-boy-lil-yachty-pump-and-dump-cryptocurrency-scheme.

Matherson, Nassor. 2021. The driving force of cryptocurrency and money laundering. Ph.D. diss., Utica College, https://www.proquest.com/dissertations-theses/driving-force-cryptocurrency-money-laundering/docview/2619239520/se-2?accountid=9902 (accessed February 25, 2022) .

Mejdrich, Kellie. “'Massive Wake-up Call': Crypto Faces Growing Legal Crackdown.” POLITICO. POLITICO, August 17, 2021. https://www.politico.com/news/2021/08/17/cryptocurrency-legal-crackdown-505595.

Patel, Nilay. “Can the Law Keep up with Crypto?” The Verge. The Verge, February 22, 2022. https://www.theverge.com/22944579/crypto-bitcoin-internet-law-nft-tiktok-dances-tonya-evans-interview.

Person, and Charles B. Mckenna Hunt S. Ricker. “Cryptocurrency Finds Itself in the Sights of Robust Regulation.” Reuters. Thomson Reuters, January 24, 2022. https://www.reuters.com/legal/transactional/cryptocurrency-finds-itself-sights-robust-regulation-2022-01-24/ .

Small, Zachary. “Sotheby's NFT Sale, Expected to Hit $30 Million, Suddenly Canceled.” The New York Times. The New York Times, February 24, 2022. https://www.nytimes.com/2022/02/24/arts/sothebys-nft-sale-canceled.html.

Stankiewicz , Matt. “What to Know about the DOJ's National Cryptocurrency Enforcement Team.” JD Supra. Accessed March 4, 2022. https://www.jdsupra.com/legalnews/what-to-know-about-the-doj-s-national-1604480/.

“The Biggest Cryptocurrency Heists of All Time.” Comparitech, February 3, 2022. https://www.comparitech.com/crypto/biggest-cryptocurrency-heists/ .

White, Molly. “Web3 Is Going Just Great.” Illustration: A sad-looking Bored Ape Yacht Club NFT monkey looks at a world engulfed in flames. Accessed February 25, 2022. https://web3isgoinggreat.com/ .

Wilson, K. B., Karg, A., & Ghaderi, H. (2021). Prospecting non-fungible tokens in the digital economy: Stakeholders and ecosystem, risk and opportunity. Business Horizons. https://www.sciencedirect.com/science/article/pii/S0007681321002019